Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

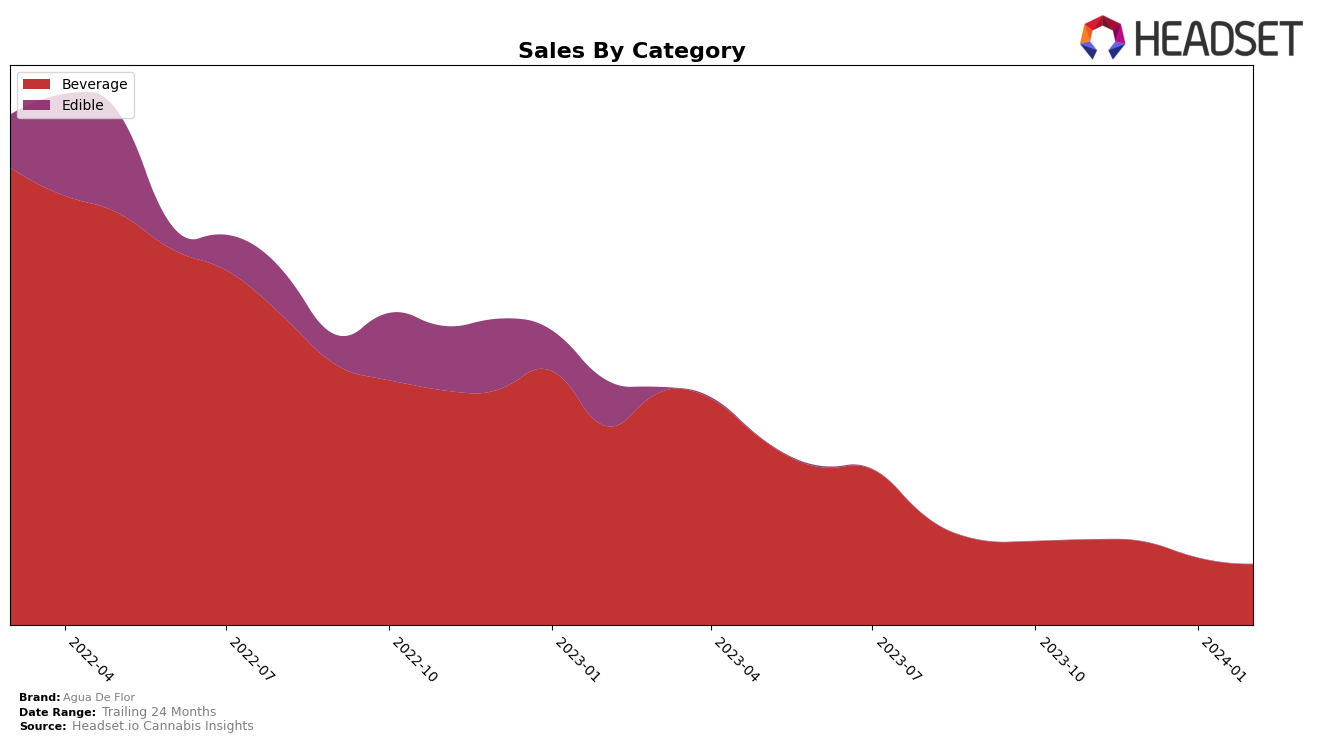

In the competitive cannabis market of California, Agua De Flor has maintained a consistent presence in the Beverage category, albeit with a slight downward trend in its rankings over the recent months. Starting at rank 25 in November 2023, the brand experienced a minor slip in position to 27th in December 2023, and further to 28th in both January and February 2024. This gradual decline in rankings could be indicative of increased competition within the category or possibly a shift in consumer preferences. Notably, the brand's sales mirrored this downward trajectory, decreasing from $17,406 in November 2023 to $12,385 by February 2024, highlighting a potential challenge in maintaining market share amidst a dynamic market landscape.

Despite the slight decrease in rankings and sales, Agua De Flor's consistent presence within the top 30 brands in California's Beverage category over these months should not be overlooked. The fact that they remained within this competitive bracket suggests a stable consumer base and brand recognition in a saturated market. However, the absence from higher ranks points to areas for potential growth and improvement. The brand's performance trajectory offers valuable insights into its market position and competitive standing, suggesting that while Agua De Flor has a foothold in the market, there is room for strategic adjustments to enhance its appeal and market share. The detailed performance across these months, including specific sales figures and ranking changes, underscores the importance of closely monitoring market trends and consumer preferences to remain competitive in the fast-evolving cannabis industry.

Competitive Landscape

In the competitive landscape of the cannabis beverage market in California, Agua De Flor has experienced a slight fluctuation in its ranking over the recent months, indicating a challenging environment. Starting from a rank of 25 in November 2023, it slightly dipped to 27 in December, before marginally dropping to 28 by February 2024. This trend suggests a need for strategic adjustments to counteract the downward movement and maintain its market position. Competitors such as Ray's Lemonade and Surplus (Surplus Cartridge Co.) have shown notable sales increases, indicating a dynamic shift in consumer preferences or marketing effectiveness. Particularly, Surplus has made a significant leap in rankings from 21 in December 2023 to 26 by February 2024, highlighting its growing influence in the market. Meanwhile, Drink Loud and Bodega also present themselves as noteworthy competitors, with Drink Loud maintaining a consistent lead over Agua De Flor in terms of rank and sales. This competitive analysis underscores the importance for Agua De Flor to innovate and adapt its strategies to not only retain its current market share but also to capitalize on emerging opportunities for growth within the California cannabis beverage sector.

Notable Products

In Feb-2024, Agua De Flor's top-performing product was the Horchata Infused Drink (100mg) in the Beverage category, ascending to rank 1 with sales of 395 units. Following closely was the Limonada Pepino Infused Drink (100mg), which moved down to rank 2 from its previous leading position in January. The Fresa Infused Drink (100mg) maintained its rank at 3, showing consistent performance within the top three spots. Notably, the Blackout - Blurrberry Lemonade (100mg) and Blackout - Guavalicious Infused Drink (100mg) held the 4th and 5th positions respectively, indicating a preference for the brand's original flavors over these newer introductions. This shift in rankings and the sales figures highlight dynamic consumer preferences within Agua De Flor's beverage line.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.