Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

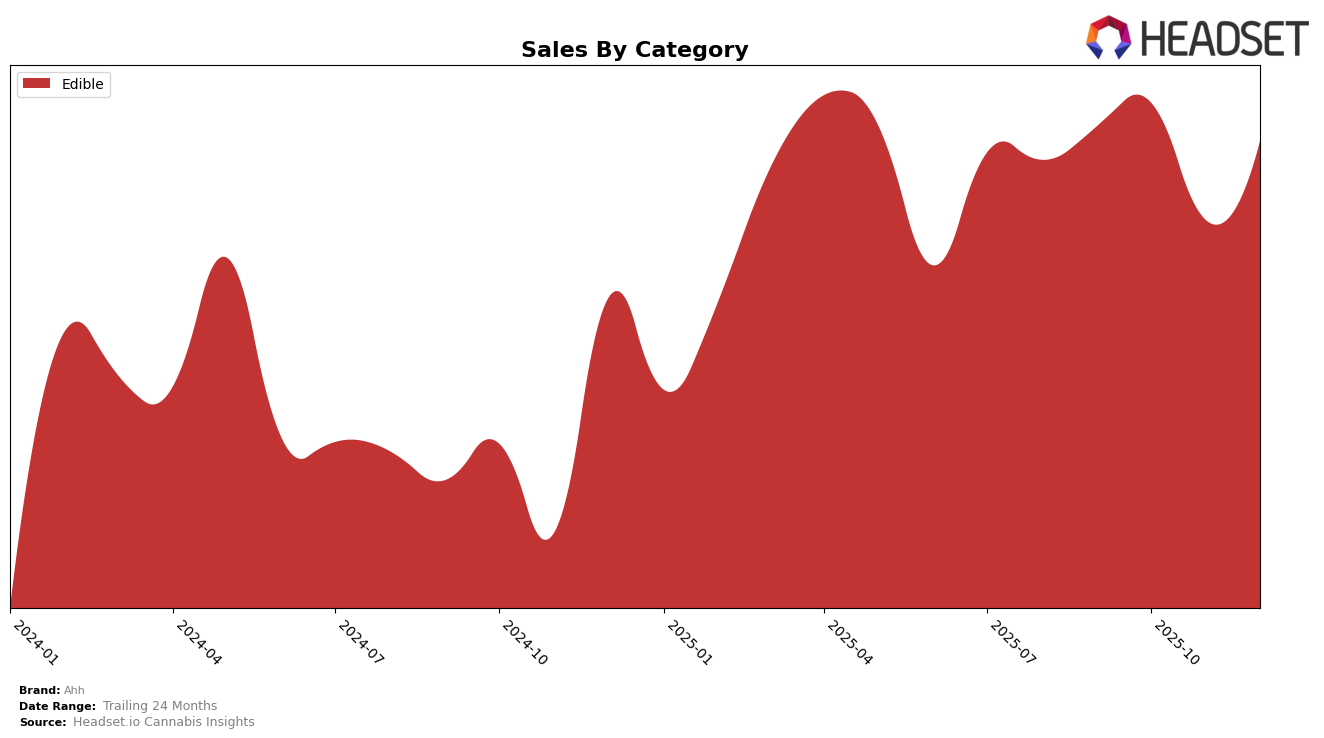

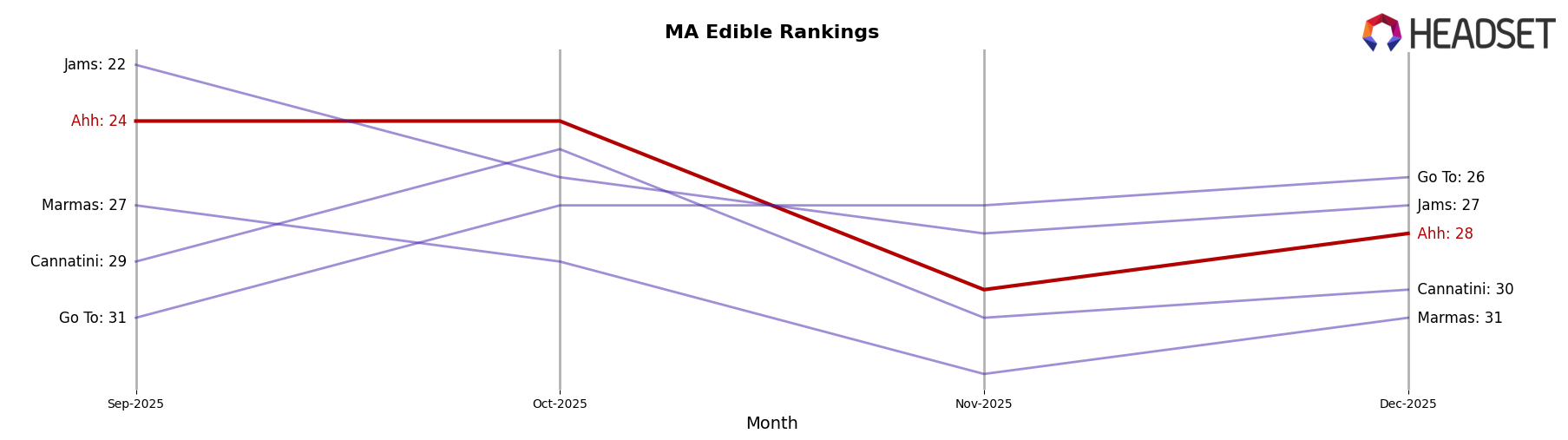

Ahh's performance in the Massachusetts edible market has shown a steady presence, albeit with some fluctuations. Over the final four months of 2025, Ahh maintained a position within the top 30 brands, starting at rank 24 in both September and October. However, the brand slipped to rank 30 in November before recovering slightly to rank 28 in December. Despite these changes in rank, the sales figures demonstrate a more nuanced story. After a slight increase in October, sales dipped in November but rebounded by December, suggesting a resilience and potential for growth in a competitive market.

While Ahh managed to stay within the top 30 in Massachusetts, the fact that they did not break into higher rankings indicates both a challenge and an opportunity. Maintaining a spot in the top 30 suggests that Ahh has a solid foothold, yet the lack of upward movement highlights the competitive nature of the edible category in this state. The fluctuation in rankings and sales could suggest seasonal demand or the impact of new product launches by competitors, which Ahh may need to address to improve its standing. Understanding these dynamics can provide insights into the brand's strategic positioning and potential areas for targeted growth.

Competitive Landscape

In the Massachusetts edible market, Ahh has demonstrated a notable performance trajectory from September to December 2025. Ahh maintained a consistent rank of 24th in September and October, before experiencing a dip to 30th in November, and then recovering slightly to 28th in December. This fluctuation in rank is reflective of the competitive dynamics within the market. For instance, Jams saw a decline from 22nd in September to 27th in December, indicating a potential opportunity for Ahh to capitalize on its competitors' volatility. Meanwhile, Go To improved its position from 31st to 26th over the same period, showcasing a competitive edge that Ahh must contend with. Despite these shifts, Ahh's sales figures remained relatively robust, with a noticeable recovery in December, suggesting resilience and potential for further growth amidst a competitive landscape.

Notable Products

In December 2025, the top-performing product from Ahh was the Sexy Sativa Raspberry Revive Dark Chocolate Rosin Bar 20-Pack (100mg), maintaining its number one rank from November with sales of 627 units. The Caramel Crush Milk Chocolate Rosin Bar 20-Pack (100mg) held steady in the second position, showing consistent performance across the months. The THC/CBN 4:1 Serene Dreams Dark Chocolate Blueberry Vanilla 20-Pack (100mg THC, 25mg CBN) rose to third place, recovering from a dip in November. The THC/CBG/THCV 4:2:1 Sky High Chai Cinnamon & Cardamom Milk Chocolate Bar 20-Pack (100mg THC, 50mg CBG, 25mg THCV) improved its rank to fourth, up from fifth in November. Meanwhile, the Atlantic Bliss- CBD/THC 2:1 Hybrid Artisan Sea Salt & Sea Moss Dark Chocolate 20-Pack (200mg CBD, 100mg THC) rounded out the top five, slipping from third place in November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.