Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

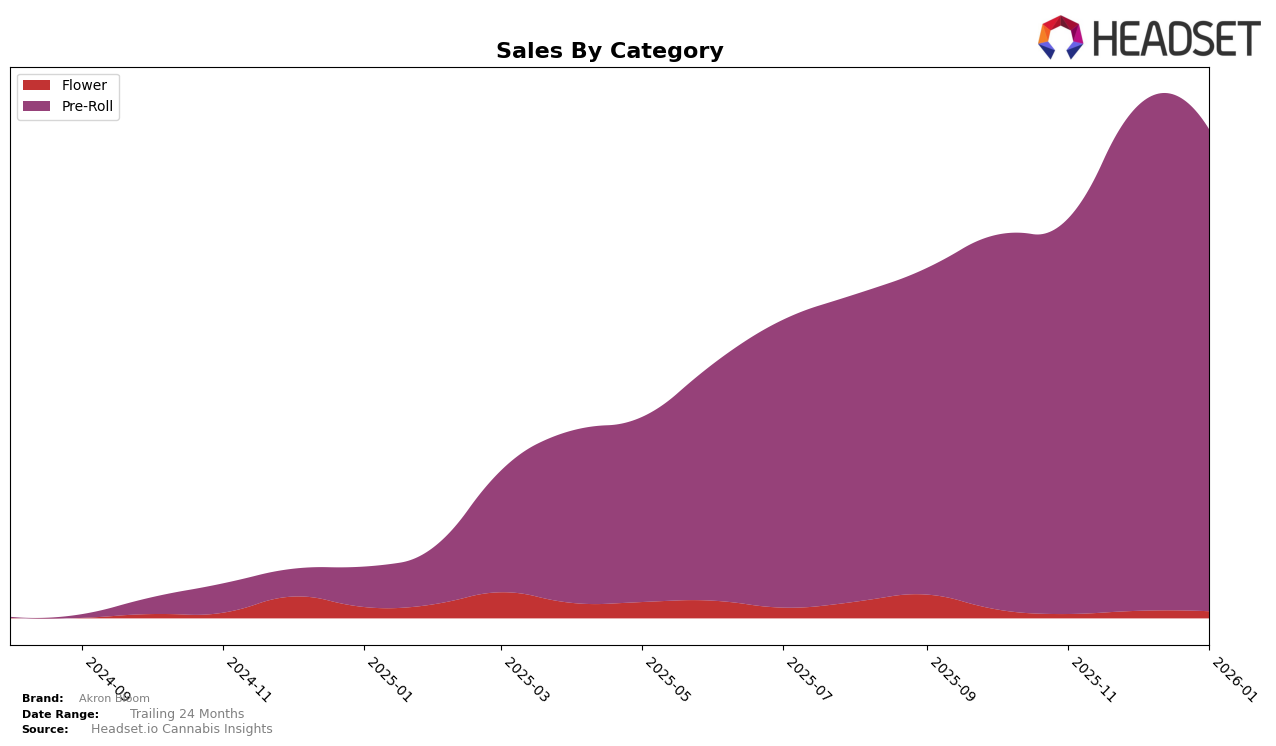

Akron Bloom has demonstrated a consistent upward trajectory in the Pre-Roll category within the New York market. The brand's ranking improved from 21st place in October 2025 to 17th place by December 2025, maintaining this position into January 2026. This steady climb in rankings suggests a growing consumer preference for Akron Bloom's offerings in this category. Notably, their sales figures reflect this positive trend, with a significant jump from October to December, followed by a slight dip in January. This pattern indicates a robust performance in the competitive landscape of New York, where maintaining a top 20 position is a commendable achievement.

However, it is important to note that Akron Bloom's presence in other states or provinces is not mentioned, highlighting a potential area for growth or expansion. The absence of rankings in markets outside of New York could indicate either a strategic focus on the New York market or challenges in penetrating other regions. This lack of visibility in additional markets could be seen as a limitation or an opportunity for Akron Bloom to explore new territories and diversify their market presence. Understanding the dynamics and consumer preferences in different regions could provide valuable insights for Akron Bloom's future strategic decisions.

Competitive Landscape

In the competitive landscape of the New York Pre-Roll category, Akron Bloom has shown a notable upward trajectory in its rankings over the past few months. Starting from a position outside the top 20 in October 2025, Akron Bloom climbed to rank 17 by December 2025 and maintained this position into January 2026. This upward movement is significant when compared to competitors like PUFF, which saw a decline from rank 13 in October to 16 in January, and Dogwalkers, which also dropped from 16 to 18 in the same period. Meanwhile, Moonys Zooties consistently held a higher rank, fluctuating between 13 and 15, indicating a stable performance. Akron Bloom's sales growth, particularly the jump in December, suggests a strengthening market presence, contrasting with the declining sales of PUFF and Dogwalkers. This trend positions Akron Bloom as a rising contender in the New York Pre-Roll market, potentially appealing to consumers seeking emerging brands with increasing popularity.

Notable Products

In January 2026, Akron Bloom's top-performing product was Birthday Cake Pre-Roll (1g), maintaining its number one rank for the third consecutive month with sales reaching 13,493 units. Cherry Kiss Pre-Roll (1g) held steady in the second position, although its sales slightly decreased from the previous month. Leso Espresso Pre-Roll (1g) consistently ranked third, showing a notable increase in sales compared to December 2025. Kosher Kush Pre-Roll (1g) improved its rank from fifth to fourth, indicating a positive trend. Santa's Cookies Pre-Roll (1g) debuted in the rankings in December 2025 at fourth place but slipped to fifth in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.