Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

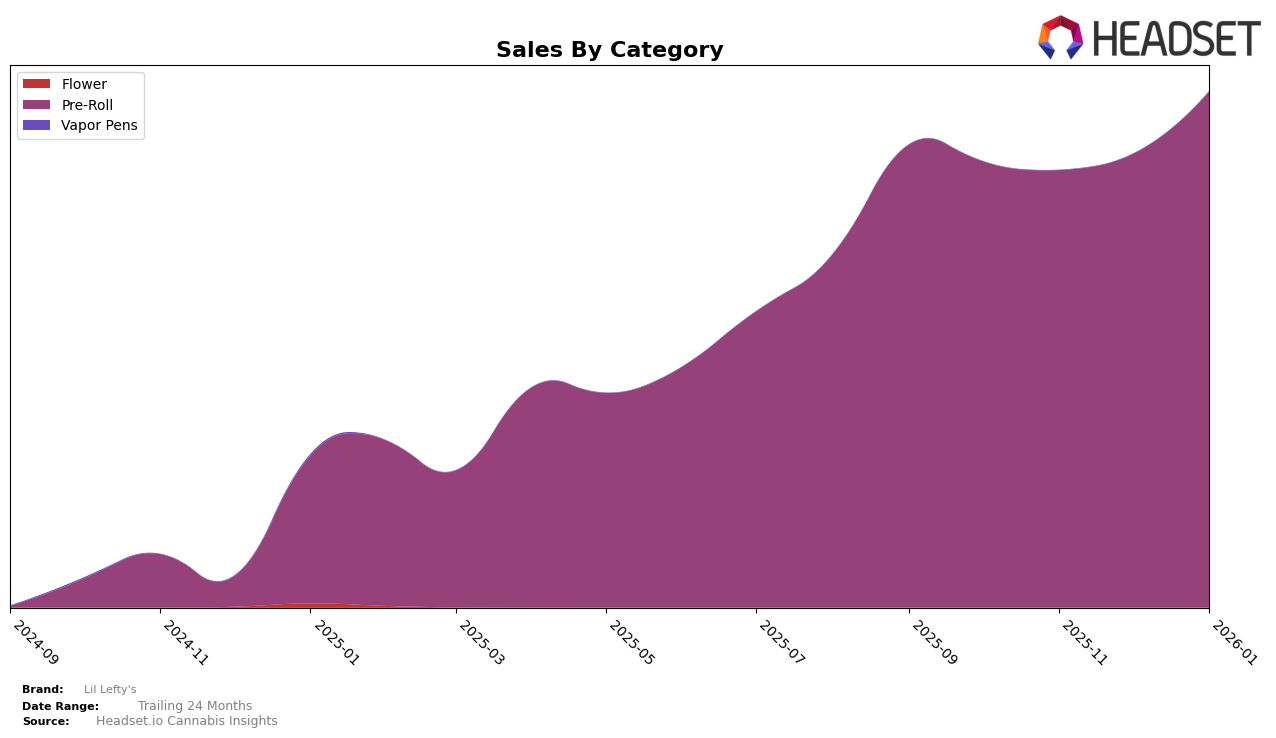

In the state of New York, Lil Lefty's has shown a noteworthy presence in the Pre-Roll category. Over the span of four months from October 2025 to January 2026, the brand has consistently maintained a position within the top 30, with a notable improvement in January 2026 when it climbed to the 19th position. This upward movement from the 26th and 25th positions in the previous months indicates a positive trend in their market performance, suggesting effective strategies or growing consumer preference for their products in this category.

However, the absence of Lil Lefty's from the top 30 rankings in other states or categories during this period might point to challenges in expanding their market reach or competition in those areas. The steady but limited presence in New York highlights both an opportunity and a potential area for growth, as focusing on strategies to penetrate additional markets could enhance their overall brand performance. While specific sales figures are not disclosed for other states or categories, understanding the dynamics in New York could provide insights into replicating success elsewhere.

Competitive Landscape

In the competitive landscape of the New York pre-roll category, Lil Lefty's has shown a promising upward trajectory in recent months. Starting from a rank of 26 in October 2025, Lil Lefty's improved its position to 19 by January 2026. This upward movement is significant when compared to competitors like Dogwalkers, which slipped from 16 to 18, and Runtz, which experienced fluctuations, peaking at 16 in December before dropping to 20 in January. Meanwhile, Akron Bloom maintained a relatively stable position, ending at rank 17 in January. Notably, Left Coast also improved its rank from 27 to 21 over the same period. Lil Lefty's sales growth aligns with its rank improvement, suggesting effective market strategies and increasing consumer preference, positioning it as a rising competitor in the New York pre-roll market.

Notable Products

In January 2026, Maui Wowie Infused Pre-Roll 5-Pack (3.75g) reclaimed the top spot in Lil Lefty's lineup, with sales reaching 2405 units. Pineapple Splash Infused Pre-Roll 5-Pack (3.75g) dropped to second place, after leading in the previous two months. Grape Cookies Infused Pre-Roll 5-Pack (3.75g) maintained its consistent third-place ranking, showing a notable increase in sales compared to December. Grape Cookies Infused Blunt 5-Pack (6.5g) climbed to fourth place, surpassing Maui Wowie Infused Blunt 5-Pack (6.5g), which fell to fifth. This shift indicates a growing preference for the Grape Cookies variant in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.