Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

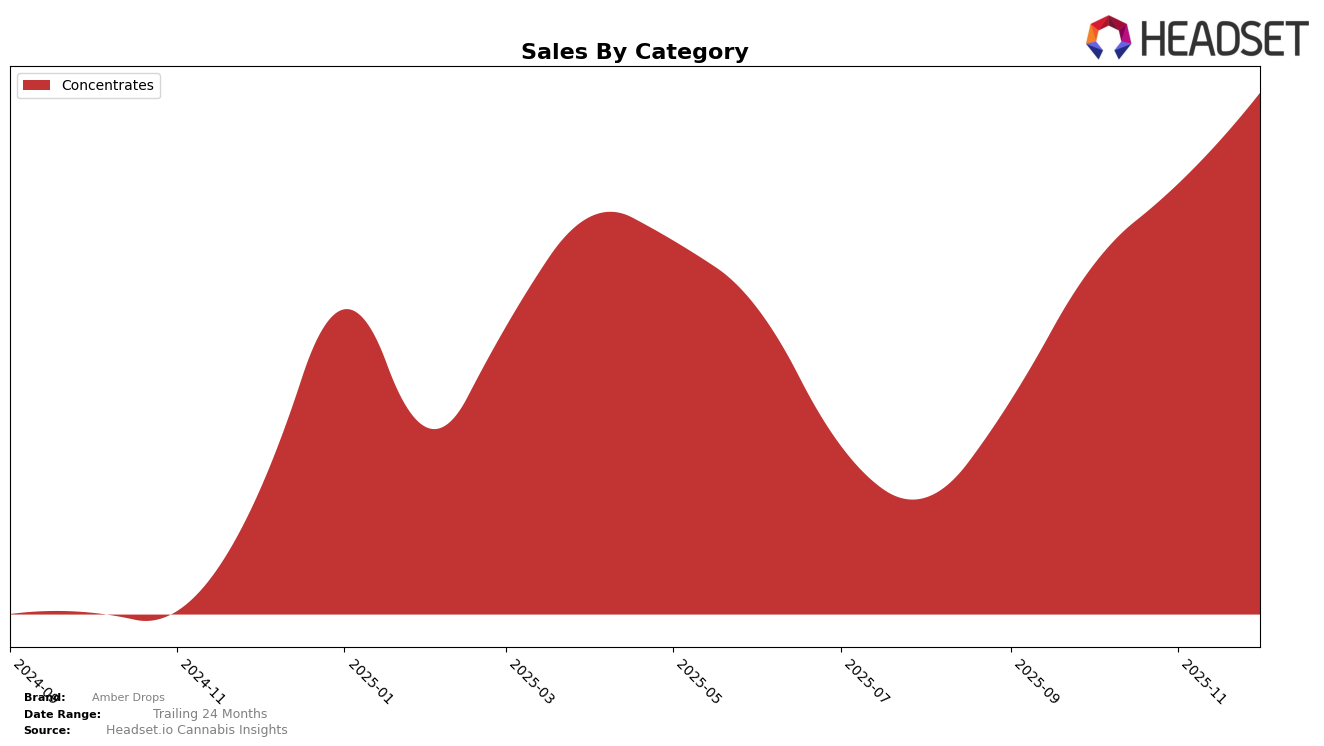

Amber Drops has shown a notable upward trajectory in the Washington market, particularly within the Concentrates category. Starting from a rank of 44 in September 2025, the brand made a significant leap to enter the top 30 by October, reaching the 29th position. This momentum continued, with Amber Drops climbing to the 18th spot in both November and December. Such consistent improvement highlights the brand's growing popularity and market penetration in Washington, especially considering it was not in the top 30 as of September. This rise in ranking is accompanied by a steady increase in sales, suggesting a strong consumer response and effective market strategies.

The Concentrates category in Washington seems to be a particularly competitive space, and Amber Drops' ability to improve its standing within just a few months is commendable. The leap from being outside the top 30 to securing a stable position within the top 20 indicates a successful brand strategy and possibly an increase in product availability or consumer preference shifts. While specific sales figures for December 2025 are not disclosed here, the upward trend across the months suggests that Amber Drops is gaining a stronger foothold in the market. The brand's performance in other states or categories could provide additional insights into its overall market strategy and growth potential, but the focus here remains on its promising ascent in Washington's Concentrates category.

Competitive Landscape

In the Washington concentrates market, Amber Drops has shown a remarkable upward trajectory in brand rank over the last few months of 2025. Starting from a rank of 44 in September, Amber Drops climbed to 29 in October and further improved to 18 by November, maintaining this position in December. This significant rise in rank is indicative of a strong increase in market presence and consumer preference. In comparison, Dabtastic experienced a slight decline from 12th to 16th place over the same period, despite higher overall sales, suggesting that Amber Drops is capturing market share from established competitors. Meanwhile, Dabs 4 Less improved its rank from 23rd in September to 17th in November and December, indicating a competitive landscape where multiple brands are vying for consumer attention. The consistent performance of Dank Czar, maintaining a top 20 position, highlights the competitive pressure Amber Drops faces as it continues to enhance its market standing. Amber Drops' ability to sustain its rank at 18 in December, despite the competitive environment, underscores its growing influence and potential for further sales growth in the Washington concentrates market.

Notable Products

In December 2025, the top-performing product for Amber Drops was Chocolate Wedding Cake Wax (1g) in the Concentrates category, maintaining its number one rank from the previous month with sales of 3055.0. Peanut Butter Breath BHO Wax (1g) held steady in second place, slightly increasing its sales figures. God's Gift Wax (1g) improved its rank to third place, bouncing back from a fourth-place position in November. Crumpets Wax (1g), a newcomer in the rankings, entered at fourth place with impressive sales figures. OG Chem Wax (1g) saw a drop to fifth place, despite consistent sales performance over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.