Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

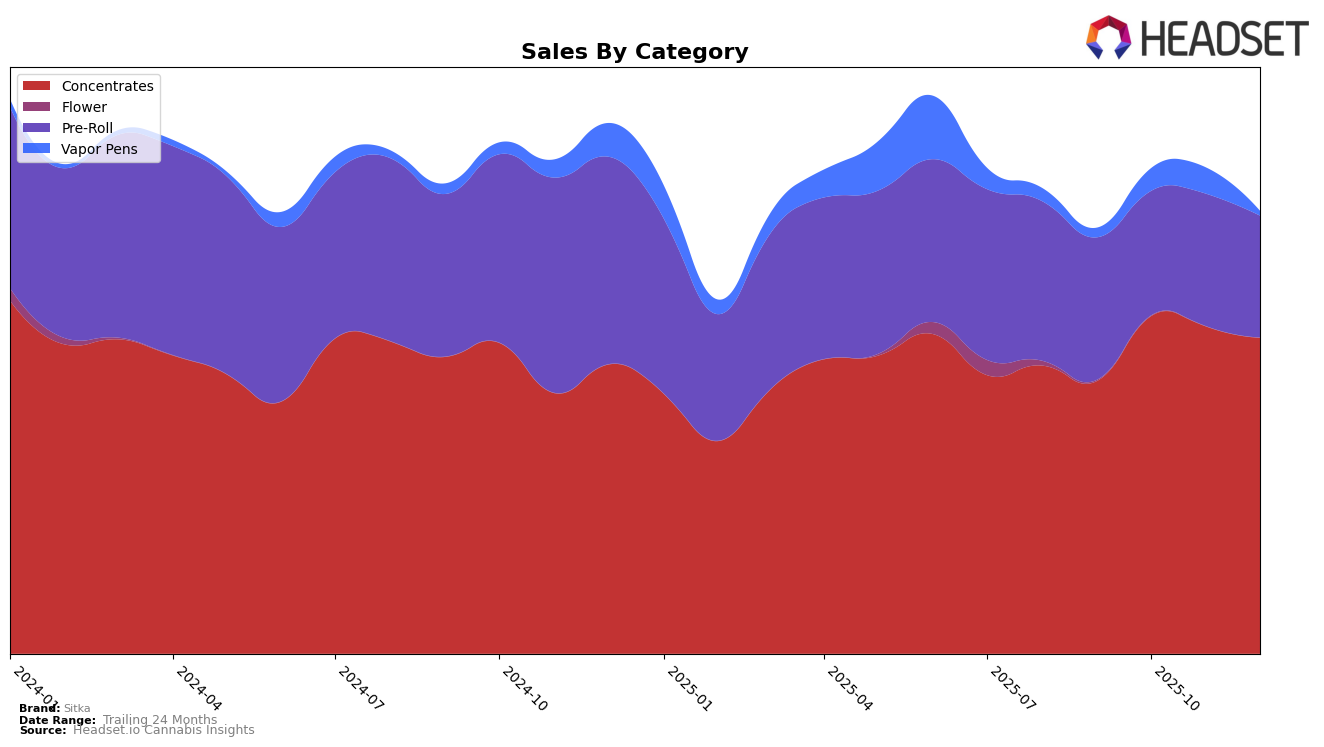

Sitka has demonstrated varying levels of performance across different states and product categories. In California, the brand's presence in the concentrates category has seen some fluctuations, with rankings moving from 67th in September to 63rd by December. Although Sitka did not make it to the top 30 in this category, the upward movement in October to 57th place suggests some potential for growth. In contrast, Oregon presents a different scenario for Sitka, where the brand has not been able to break into the top 30 for vapor pens, only appearing at 83rd in November, indicating a challenging market environment for this category.

In Washington, Sitka has maintained a relatively stable position in the concentrates category, consistently ranking in the low 20s throughout the final months of 2025. This stability suggests a strong foothold in this category, although the slight dip in December to 26th place could warrant attention. Meanwhile, the pre-roll category shows a different trend, with Sitka's ranking declining from 79th in September to 87th by December. This decline highlights potential challenges in maintaining competitiveness in the pre-roll market within Washington. Despite these varied performances, Sitka's overall sales figures across categories indicate a brand that is actively navigating its market positions.

Competitive Landscape

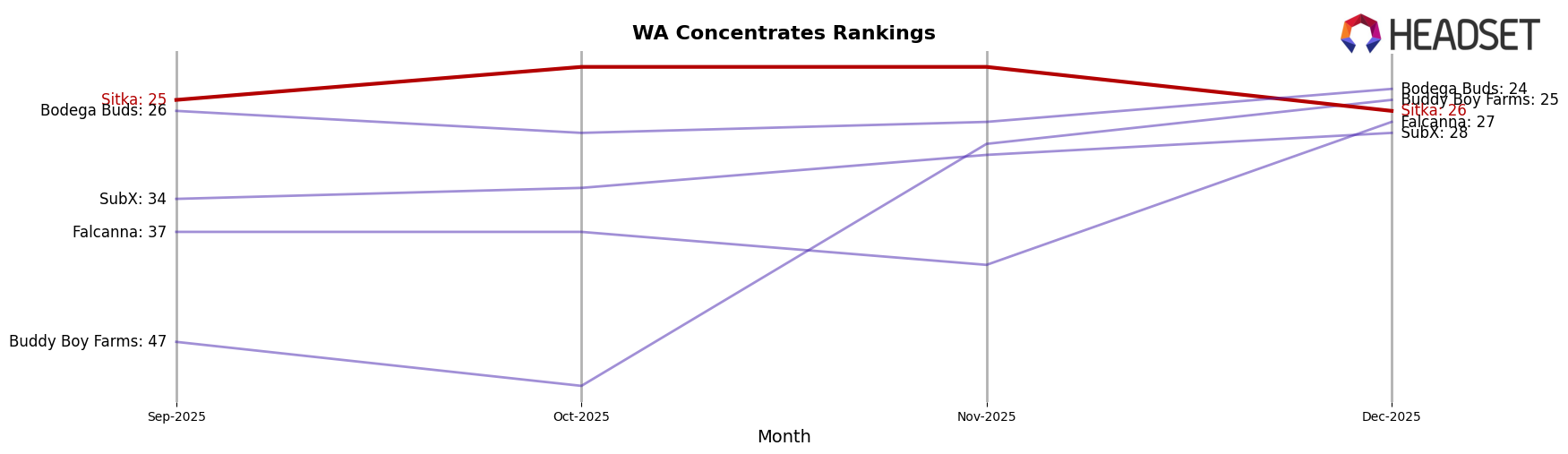

In the Washington concentrates market, Sitka experienced fluctuations in its competitive positioning from September to December 2025. Initially ranked 25th in September, Sitka improved to 22nd place in October and maintained this rank in November, before dropping to 26th in December. This decline in rank coincides with a slight dip in sales from November to December, suggesting increased competition. Notably, Buddy Boy Farms showed a significant improvement, moving from 47th in September to 25th in December, with sales nearly doubling during this period. Similarly, Falcanna improved from 37th to 27th, with a notable sales increase in December. Meanwhile, Bodega Buds consistently ranked close to Sitka, ending December at 24th, with a steady sales increase. These competitors' upward trends highlight the dynamic nature of the market, emphasizing the need for Sitka to strategize effectively to regain and maintain its competitive edge.

Notable Products

In December 2025, Classic - Lebanese Red Hash (1g) maintained its top position as the leading product for Sitka with sales reaching 1,147 units. Lebanese Gold Hash (1g) and Lebanese Red Dry Sift Hash (1g) were tied in second place, continuing their consistent performance from the previous months. Notably, Classic - Cascade Cream Hash (1g) debuted in the rankings at third place, while Cascade Cream Hashish (1g) followed closely at fourth. From September to December, Classic - Lebanese Red Hash (1g) demonstrated a steady increase in sales, securing its dominance. The introduction of Cascade Cream products in December highlights a potential shift in consumer interest within the Concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.