Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

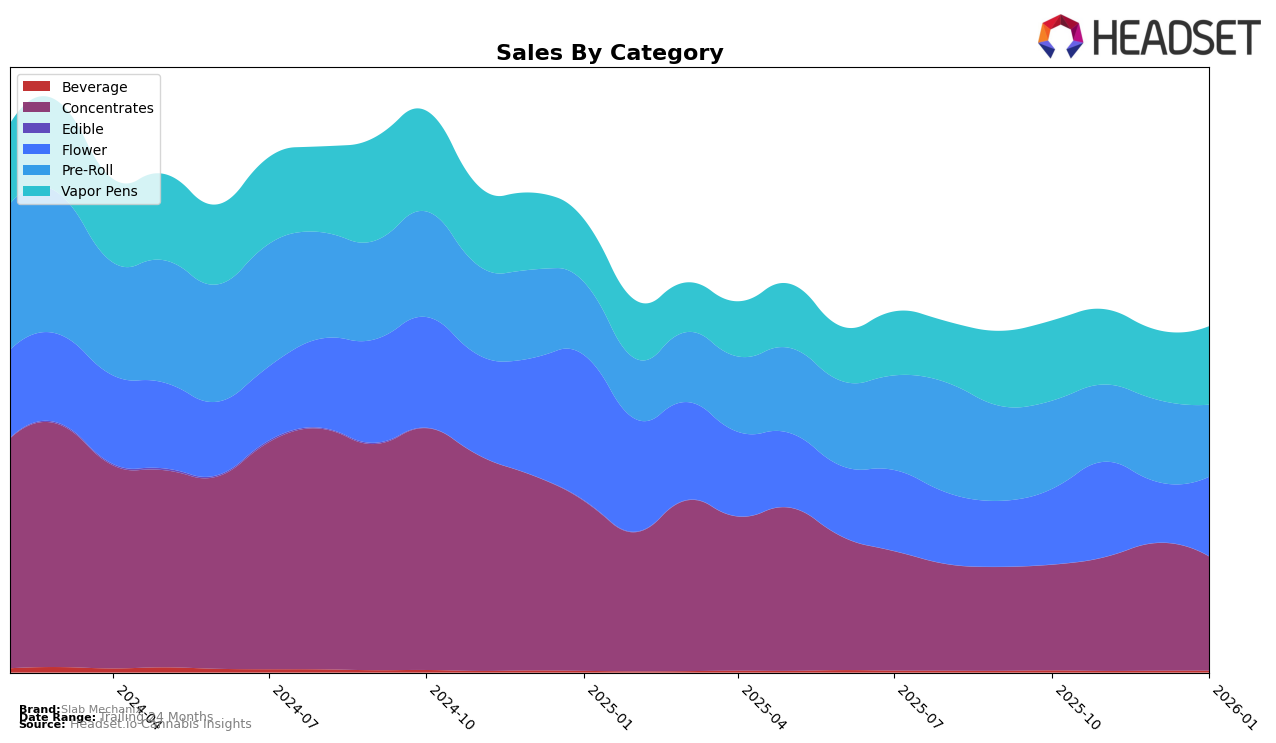

Slab Mechanix has demonstrated a noteworthy performance trajectory in the Washington cannabis market, particularly within the Concentrates category. Over the analyzed months, Slab Mechanix consistently maintained its presence within the top 30 brands, with a peak ranking of 26 in December 2025. This upward movement from October to December, followed by a slight dip to rank 30 in January 2026, suggests a competitive but stable positioning. Such consistency in ranking is indicative of a robust brand presence and consumer loyalty within the Concentrates space, despite the dynamic nature of the market.

In contrast, the performance of Slab Mechanix in other categories such as Pre-Rolls and Vapor Pens in Washington reflects a more challenging landscape. The brand did not break into the top 30 in these categories, with Pre-Rolls and Vapor Pens consistently ranking outside the top 60. This indicates potential areas for growth and market penetration strategies. The Vapor Pens category, however, did witness a positive shift in January 2026, moving up to rank 70, which could signal the beginning of a positive trend if sustained. These insights highlight the brand's stronghold in Concentrates while also pointing to opportunities for expansion and increased market share in other product lines.

Competitive Landscape

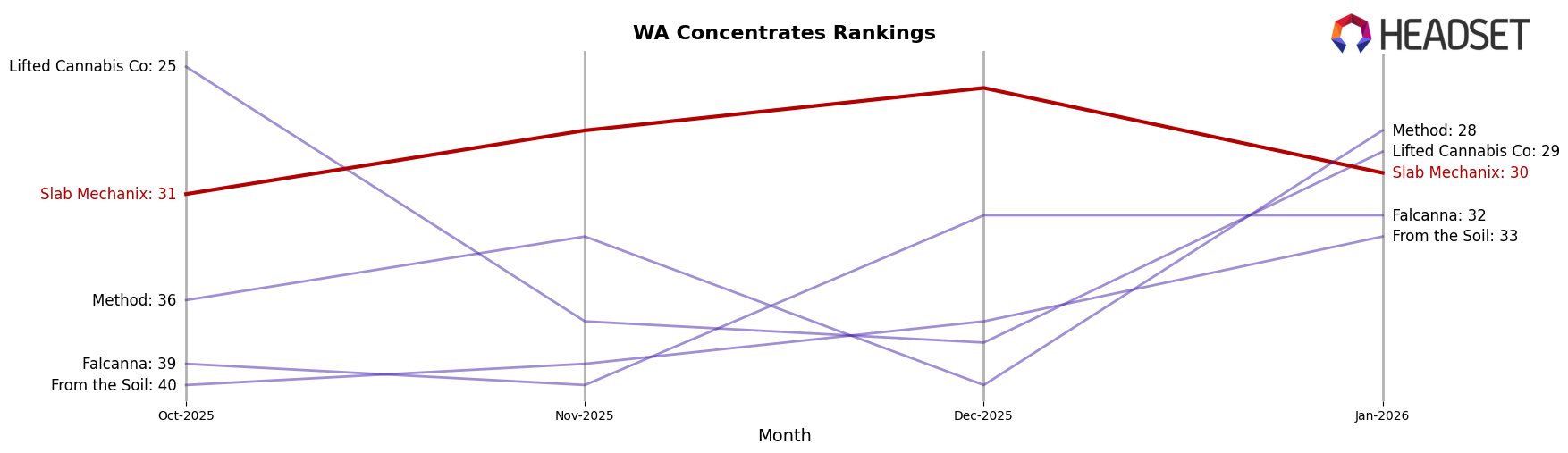

In the competitive landscape of the Washington concentrates market, Slab Mechanix has shown a notable upward trend in its rankings over the last few months, moving from 31st in October 2025 to 26th by December 2025, before slightly declining to 30th in January 2026. This fluctuation in rank suggests a competitive environment with dynamic shifts among brands. Notably, Lifted Cannabis Co experienced a decline in rank from 25th to 29th over the same period, indicating potential challenges in maintaining its market position. Meanwhile, Falcanna and From the Soil have shown some improvement in their ranks, though they remain outside the top 30 for most months. Method presents a competitive edge, improving its rank to 28th in January 2026, surpassing Slab Mechanix. These shifts highlight the importance for Slab Mechanix to leverage its recent sales growth, particularly the peak in December 2025, to strengthen its market position amidst fluctuating competition.

Notable Products

In January 2026, the top-performing product from Slab Mechanix was Blue Nerdz Distillate Cartridge (1g) in the Vapor Pens category, maintaining its first-place rank from December with sales reaching 1000 units. Gummy Bears Infused Pre-Roll (1g) made a notable leap to the second position, having not been ranked in November and December, with sales of 771 units. Alaskan Thunderfuck Infused Pre-Roll (1g) remained steady in third place, showing consistent performance over the past months. Apple Jax Distillate Cartridge (1g) held its fourth-place position, indicating stable demand. Candy Mac Sugar Wax (1g) entered the rankings at fifth place, highlighting its emergence as a significant player in the Concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.