Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

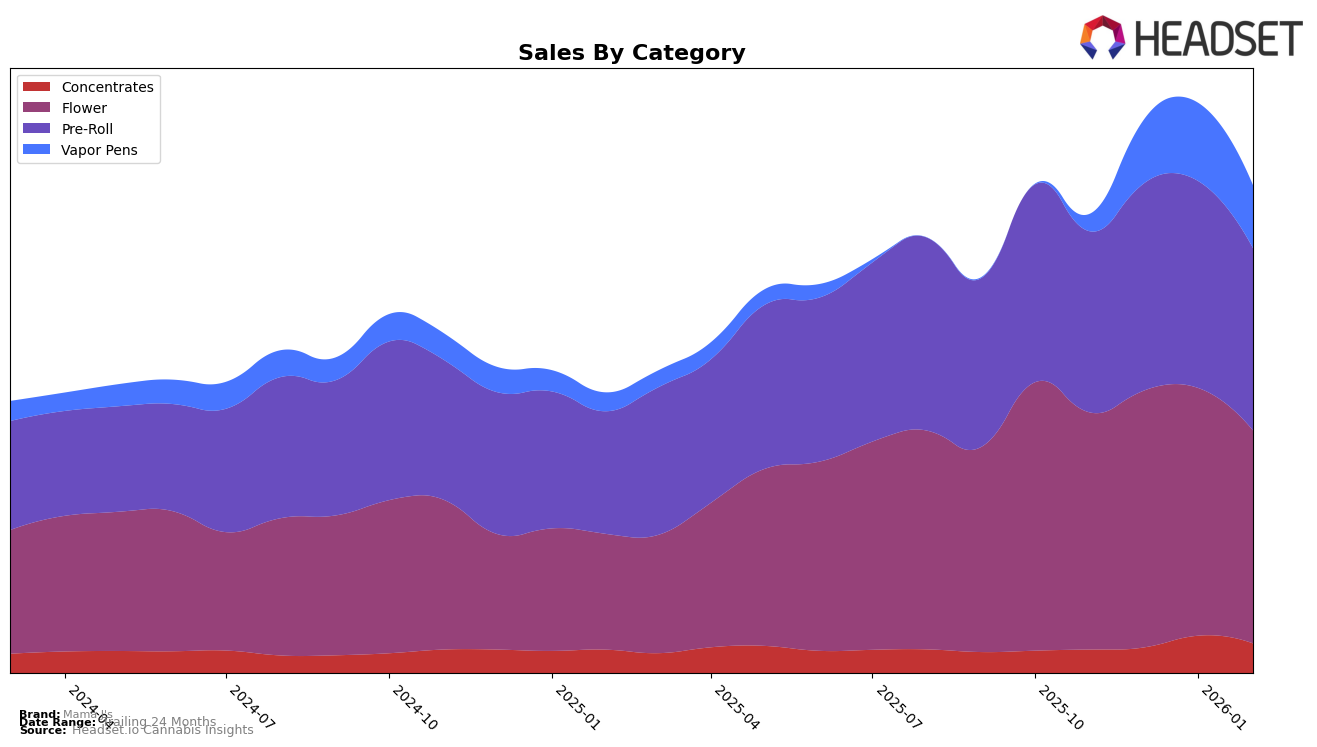

In the state of Nevada, Mama J's performance in the Flower category saw a notable improvement. While the brand did not rank in the top 30 in November 2025, by February 2026, it climbed to the 53rd position. This upward trajectory indicates a growing market presence within the state, although it remains outside the top 30, suggesting there is still room for growth. The absence of a ranking in the earlier months highlights the challenges faced by the brand in gaining traction initially, but the recent movement suggests positive momentum.

In Washington, Mama J's has shown a strong performance across multiple categories. The brand maintained a consistent presence in the top ranks for Flower and Pre-Roll categories, holding steady at the 2nd and 3rd positions, respectively. This stability underscores their strong market position in these categories. However, the most significant movement was observed in the Concentrates category, where Mama J's improved from 25th to 13th position in January 2026 before settling at 18th in February. This indicates a growing acceptance and demand for their concentrates, although the fluctuation suggests a competitive landscape. Additionally, their Vapor Pens category saw a dramatic jump from 70th to 25th position between November and January, reflecting a successful strategy in capturing consumer interest in this segment.

Competitive Landscape

In the competitive landscape of the flower category in Washington, Mama J's has consistently maintained a strong position, holding the second rank from December 2025 through February 2026. This stability highlights its resilience and appeal in a highly competitive market. Despite a slight dip in sales from January to February 2026, Mama J's has managed to outperform Legends, which saw a similar decline in sales and maintained the third rank during the same period. Meanwhile, Phat Panda remains the dominant leader, consistently ranking first, indicating a significant gap in market leadership. However, Mama J's faces increasing competition from Fifty Fold, which showed a notable improvement in rank, jumping from tenth in January 2026 to fourth in February 2026. This competitive pressure underscores the importance for Mama J's to innovate and strategize effectively to maintain its market position and potentially close the gap with the top-ranked brand.

Notable Products

In February 2026, the top-performing product for Mama J's was the Alien Rock Candy Pre-Roll 2-Pack (2g), which reclaimed its position at the top with sales figures of 5692. The Lemon Cherry Gelato Pre-Roll 2-Pack (2g) moved up to the second spot, showing a consistent rise from its fifth position in November 2025. Hidden Pastry Pre-Roll 2-Pack (2g) ranked third, experiencing a slight drop from its first position in January 2026. Amnesia Lemon Pre-Roll 2-Pack (2g) made its debut in the rankings at fourth place, indicating a strong entry into the market. The Jack And Coke Pre-Roll 2-Pack (2g) maintained its fifth position, although its sales saw a decline from previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.