Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

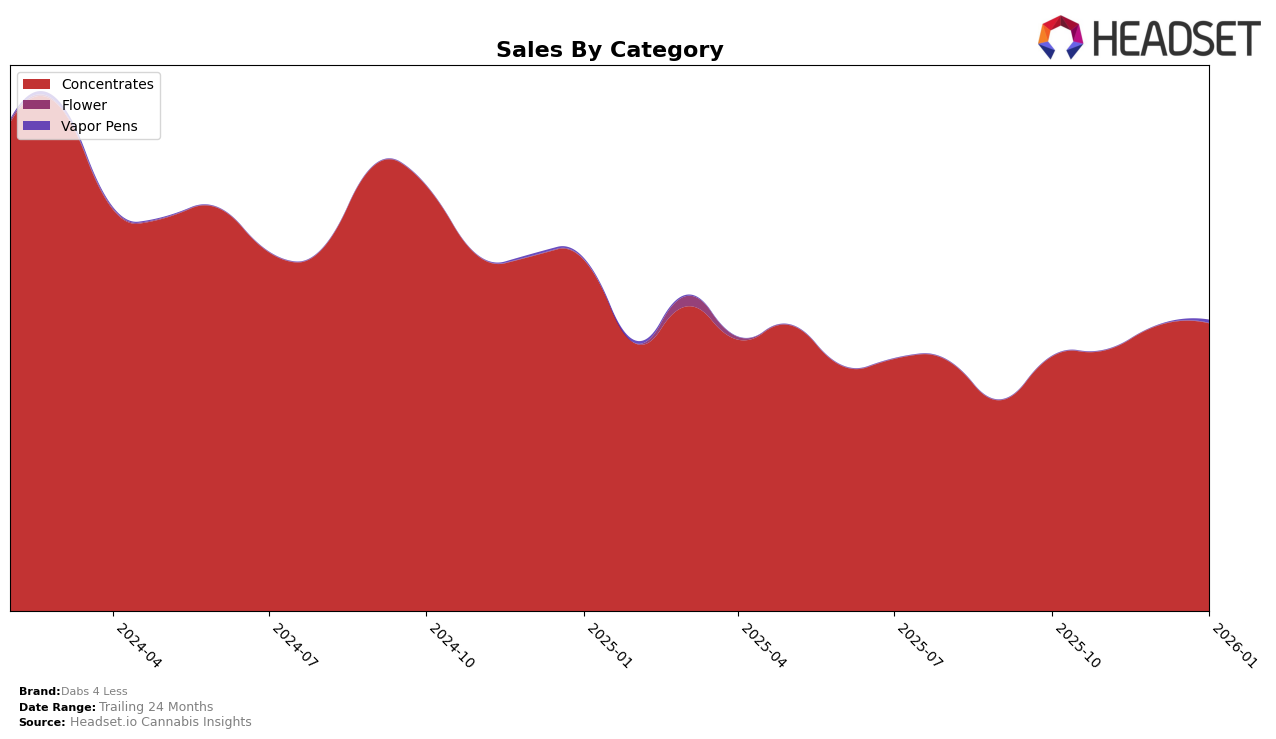

Dabs 4 Less has shown consistent performance in the Concentrates category within Washington, maintaining a steady position in the top 20 brands. The brand was ranked 19th in October 2025, improved slightly to 17th in November, and held the 18th and 19th spots in December and January 2026, respectively. This indicates a stable market presence in Washington, despite not breaking into the top 15. The sales figures reflect a positive trend, with a noticeable increase from October to January, suggesting growing consumer interest and potential for further market penetration.

While Dabs 4 Less has maintained a steady ranking in Washington, the absence of rankings in other states or provinces indicates that the brand has not yet expanded its reach beyond this region or has not achieved significant market impact elsewhere. This could be seen as a limitation in their geographic market strategy, potentially missing opportunities in other lucrative markets. However, their consistent sales growth within Washington might provide a solid foundation for future expansion plans. Focusing on strengthening their presence in Washington could also be a strategic move to build a robust brand reputation before venturing into other states.

Competitive Landscape

In the Washington concentrates market, Dabs 4 Less has shown a consistent performance, maintaining a stable rank between 17th and 19th place from October 2025 to January 2026. This steadiness in rank suggests a loyal customer base and reliable sales figures, with sales peaking in December 2025 at 104,787 units. However, competitors like Buddy Boy Farms and Full Spec have demonstrated more dynamic growth. Buddy Boy Farms, for instance, improved its rank significantly from 53rd in October 2025 to 18th by January 2026, indicating a rapid increase in market share that could pose a threat to Dabs 4 Less. Meanwhile, Dank Czar maintained a strong position, consistently ranking within the top 20, though it experienced a slight dip to 20th in January 2026. These shifts highlight the competitive pressures Dabs 4 Less faces, emphasizing the need for strategic marketing and product differentiation to maintain and potentially improve its market position.

Notable Products

In January 2026, Purple Punch Wax (1g) emerged as the top-performing product for Dabs 4 Less, with sales reaching 1890 units. Following closely, Pineapple Express BHO Wax (1g) secured the second position, while Wedding Cake Wax (1g) ranked third. Tangerine Dream Wax (1g) and Zookies BHO Sugar Wax (1g) rounded out the top five, holding fourth and fifth places respectively. Notably, this is the first month these products have been ranked, indicating a fresh surge in popularity. The Concentrates category as a whole showed significant growth, with these products leading the charge in sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.