Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

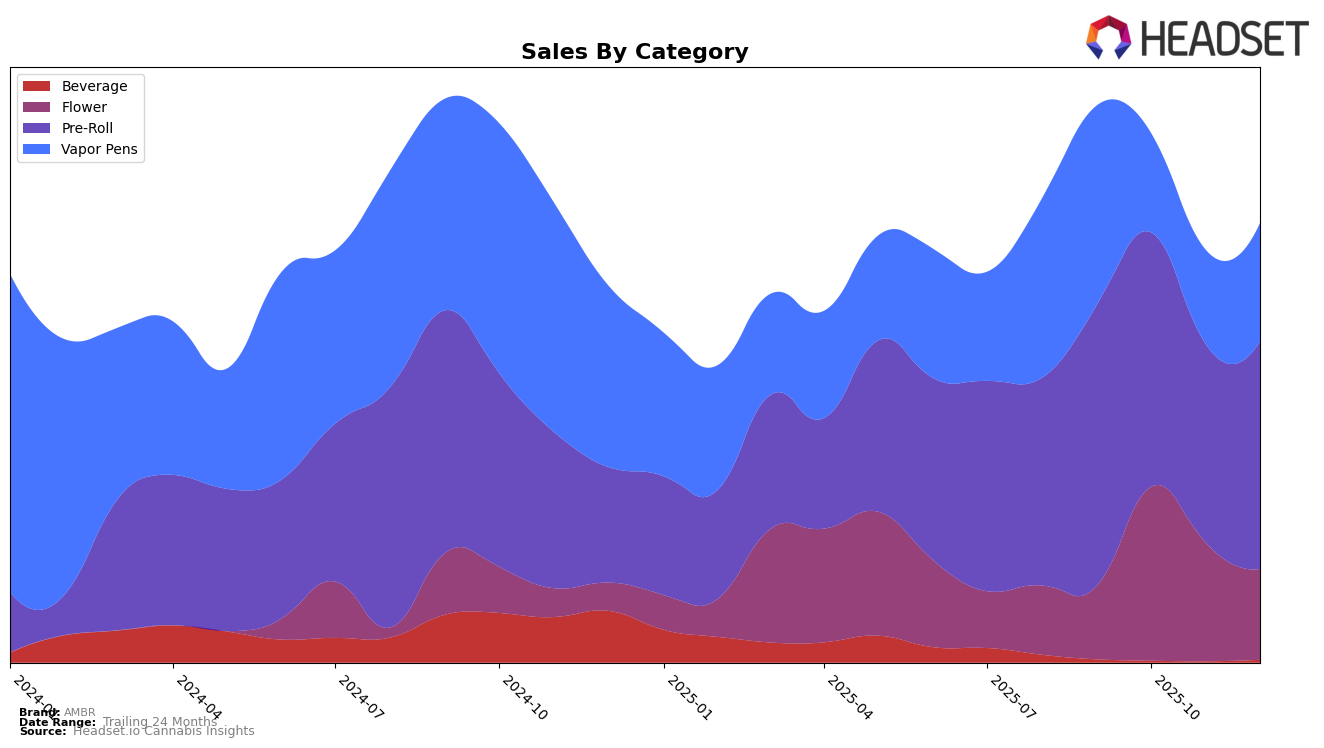

AMBR's performance across different categories and regions has shown some fluctuations over the past months. In Alberta, the brand's presence in the Vapor Pens category has been somewhat inconsistent, with rankings oscillating from 41st in September to 72nd in October, before improving to 57th by December. This suggests a recovery towards the end of the year, despite a significant dip in sales in October. Meanwhile, in Ontario, AMBR's Flower category did not make it into the top 30 rankings, indicating a challenge in capturing significant market share. However, it's worth noting that the brand did manage to secure a position in the top 100, which could be a stepping stone for future growth.

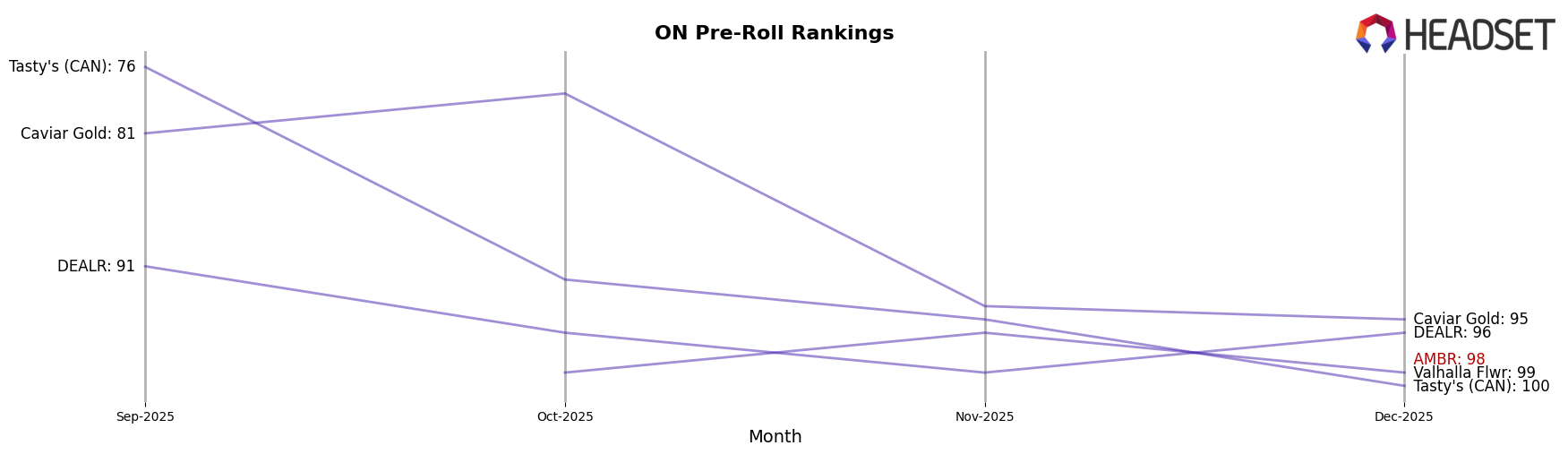

In the Pre-Roll category in Ontario, AMBR appeared on the radar in December, ranking 98th, which marks its first entry into the top 100. This could signal emerging potential in this category if the trend continues. For Vapor Pens in Ontario, the rankings have shown a downward trend from 71st in September to 93rd in November, before a slight improvement to 91st in December. This indicates a challenging competitive landscape, but the slight uptick in December might suggest a stabilization or strategic adjustments by the brand. Overall, while AMBR has faced challenges in breaking into the top tiers, there are signs of potential growth and recovery in certain areas that could be explored further.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Ontario, AMBR has shown a notable entry into the top 100 rankings in December 2025, securing the 98th position. This marks a significant milestone as AMBR was not ranked in the top 20 in the preceding months, indicating a positive trajectory in its market presence. In contrast, Caviar Gold experienced a decline, moving from 78th in October to 95th in December, suggesting a potential opportunity for AMBR to capture market share from declining competitors. Meanwhile, Valhalla Flwr maintained a relatively stable position around the 96th to 99th range, while Tasty's (CAN) and DEALR both saw fluctuations, with Tasty's (CAN) dropping to 100th in December. These dynamics suggest that AMBR's recent entry into the rankings could be leveraged to further enhance its market share, especially as some competitors face declining sales and rank positions.

Notable Products

In December 2025, the Gelato Infused Blunt (1g) emerged as the top-performing product for AMBR, climbing from fourth place in September to first place with sales reaching 1003 units. The Pineapple Express Infused Pre-Roll (1.5g) maintained its strong performance, ranking second after holding the top spot in November. The Cereal Milk Infused Blunt (1g) debuted impressively in third place, showing significant demand. The BSCTI Infused Pre-Roll 3-Pack (1.5g) remained steady at fourth, while the GLTO Infused Pre-Roll 3-Pack (1.5g) slipped to fifth, reflecting a slight decline in sales compared to previous months. Overall, the rankings indicate a dynamic shift in consumer preferences towards single-unit infused blunts over multi-pack pre-rolls.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.