Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

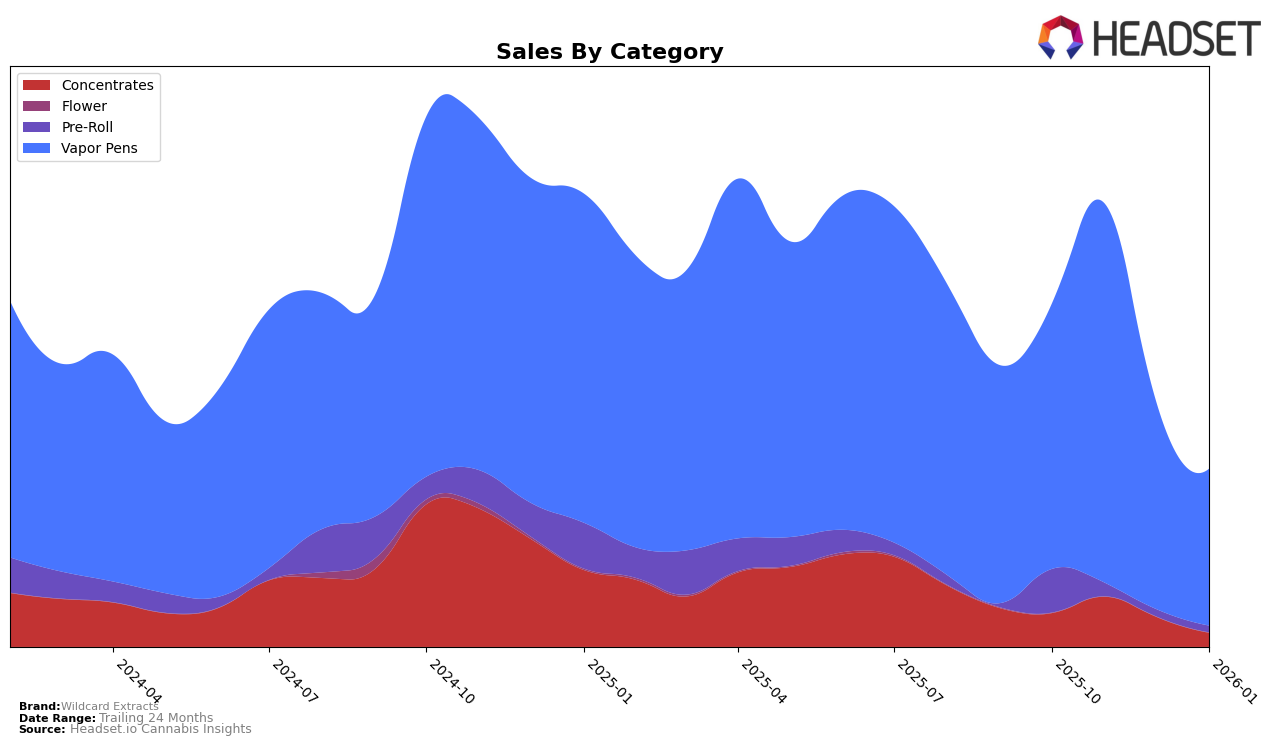

Wildcard Extracts has shown varied performance across different categories and regions, with notable movements in the vapor pen segment. In British Columbia, the brand has maintained a strong presence, consistently ranking within the top 30 for vapor pens. However, there has been a gradual decline from 5th in October 2025 to 24th by January 2026. This decline in rank might be concerning, but it's important to note that the brand still managed to maintain significant sales figures. In contrast, in Alberta, Wildcard Extracts did not break into the top 30 for vapor pens, indicating a potential area for improvement or increased competition in that market.

In the concentrates category, Wildcard Extracts had a presence in British Columbia but dropped out of the top 30 by January 2026. This suggests a decline in market share or increased competition. Meanwhile, their pre-rolls briefly appeared at 58th in October 2025 but did not maintain a ranking in subsequent months, indicating a potential challenge in sustaining market presence in this category. In Ontario, the brand's vapor pen performance showed a slight decline, moving from 76th to 91st over the observed months, which could imply a need for strategic adjustments to regain competitiveness in this populous market.

Competitive Landscape

In the competitive landscape of vapor pens in British Columbia, Wildcard Extracts has experienced a notable shift in its ranking and sales performance over the past few months. Starting strong in October 2025 with a rank of 5, Wildcard Extracts saw a decline to 24 by January 2026. This downward trend in rank is accompanied by a decrease in sales, suggesting a challenging competitive environment. Meanwhile, brands like Glacial Gold and Hycycle have shown upward momentum, with Hycycle notably improving from rank 42 in October to 25 in January, surpassing Wildcard Extracts. High Key also edged past Wildcard Extracts, moving from rank 14 to 21 over the same period. The entry of DEALR into the top 20 in December further intensifies the competition. These dynamics highlight the need for Wildcard Extracts to reassess its strategies to regain its competitive edge in this rapidly evolving market.

Notable Products

In January 2026, Wildcard Extracts' top-performing product was the White Mimosa Live Resin Cartridge (1g) in the Vapor Pens category, maintaining its position as the number one ranked product from December 2025. The Mint Chip FSE Cured Resin Cartridge (1g) climbed to the second spot, showing a significant improvement from its absence in December's ranking. The OJ Zainbow Cured Resin Cartridge (1g) dropped to third place from its previous second-place ranking in December. Notably, the Dancehall Cured Resin Cartridge (1g) made its debut in the rankings at fourth place. The Small Batch Resin Distillate Cartridge (1g) maintained a consistent presence, holding the fifth position with sales of 392 units in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.