Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

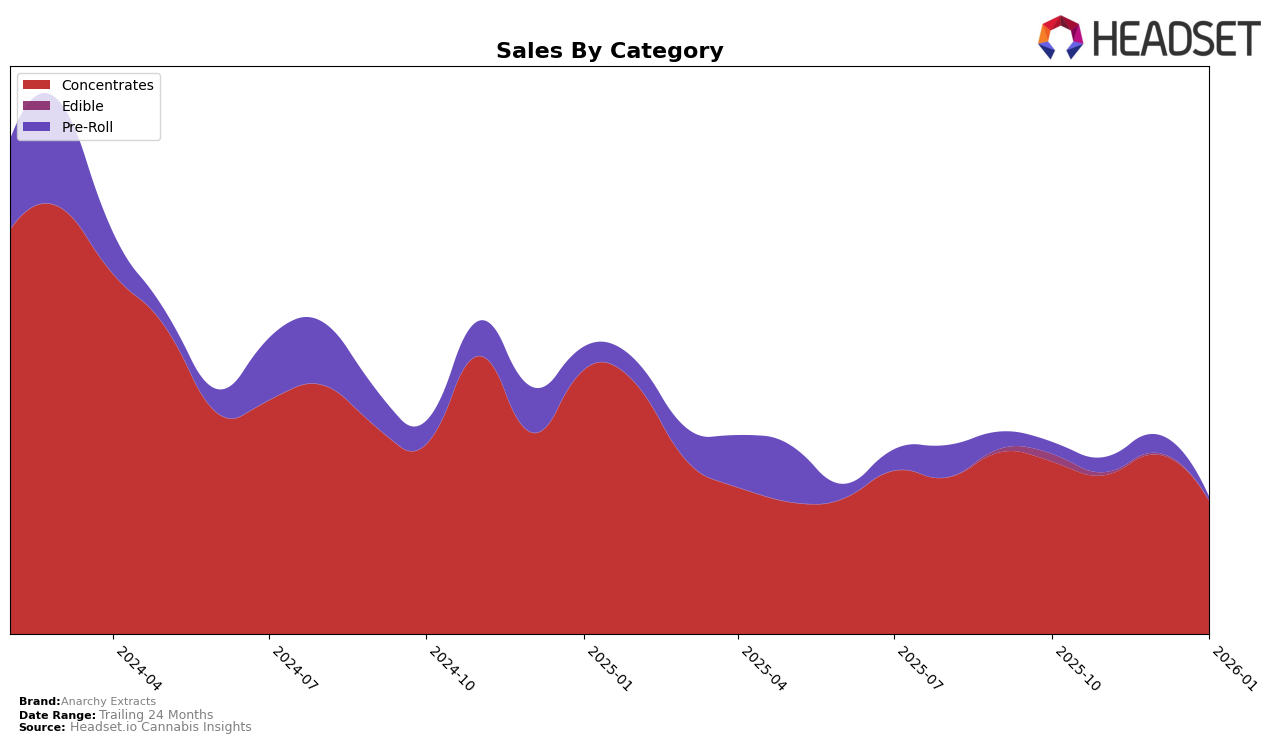

In the state of Michigan, Anarchy Extracts has shown a notable pattern in the Concentrates category over the past few months. Starting from a rank of 14 in October 2025, the brand experienced a slight decline, moving to 18th in November, and then to 19th in December. By January 2026, they further slipped to the 24th position. This downward trend suggests that while the brand had a strong presence initially, maintaining its competitive edge has been challenging. Their performance indicates potential areas for strategic improvement to regain higher rankings.

Despite the fluctuations in rankings, Anarchy Extracts' sales figures reveal some interesting insights. While there was a dip in sales from October to November, December witnessed a rebound, surpassing even the October sales figures. However, this recovery was short-lived as January saw a significant drop in sales. The brand's performance in Michigan's Concentrates category highlights the volatility and competitive nature of the market, suggesting that Anarchy Extracts may need to explore innovative strategies or product enhancements to stabilize and improve their market position.

```Competitive Landscape

In the competitive landscape of the concentrates category in Michigan, Anarchy Extracts has experienced notable fluctuations in its market position over recent months. Starting from a rank of 14 in October 2025, Anarchy Extracts saw a decline to 24 by January 2026. This shift in rank is significant when considering competitors such as GreenCo Ventures, which consistently maintained a higher rank, peaking at 15 in December 2025 before dropping to 23 in January 2026. Meanwhile, Redemption and Bowhouse have shown varied performance, with Redemption not making the top 20 in January 2026, and Bowhouse improving to rank 22. Interestingly, LOCO surged from outside the top 50 to rank 25 in January 2026, suggesting a potential emerging threat. Despite these competitive pressures, Anarchy Extracts' sales remained robust, although they experienced a decline from December 2025 to January 2026, mirroring the broader market trend observed among its competitors. This dynamic environment underscores the importance for Anarchy Extracts to strategize effectively to regain its competitive edge and improve its market position.

Notable Products

In January 2026, Sugar Cookie Budder (1g) emerged as the top-performing product for Anarchy Extracts, achieving the number one rank with notable sales of 1390 units. Afghan Punch Sugar (1g) followed closely, advancing from the third position in December 2025 to secure the second spot. Truffle Cake Budder (1g) debuted in the rankings at the third position, marking its entry as a strong contender. Gary Payton Budder (1g) and Apple Fritter Shatter (1g) filled the fourth and fifth positions, respectively, showcasing a consistent preference for concentrates. Overall, January saw a reshuffling of ranks with new entries and upward movements, highlighting a dynamic market shift for Anarchy Extracts' product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.