Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

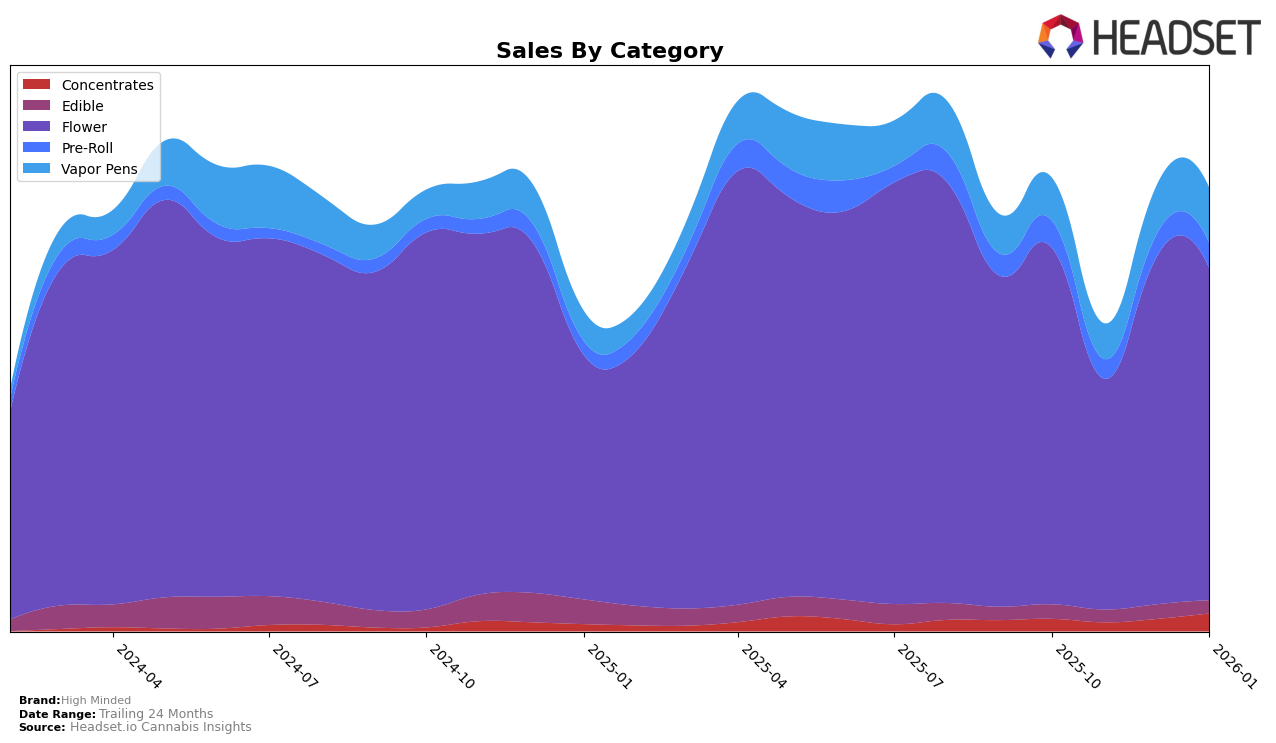

High Minded has shown varied performance across different product categories in Michigan. In the Concentrates category, the brand experienced a significant upward movement, climbing from 16th place in November 2025 to 8th by January 2026. This indicates a strong recovery and growing popularity in this segment, as evidenced by the impressive increase in sales from $192,123 to $329,755 over the same period. Conversely, the brand's performance in the Edible category has been relatively stable, maintaining a consistent presence but not breaking into the top 20, which suggests a potential area for strategic improvement.

In the Flower category, High Minded has maintained a dominant position, consistently ranking 1st in most months, except for a brief dip to 3rd in November 2025. This category appears to be a stronghold for the brand, with substantial sales figures supporting its top ranking. Meanwhile, in the Pre-Roll category, the brand's ranking has fluctuated but showed a positive trend from 29th in November to 19th in January 2026. The Vapor Pens category also witnessed a notable improvement, with the brand moving up from 17th to 9th place, indicating a growing consumer preference and successful market penetration in this product line.

Competitive Landscape

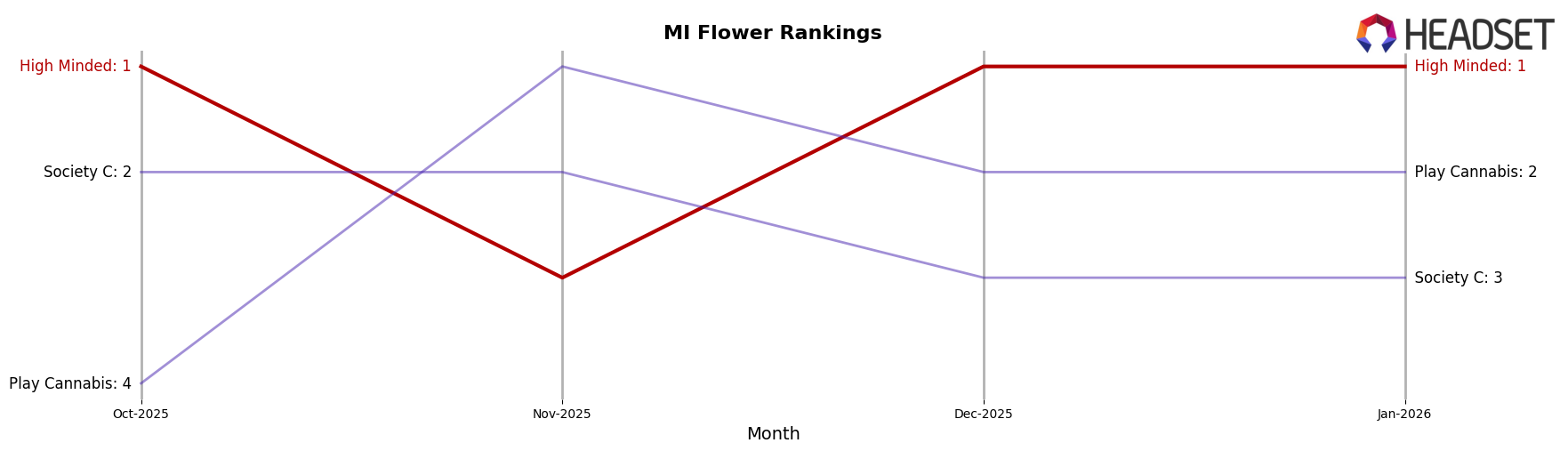

In the competitive landscape of the Michigan flower category, High Minded has demonstrated a strong presence, consistently securing the top rank in October and December 2025, as well as January 2026. However, the brand experienced a dip to the third position in November 2025, which highlights a temporary challenge in maintaining its lead. During this period, Play Cannabis surged to the top rank in November, showcasing a significant competitive threat with a consistent second-place finish in December 2025 and January 2026. Meanwhile, Society C maintained a steady presence in the top three, indicating stable performance but not enough to overtake High Minded's leading position. These dynamics suggest that while High Minded remains a dominant force, the competitive pressure from brands like Play Cannabis and Society C requires strategic attention to sustain its market leadership.

Notable Products

In January 2026, High Minded's Blue Raspberry Gummies 10-Pack (200mg) maintained its top position as the leading product, with sales reaching $18,233. The Tropical Punch Gummies 20-Pack (200mg) consistently held the second spot across the months. Strawberry Pineapple High Dose Gummies 10-Pack (200mg) climbed to the third rank in December 2025 and retained this position in January 2026. Gorilla Fuck (Bulk) made a notable entry in January 2026, securing the fourth rank. Meanwhile, Sour Blueberry Lemonade Gummies High Dose 4-Pack (200mg) saw a decline, dropping from fourth in December 2025 to fifth in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.