Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

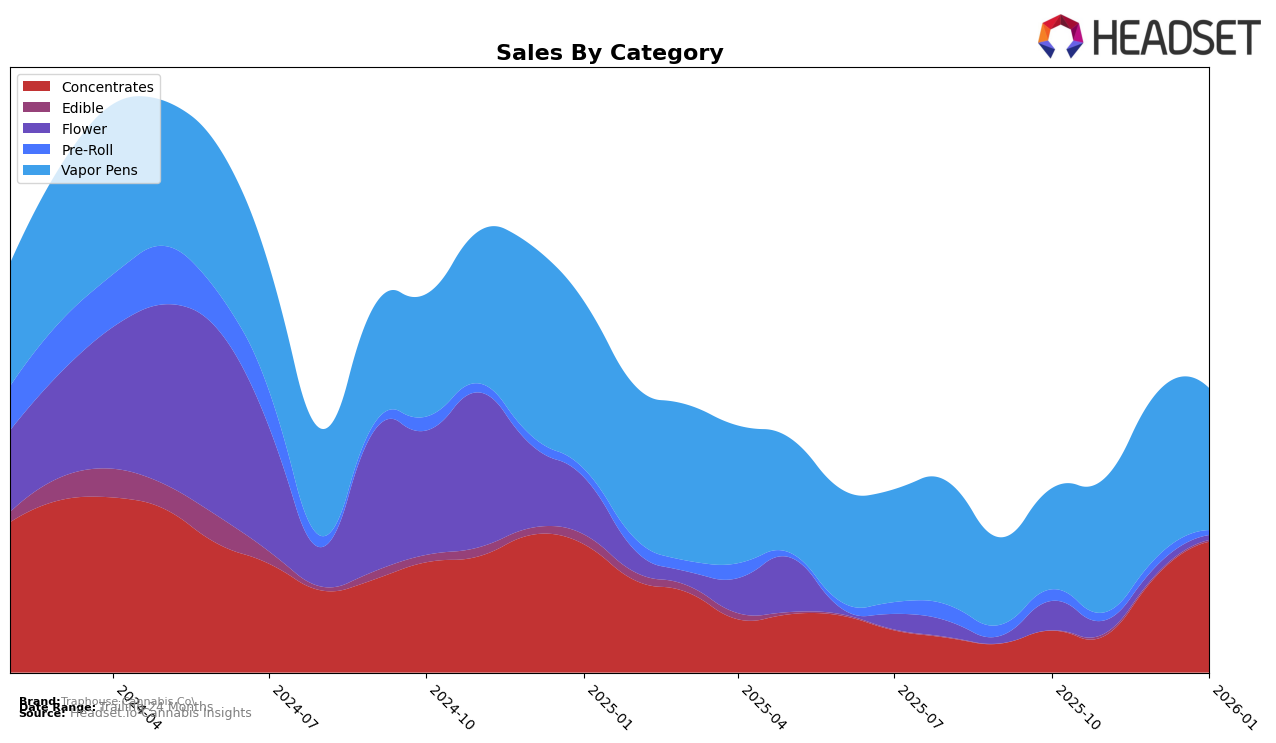

Traphouse Cannabis Co. has shown a notable upward trajectory in the Michigan concentrates market. Starting from the 15th position in October 2025, the brand rose to a remarkable 2nd place by January 2026. This consistent climb in rankings is indicative of a strong performance and increasing consumer preference in this category. The brand's sales in concentrates also reflect this upward trend, with a significant increase over the four-month period. Such a performance in Michigan highlights the brand's growing influence and competitive edge in the concentrates sector.

In contrast, Traphouse Cannabis Co.'s performance in the vapor pens category in Michigan has been relatively stable, with some fluctuations. The brand improved from the 21st position in October 2025 to 16th in November, maintaining this rank in January 2026. Despite these fluctuations, the brand managed to stay within the top 30, which is a positive indicator, although there is still room for improvement to break into the top 10. The sales figures in this category show a healthy volume, yet there seems to be an opportunity to leverage this stability into a more aggressive growth strategy to capture a larger market share.

Competitive Landscape

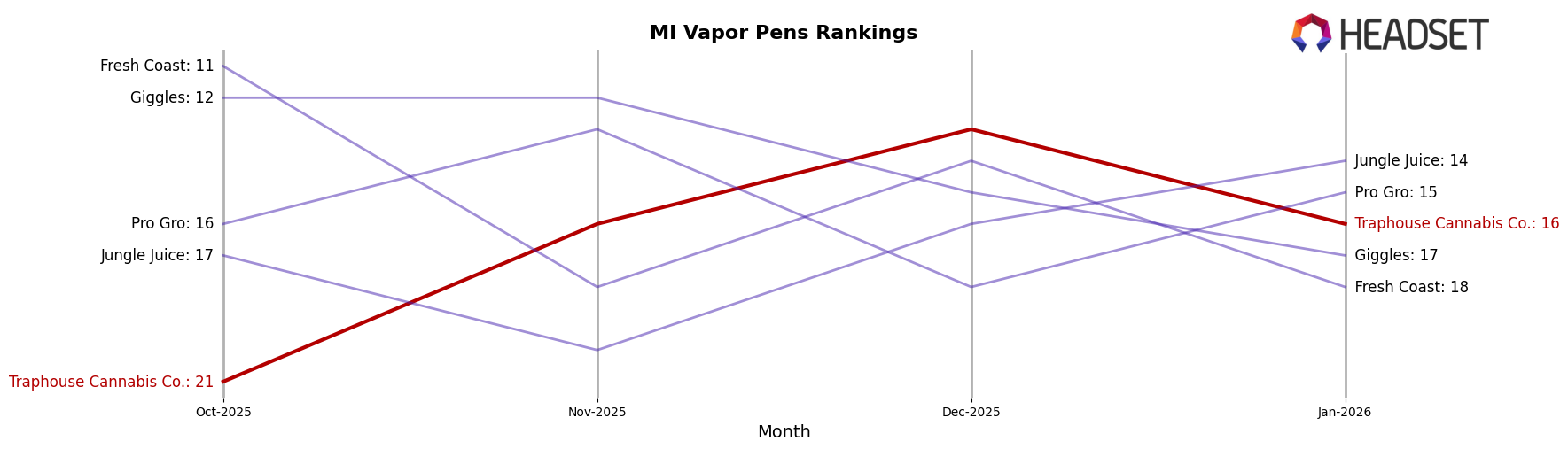

In the competitive landscape of vapor pens in Michigan, Traphouse Cannabis Co. has shown a dynamic trajectory, climbing from a rank of 21 in October 2025 to 13 by December, before settling at 16 in January 2026. This upward movement is notable given the competitive pressure from brands like Fresh Coast, which saw fluctuating ranks, peaking at 11 in October but dropping to 18 by January. Pro Gro and Giggles also experienced volatility, with Pro Gro moving from 16 to 15 and Giggles dropping from 12 to 17 over the same period. Meanwhile, Jungle Juice showed a slight improvement, ending at rank 14 in January. Despite these shifts, Traphouse Cannabis Co.'s sales growth trajectory, particularly the significant increase from November to December, suggests a strengthening market position amidst fluctuating competition.

Notable Products

In January 2026, Traphouse Cannabis Co.'s top-performing product was the Sour Tangie Distillate Cartridge (1g) from the Vapor Pens category, securing the number one rank with sales of 7277. The Sweet Island Punch Distillate Cartridge (1g) maintained its second-place position from December 2025, reflecting consistent demand. The Strawberry Shortcake Distillate Cartridge (1g) held the third spot, showing a slight drop from its second-place rank in November 2025. Newcomers Papaya Punch Distillate Disposable (1g) and Raspberry Kush Distillate Disposable (1g) entered the rankings at fourth and fifth positions, respectively, indicating a diversification in consumer preferences. Overall, the Vapor Pens category dominated the top ranks, highlighting its popularity among consumers.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.