Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

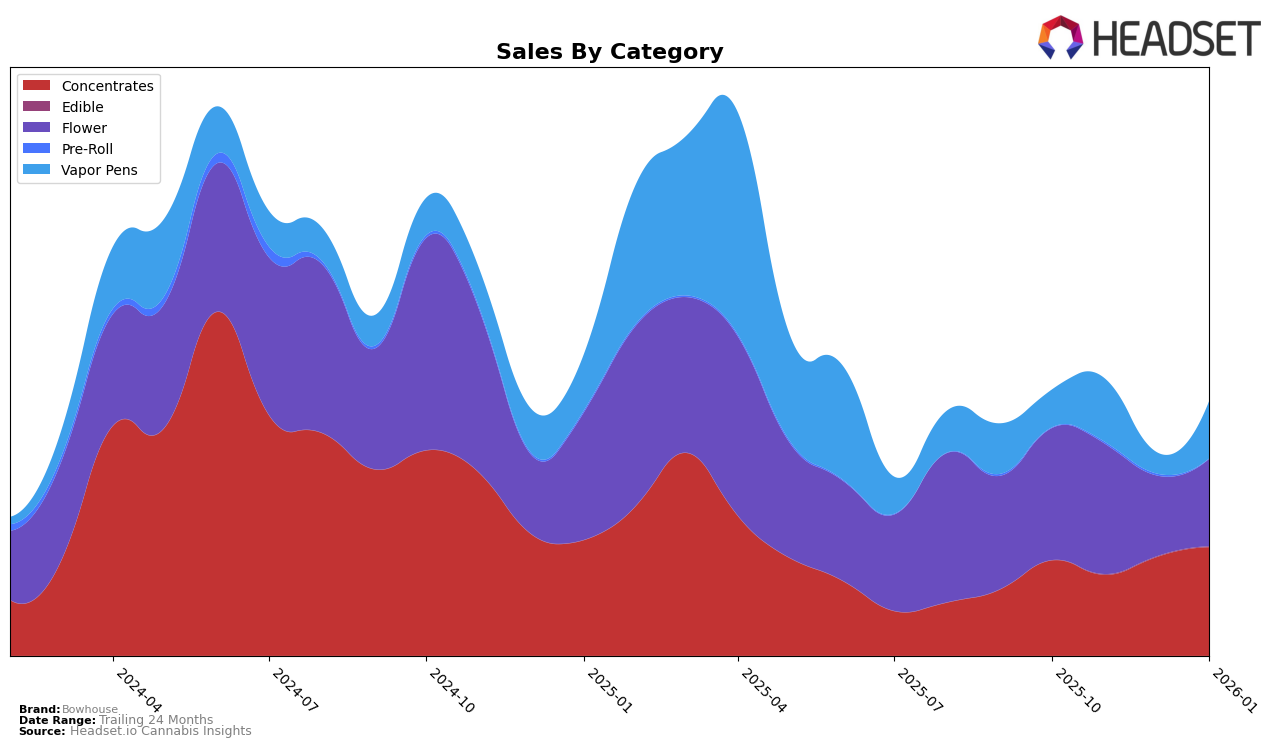

Bowhouse has shown a notable performance in the Michigan market, particularly in the Concentrates category. Over the past few months, their ranking in this category has demonstrated a positive trend, moving from 23rd in October 2025 to 22nd by January 2026. This upward movement is indicative of their growing presence and competitiveness in the market. The sales figures also support this trend, with an increase from $144,292 in October 2025 to $164,377 in January 2026. Such growth suggests that Bowhouse is successfully capturing consumer interest and expanding its market share in the Concentrates segment.

In the Vapor Pens category, Bowhouse's performance in Michigan presents a more mixed picture. While they were ranked 88th in October 2025, their position improved to 74th in November, indicating some positive momentum. However, they fell out of the top 30 in December, only to re-enter at 73rd in January 2026. This fluctuation points to challenges in maintaining a consistent ranking in a competitive category. Despite this, the sales figures reveal a recovery from November's dip, suggesting potential for stability or growth if Bowhouse can leverage their recent gains effectively.

Competitive Landscape

In the competitive landscape of the Michigan concentrates market, Bowhouse has experienced fluctuating rankings over the past few months, indicative of a dynamic market environment. Notably, Bowhouse's rank dropped from 23rd in October 2025 to 30th in November 2025, before recovering slightly to 28th in December 2025 and 22nd in January 2026. This volatility contrasts with competitors like Common Citizen and GreenCo Ventures, which maintained more stable rankings, with GreenCo Ventures even peaking at 15th in December 2025. Despite Bowhouse's sales increasing from December 2025 to January 2026, the brand still faces challenges in climbing the ranks, as competitors like Anarchy Extracts and Peachy Hash & Co. also show strong sales figures, indicating a competitive pressure that Bowhouse must navigate to improve its market position.

Notable Products

In January 2026, the top-performing product from Bowhouse was Orange Marmalade Live Resin Badder (1g) in the Concentrates category, achieving the highest sales figure of 1959 units. Following closely was Jelly Rancher Live Resin Sugar (1g), also in Concentrates, ranking second with notable sales. Blue Zushi Live Resin Badder (1g) secured the third position, maintaining a strong presence within the Concentrates category. Red Runtz (3.5g) in the Flower category held steady in fourth place, showing a consistent upward trend from its fourth-place ranking in October 2025. Cereal Milk Distillate Disposable (1g) in Vapor Pens rounded out the top five, marking a significant entry into the rankings for January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.