Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

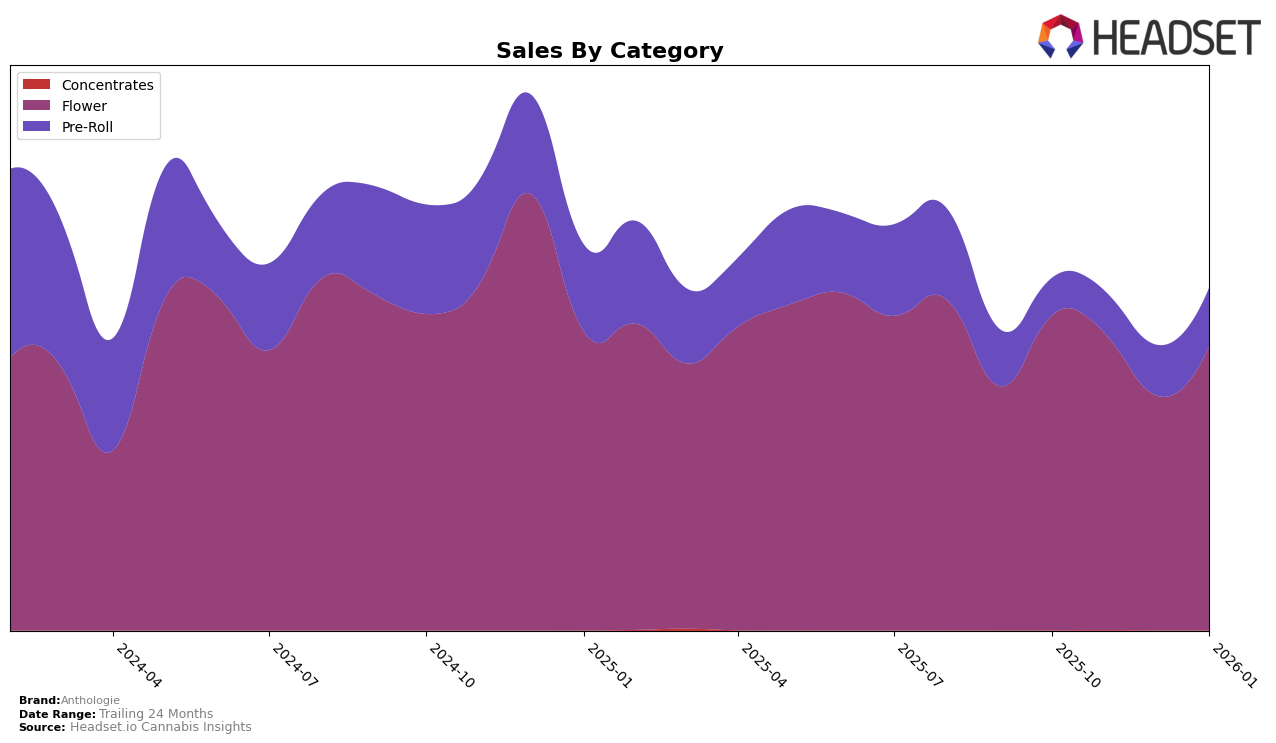

Anthologie's performance in the Massachusetts flower category has seen a downward trend in recent months. Starting from a rank of 67 in October 2025, the brand dropped to 88 by January 2026, indicating a decline in its competitive stance within the top 30 brands. This movement correlates with a decrease in sales from $178,039 in October to $102,885 in January. Such a shift suggests potential challenges in maintaining market share or consumer interest in the Massachusetts flower segment, which might require strategic adjustments.

In contrast, Anthologie's performance in New Jersey presents a more mixed picture. Within the flower category, Anthologie maintained a relatively stable presence, moving from rank 31 in October to 27 by January, despite a sales dip in November and December. This suggests resilience and potential growth in market penetration. Meanwhile, in the pre-roll category, Anthologie experienced a positive trajectory, improving from rank 46 in October to 34 by January, alongside a steady increase in sales. This upward movement in New Jersey's pre-roll market highlights a successful strategy in this category, potentially offering insights into consumer preferences and brand strengths.

Competitive Landscape

In the competitive landscape of the New Jersey flower category, Anthologie has experienced notable fluctuations in its ranking and sales performance over recent months. Despite starting at rank 31 in October 2025, Anthologie saw a dip to rank 35 in December 2025, before making a significant comeback to rank 27 by January 2026. This improvement in rank coincided with a recovery in sales, which increased from a low in December to a higher figure in January. In comparison, Verano and Goodies maintained relatively stable positions, with Goodies consistently outperforming Anthologie in sales. Meanwhile, Illicit / Illicit Gardens and Breakwater also showed dynamic ranking changes, with Breakwater achieving a higher rank than Anthologie in December. These shifts highlight the competitive pressures Anthologie faces, underscoring the importance of strategic adjustments to sustain its upward trajectory in the New Jersey market.

Notable Products

In January 2026, Local Skunk Pre-Roll (1g) maintained its top position as the best-selling product for Anthologie, with sales reaching 3698 units. AJ's Sour Diesel Pre-Roll (1g) improved its ranking from third in December 2025 to second place in January 2026. Strawberry Mango Haze Pre-Roll (1g) entered the rankings at third place with notable sales. Local Skunk (3.5g), which was previously ranked second in December, dropped to fourth place in January. Super Boof Smalls (7g) debuted in the rankings at fifth position, indicating a strong entry into the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.