Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

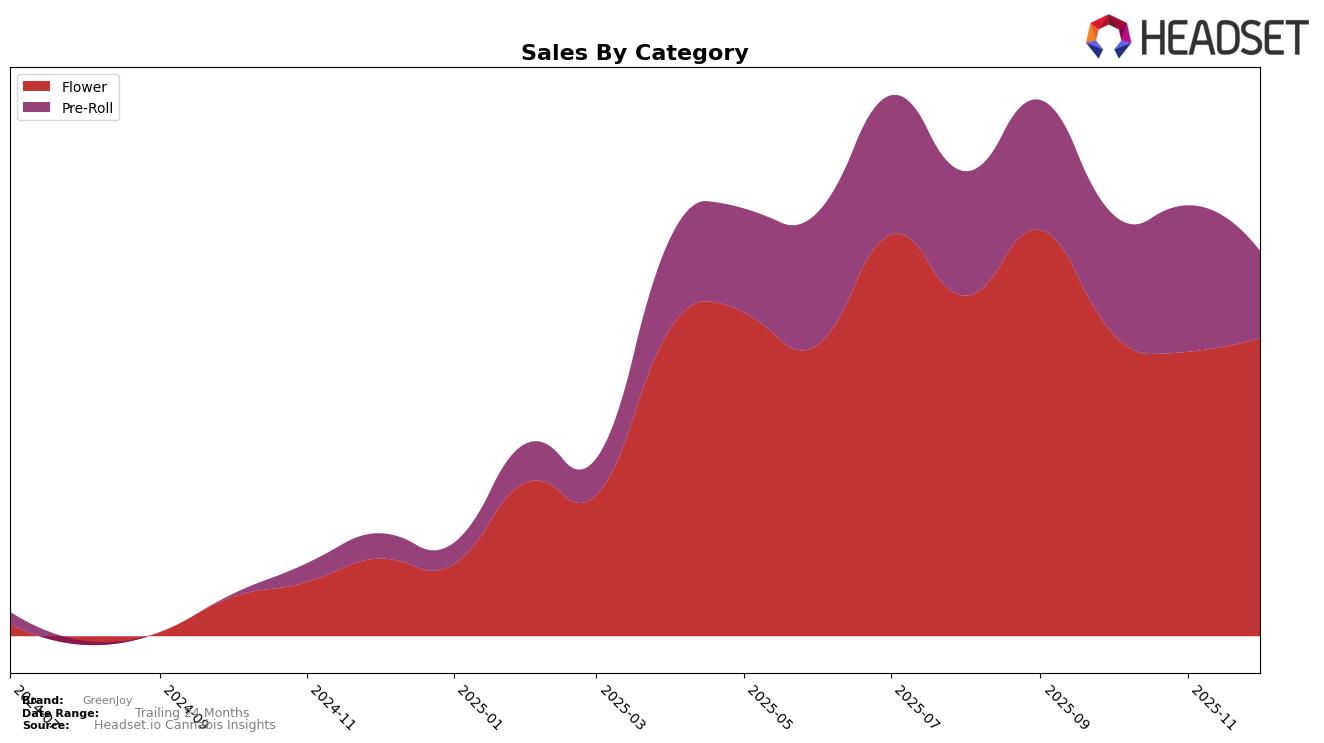

GreenJoy's performance across different categories in New Jersey has shown varied trends over the past few months. In the Flower category, the brand experienced a downward trajectory, dropping from a rank of 15 in September 2025 to 26 by December 2025. This decline in rank is indicative of a competitive landscape or possibly a shift in consumer preferences. Despite the drop in rankings, sales figures suggest a slight rebound in December, although they have not returned to the higher levels seen in September. This suggests that while GreenJoy is maintaining a presence, there might be challenges in regaining its earlier momentum in the Flower segment.

In contrast, the Pre-Roll category in New Jersey paints a different picture. GreenJoy's rank fluctuated, peaking at 15 in November before slipping to 23 in December 2025. This volatility could point to seasonal demand shifts or promotional activities affecting consumer choices. Interestingly, November saw a significant boost in sales, indicating that despite the fluctuations in rank, there's a potential for high consumer engagement with GreenJoy's Pre-Roll products. The brand's ability to reach the top 15 in November demonstrates its potential to capture market interest, though sustaining that position appears to be challenging.

Competitive Landscape

In the competitive landscape of the Flower category in New Jersey, GreenJoy has experienced notable fluctuations in its ranking, which could impact its market positioning and sales strategy. As of December 2025, GreenJoy holds the 26th rank, a slight improvement from November but a decline from its 15th position in September. This downward trend contrasts with competitors like Old Pal, which maintained a stronger presence, peaking at 17th in November before dropping to 24th in December. Meanwhile, Full Tilt Labs demonstrated a volatile pattern, achieving a high of 17th in October but falling to 25th by December. Despite these shifts, GreenJoy's sales have shown resilience, with a slight uptick in December compared to November, suggesting potential for recovery. However, the brand must strategize effectively to regain its earlier momentum and compete with brands like Verano and Savvy, which have also seen varying ranks but consistent sales growth.

Notable Products

In December 2025, GreenJoy's top-performing product was Bread and Butter 3.5g from the Flower category, which ascended to the number one spot with sales reaching 2105 units. The Slurricane Pre-Roll 2-Pack 1g ranked second, showcasing a notable improvement from its previous fourth position in November. Following closely, the Strawberry Candy Pre-Roll 2-Pack 1g secured the third spot, slightly dropping from its previous ranking. The Morning Diesel Pre-Roll 2-Pack 1g entered the rankings in December, taking the fourth position. Lastly, the Slurricane Pre-Roll 5-Pack 2.5g completed the top five, maintaining its rank from November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.