Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

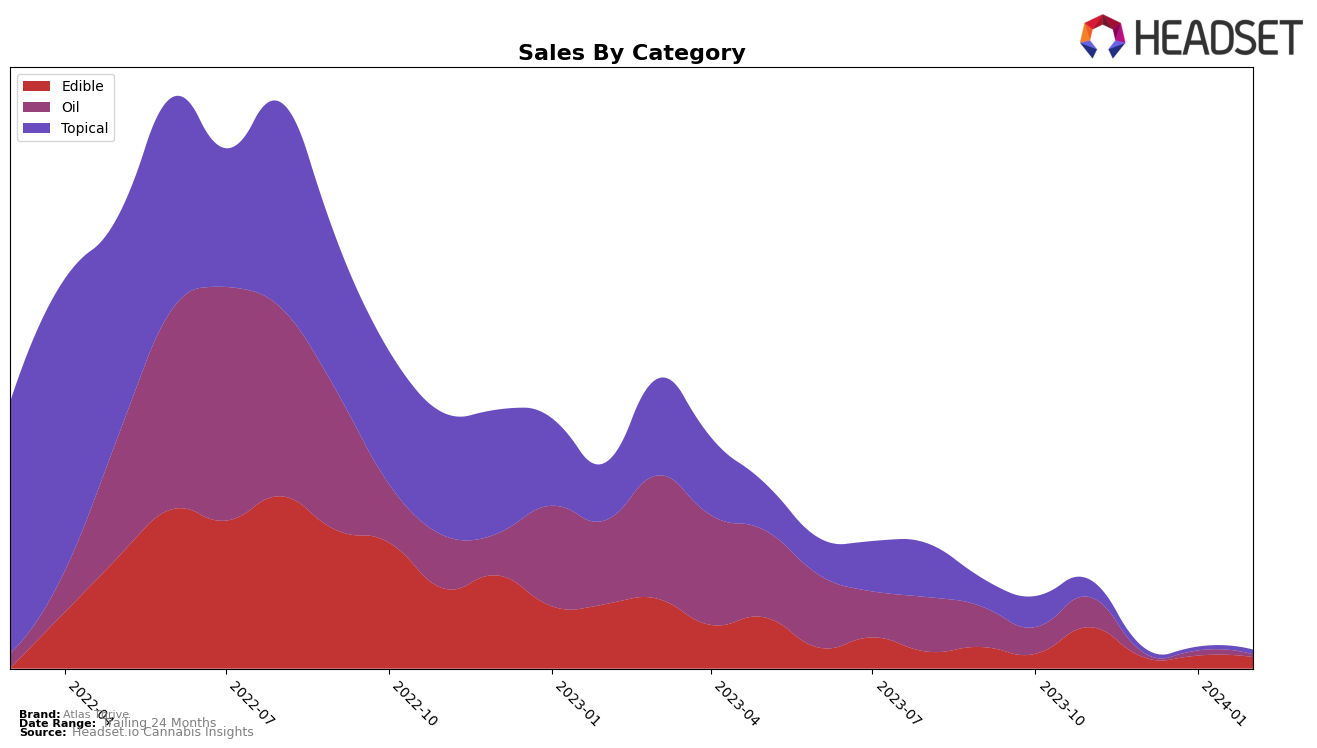

Atlas Thrive has shown a varied performance across categories and states, with notable trends in both positive and negative directions. In Alberta, the brand's position in the Edibles category experienced a significant drop, not ranking in December 2023 and then descending from 46th in November 2023 to 57th by February 2024, alongside a decrease in sales from 1716 units to 201 units in the same period. This indicates a challenging period for Atlas Thrive in the Alberta Edibles market. Conversely, in the Topicals category within Alberta, Atlas Thrive started strong in November 2023, ranking 17th, but did not maintain a presence in the rankings thereafter, suggesting a potential focus shift or market challenges. In British Columbia, Atlas Thrive's performance in the Oils category showed more stability, maintaining a position within the top 25 from November 2023 through February 2024, albeit with slight fluctuations in ranking and a gradual decrease in sales over the same period.

In Ontario, Atlas Thrive's presence varied significantly across categories. The brand struggled to maintain a strong position in the Edibles category, with rankings falling from 72nd in November 2023 to being unranked in February 2024, reflecting either increased competition or decreased market focus. However, in the Topicals category, Atlas Thrive demonstrated resilience and growth, improving its rank from 19th in November 2023 to 22nd in February 2024, alongside an increase in sales from 701 units to 334 units, showcasing a potential strategic success in this market segment. Meanwhile, in Saskatchewan, the brand maintained a consistent presence in the Edibles category, staying within the top 40 from November 2023 to February 2024, and even showing an increase in sales to 538 units by February 2024, indicating a solid consumer base and potential for growth in this region. This mixed performance across states and categories highlights the dynamic nature of the cannabis market and the importance of strategic agility for brands like Atlas Thrive.

Competitive Landscape

In the competitive landscape of the edible category in Saskatchewan, Atlas Thrive has shown a consistent performance, maintaining its position within the top 40 brands from November 2023 through February 2024. Despite a slight fluctuation in rank—moving from 35th in November 2023 to 37th by February 2024—Atlas Thrive's sales trajectory indicates resilience, with a notable rebound in February after a dip in January. Competing brands such as THC BioMed and Kiss have experienced more significant rank shifts and sales volatility during the same period. Notably, HYTN, despite not ranking in November, surged in December, only to see a sharp decline in February. Meanwhile, Summit (Canada) was absent from the rankings after November, reappearing in February at 38th. Atlas Thrive's steadiness amidst these fluctuations underscores its potential for growth and stability in a volatile market, positioning it as a brand worth watching for sustained performance and resilience.

Notable Products

In February 2024, Atlas Thrive's top-performing product remained the CBD:THC 20:1 Vanilla Mint Gum 10-Pack (200mg CBD, 10mg THC), holding its number one rank consistently since November 2023, with sales figures reaching 72 units. The second position was claimed by MUV - CBD/THC 1:1 Transdermal Patch (10mg CBD, 10mg THC), moving up one rank from January to surpass MÜV - THC150 EnCaps Oil Tincture (7.5ml), which settled in third after previously holding the second spot. Notably, the MUV - CBD Transdermal Patch (20mg CBD) did not make the top rankings in February, indicating a shift in consumer preferences or availability issues. This shift in rankings highlights a dynamic market and the importance of product diversity for Atlas Thrive. Overall, the consistency of the CBD:THC 20:1 Vanilla Mint Gum 10-Pack at the top spot underscores its popularity and consumer demand within the Atlas Thrive product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.