Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

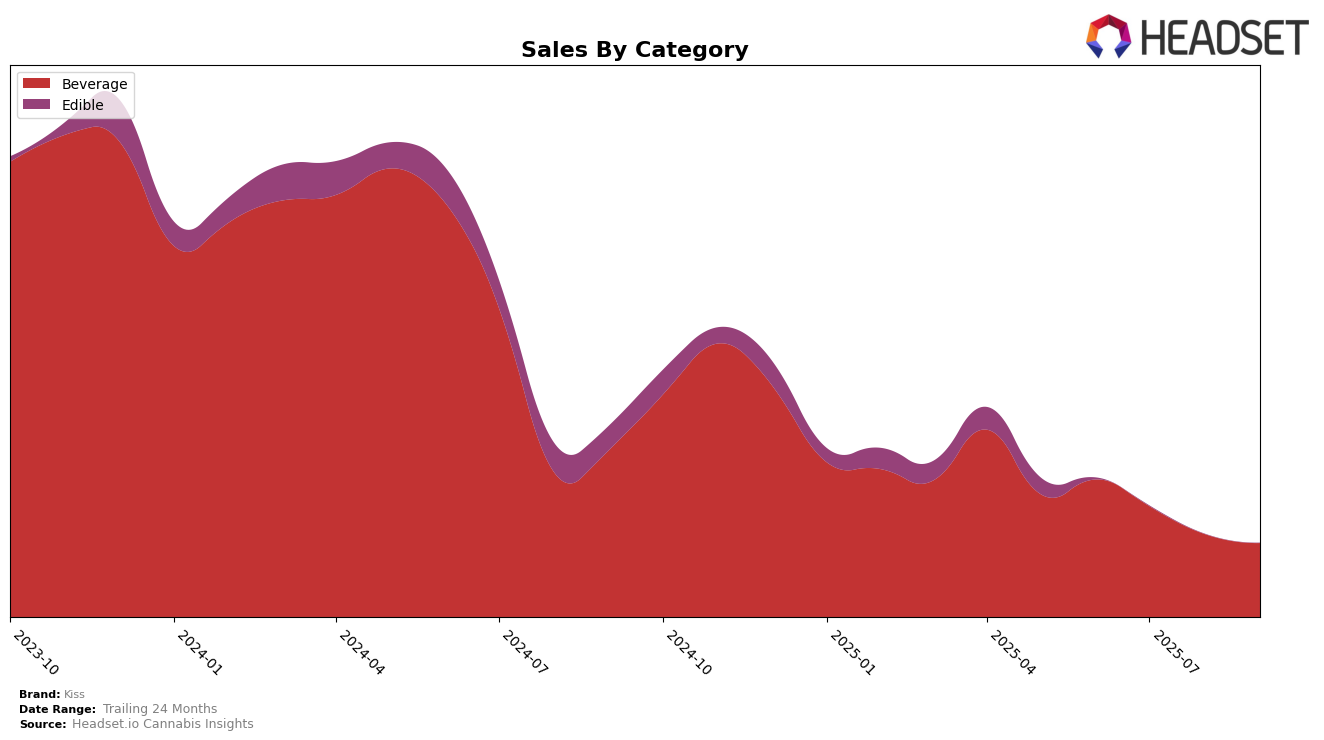

In the province of Ontario, the cannabis brand Kiss has shown a fluctuating performance in the Beverage category over the summer months of 2025. Starting with a rank of 27 in June, it slipped slightly to 29 in July. Unfortunately, by August and September, Kiss was no longer in the top 30 brands, indicating a decline in its competitive standing within the category. This drop out of the rankings could suggest increasing competition or a shift in consumer preferences away from Kiss's beverage offerings during this period. Despite these challenges, Kiss's presence in the rankings earlier in the summer demonstrates its potential to reach the top tier in this market.

While the specific sales figures for August and September are not available, the sales data from June and July show a downward trend, with sales decreasing from 13,014 in June to 10,314 in July. This decline in sales aligns with the drop in ranking, suggesting that Kiss may need to reassess its strategies to regain its foothold in the Ontario beverage market. The absence of Kiss from the top 30 in later months could be seen as a critical point for the brand, potentially prompting a re-evaluation of its product offerings or marketing strategies to better align with consumer demands. Without more detailed information, it's challenging to pinpoint the exact causes, but these movements certainly highlight areas for potential improvement.

Competitive Landscape

In the competitive landscape of the beverage category in Ontario, Kiss has faced significant challenges in maintaining its rank and sales. While Kiss was not in the top 20 brands from June to September 2025, its competitors have shown varying degrees of performance. Keef Cola maintained a stable presence, ranking 14th in both June and August, although it dropped to 16th in July. Despite this fluctuation, Keef Cola's sales remained significantly higher than Kiss's. Similarly, Deep Space hovered around the 20th position, indicating a stronger market presence compared to Kiss. Notably, Snap Back entered the top 20 in July and improved its rank to 25th by August, showcasing a positive sales trajectory. These insights suggest that Kiss needs to strategize effectively to enhance its market position and compete with these established brands.

Notable Products

In September 2025, the Mango Shot (10mg THC, 30ml) from Kiss retained its top position as the leading product in the Beverage category, despite a slight decrease in sales to 1565 units. The THC Kiss Guava Shot (10mg THC, 30ml) also maintained its consistent second place with a sales increase to 459 units. Notably, the Chocolate Chip Biscuit (10mg), previously ranked third, was not listed in the rankings for September. The Double Chocolate Chip Biscuit (10mg), which appeared in the rankings in July, did not maintain its presence in August or September. Overall, the top two beverages have shown strong stability in their rankings over the past few months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.