Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

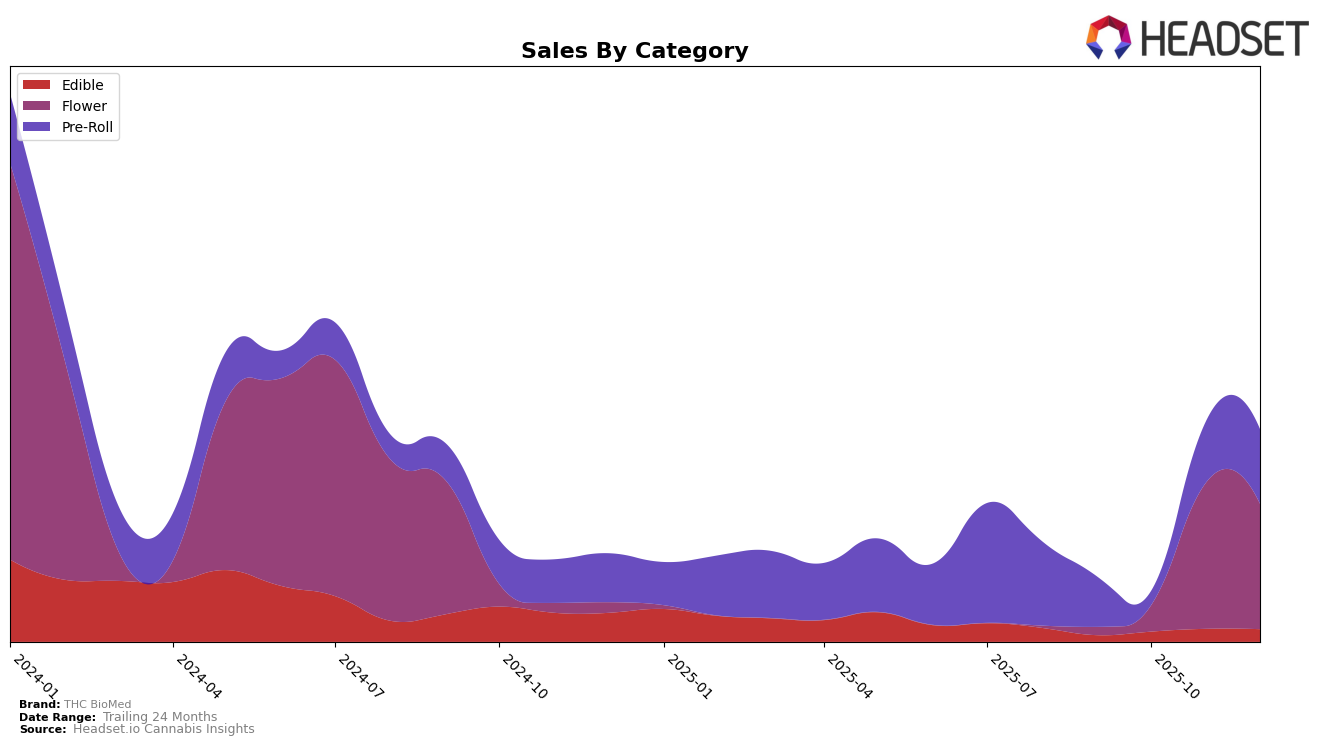

THC BioMed has shown a notable presence in the British Columbia market, particularly within the Flower category. However, their performance has seen some fluctuations towards the end of 2025. In both November and December, THC BioMed did not make it into the top 30 brands, which indicates a decline in their competitive standing within the province. This drop in ranking suggests that THC BioMed may be facing increased competition or other market challenges in British Columbia. Despite these challenges, the brand managed to maintain a consistent presence in the market, which could indicate a loyal customer base or strategic positioning in certain segments.

The sales figures for THC BioMed in British Columbia reflect a downward trend from September to December 2025, with December sales at $20,197. This decline in sales aligns with their absence from the top 30 rankings in the last two months of the year. The brand's performance in the Flower category highlights an area that may require strategic adjustments or marketing efforts to regain lost ground. The absence from the top 30 rankings during these months might be a cause for concern, indicating potential areas for improvement in product offerings or market strategy to better compete in the dynamic cannabis market of British Columbia.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, THC BioMed has experienced a challenging period, with its rank slipping to 97th by December 2025. This decline in rank is indicative of a broader trend of decreasing sales, as evidenced by a drop from 23,654 in September to 20,197 by December. In contrast, competitors like Redecan and Sheeesh! have shown more resilience, with Sheeesh! notably climbing to 66th in November before settling at 82nd in December, suggesting a more volatile but upward trajectory in sales. Meanwhile, Tuck Shop has demonstrated a significant improvement, moving from outside the top 20 to 71st by December, indicating a strong sales performance. These shifts highlight the competitive pressure on THC BioMed, emphasizing the need for strategic adjustments to regain market share in this dynamic environment.

Notable Products

In December 2025, THC BioMed's top-performing product was the Durga Mata II CBD Pre-Roll 3-Pack (1.5g) in the Pre-Roll category, maintaining its number one rank from November with a notable sales figure of 1313 units. The THC Kiss Cinnamon Biscuit (10mg) in the Edible category rose to the second position, improving from its previous absence in November rankings. THC Kiss - Cocoa Biscuit (10mg) experienced a slight drop, moving from second to third place. Biomed Sativa (15g) in the Flower category ranked fourth, showing a consistent presence since its entry in November. Finally, THC Kiss Orange Gummies 4-Pack (10mg) debuted in the rankings at fifth place in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.