Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

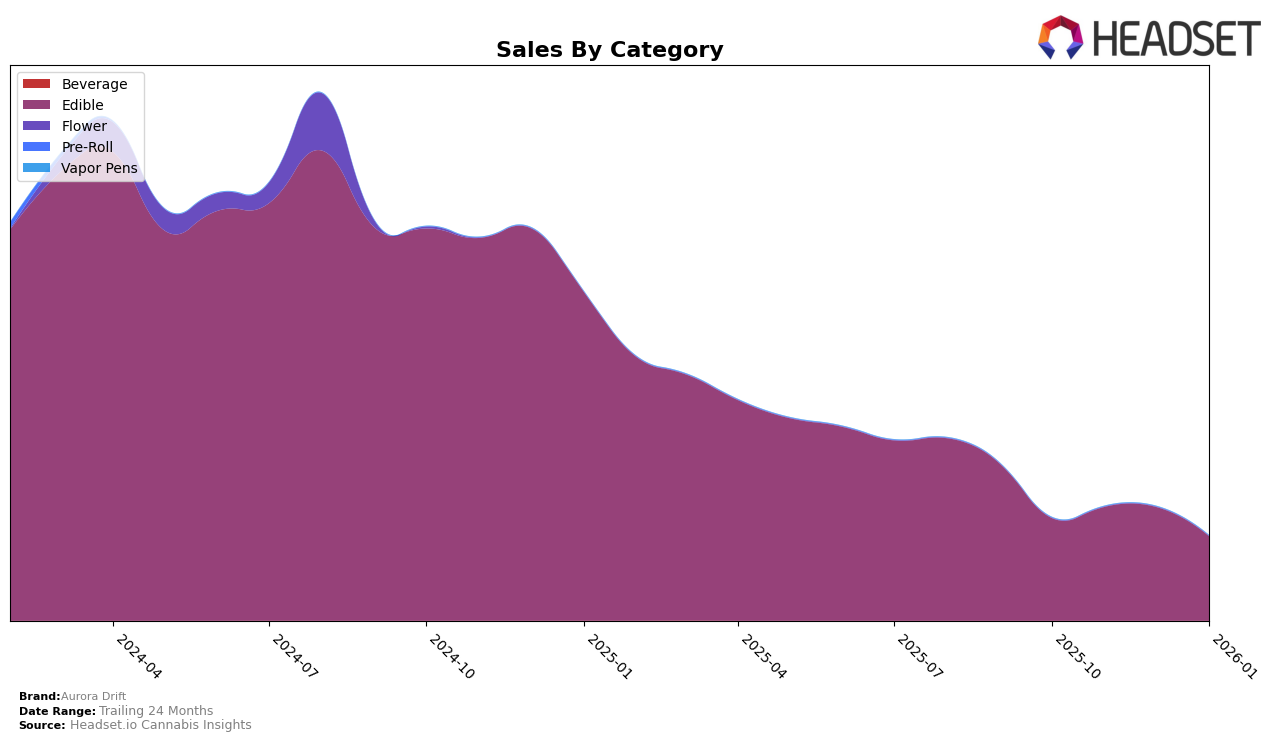

In the Canadian cannabis market, Aurora Drift's performance in the Edible category has shown varying trends across different provinces. In Alberta, Aurora Drift maintained a steady presence, ranking consistently at 18th in October and November 2025, before slipping slightly to 20th by January 2026. This stability, despite a gradual decline in sales from October to January, suggests a resilient brand presence in the province. Meanwhile, in British Columbia, the brand demonstrated a more positive trajectory, improving its rank from 17th to 16th by December and maintaining this position into January 2026. This upward movement, coupled with a noticeable increase in sales from October to December, highlights a strengthening foothold in the British Columbia market.

Conversely, the performance of Aurora Drift in Ontario presents a more challenging scenario. The brand saw a decline in its ranking from 23rd in October to 29th by January 2026, indicating a struggle to maintain its competitive edge in the province's Edible category. The significant drop in sales from October to January further underscores this challenge. Notably, the absence of Aurora Drift in the top 30 rankings in any other states or categories during this period suggests areas where the brand might explore opportunities for growth or improvement. This mixed performance across provinces highlights the dynamic nature of the cannabis market and the importance of strategic positioning for brands like Aurora Drift.

Competitive Landscape

In the British Columbia edible market, Aurora Drift has shown a consistent presence, maintaining a steady rank of 16th in December 2025 and January 2026, after slightly improving from 17th in October and November 2025. This stability contrasts with the fluctuating ranks of competitors such as Bhang, which saw a dip to 15th in December before recovering to 13th in January. Meanwhile, Edison Cannabis Co experienced a decline in sales, reflected in its drop to 18th place in January 2026. Olli also faced challenges, missing from the top 20 in October and January, despite peaking at 14th in November. Notably, Vacay re-entered the rankings at 17th in January after being absent in October and December. These dynamics suggest that while Aurora Drift's sales are lower than some competitors, its consistent rank indicates a stable market position amidst the volatility of its peers.

Notable Products

In January 2026, Aurora Drift's top-performing product was Glitch - Strawberry Lemonade Gummy (10mg), maintaining its consistent first-place ranking from previous months with sales of 6,592 units. Glitch - Berry Cherry Gummy (10mg) also held its ground in second place, showing a slight decline in sales compared to December 2025. Glitches - Pomegranate Berry Gummy (10mg) remained steady in third place, despite a notable drop in sales figures. The Glitches - Pomegranate Berry Chews 10-Pack (100mg) reappeared in the rankings at fourth place after not being ranked in December 2025. A new entry, Glitches - Berry Cherry Chews 10-Pack (100mg), emerged at fifth place, indicating a growing interest in higher-dosage edible products.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.