Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

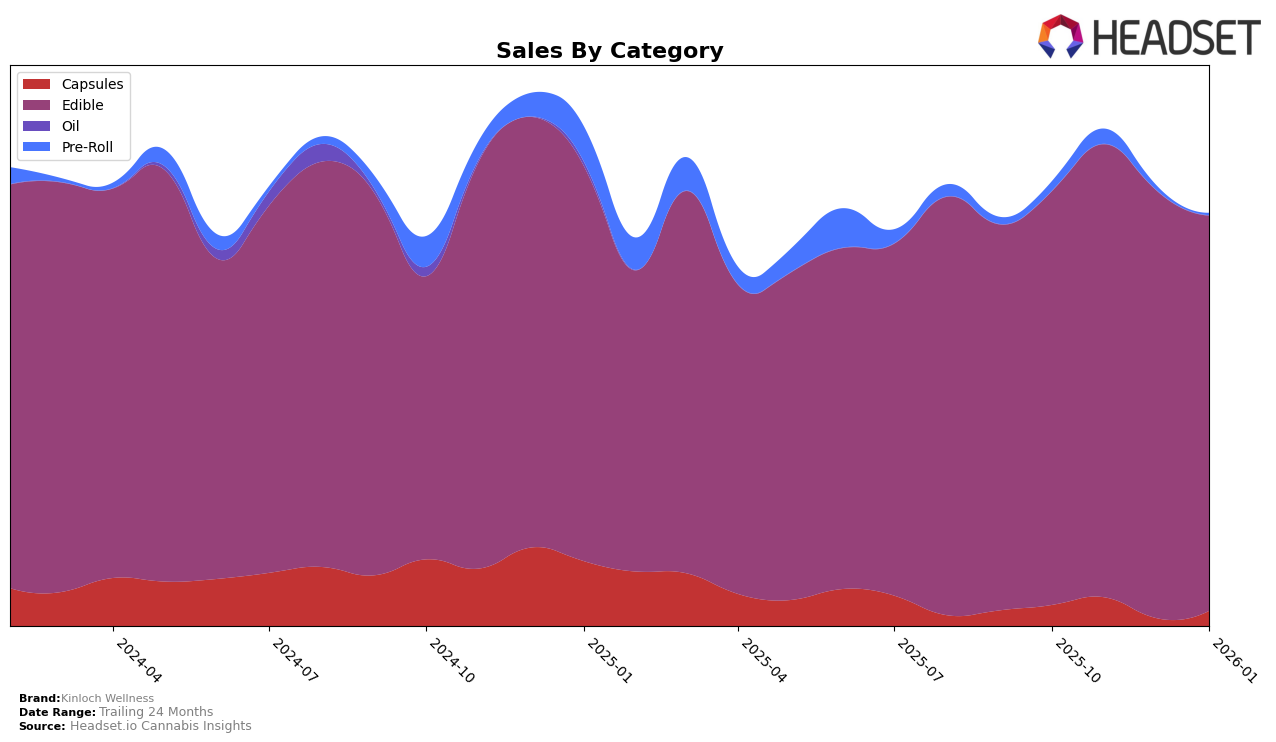

Kinloch Wellness has shown a consistent performance in the Edible category within Ontario. From October 2025 to January 2026, the brand maintained a steady presence, ranking 20th for three consecutive months before improving slightly to 19th in January 2026. This upward movement suggests a potential positive reception to their product offerings or marketing strategies. The brand's sales figures in Ontario reflect moderate fluctuations, with a notable peak in November 2025, where sales reached a high point, before slightly declining in the following months. Such trends could indicate seasonal influences or promotional activities impacting consumer purchasing behavior.

While Kinloch Wellness has managed to secure a foothold in the Ontario market, the absence of rankings in other states or provinces might be a cause for concern or an area for potential growth. The lack of top 30 rankings outside Ontario suggests that the brand's market penetration and visibility could be limited geographically. This presents both a challenge and an opportunity for Kinloch Wellness to explore strategies that could enhance their presence and appeal in new regions. Understanding consumer preferences and competitive dynamics in these untapped markets could be crucial for expanding their footprint and driving future growth.

Competitive Landscape

In the Ontario edible cannabis market, Kinloch Wellness has shown a steady presence, maintaining a consistent rank of 20th from October to December 2025, before improving slightly to 19th in January 2026. This upward movement suggests a positive trend, albeit modest, in their market performance. In comparison, Rosin Heads has consistently outperformed Kinloch Wellness, holding ranks between 16th and 18th, with significantly higher sales figures. Meanwhile, Glenn's also maintains a stronger position, though it experienced a slight decline from 15th to 17th over the same period. On the other hand, San Rafael '71 and Lord Jones have consistently ranked lower than Kinloch Wellness, with sales figures indicating a less competitive edge. These insights suggest that while Kinloch Wellness is holding its ground, there is room for growth to challenge the higher-ranking brands in the Ontario edible market.

Notable Products

In January 2026, the top-performing product for Kinloch Wellness was Serene™ CBD Green Apple Gummy 30-Pack (1500mg CBD), maintaining its first-place rank for four consecutive months with sales of 952 units. Following closely was CBZ™ CBN/CBD Pomegranate Berry Gummy 4-Pack (80mg CBD, 40mg CBN), consistently holding the second rank throughout the period. Refresh - CBD/CBG 1:1 Mango Gummies 4-Pack (80mg CBD, 80mg CBG) improved its position to third, recovering from a slip in December 2025. Elevate™ CBD Blackberry Lemon Gummy 30-Pack (900mg CBD) dropped to fourth place in January, despite a previous rise in December. Lastly, Refresh - CBD:CBG 1:1 Mango Gummies 15-Pack (300mg CBD, 300mg CBG) remained steady in fifth place, although it experienced a decrease in sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.