Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

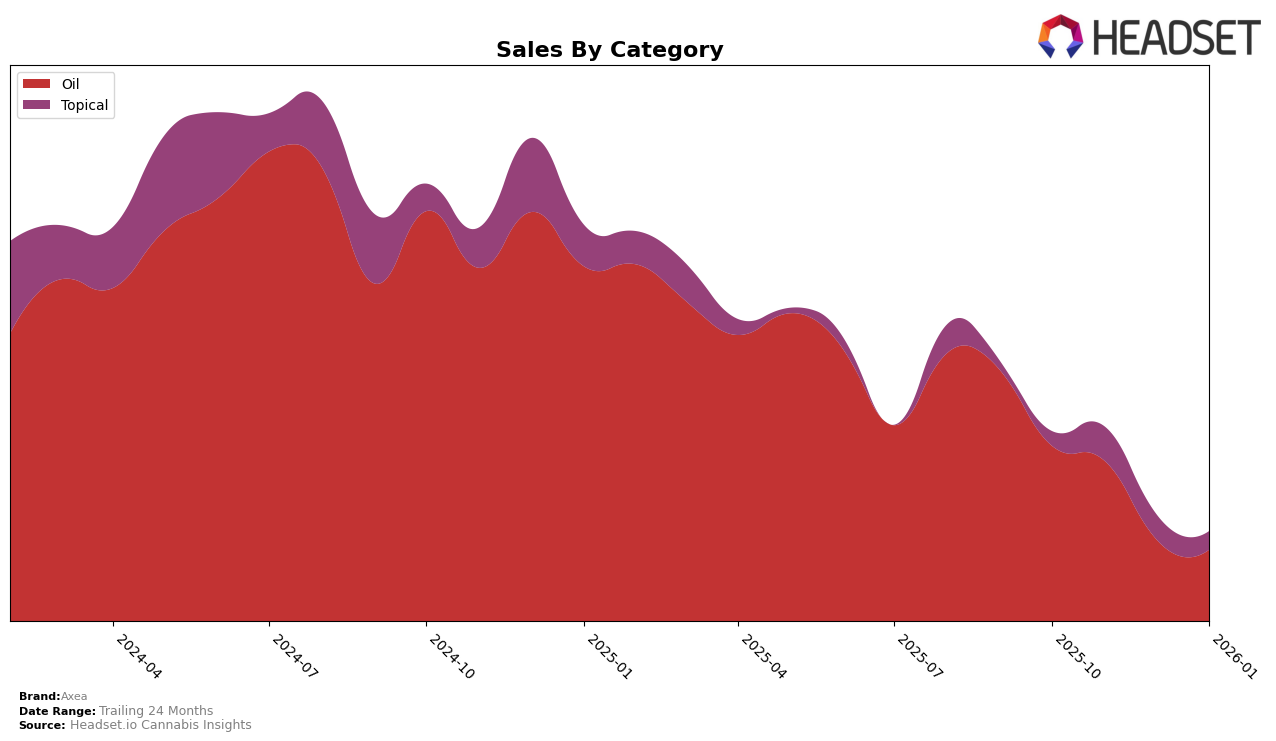

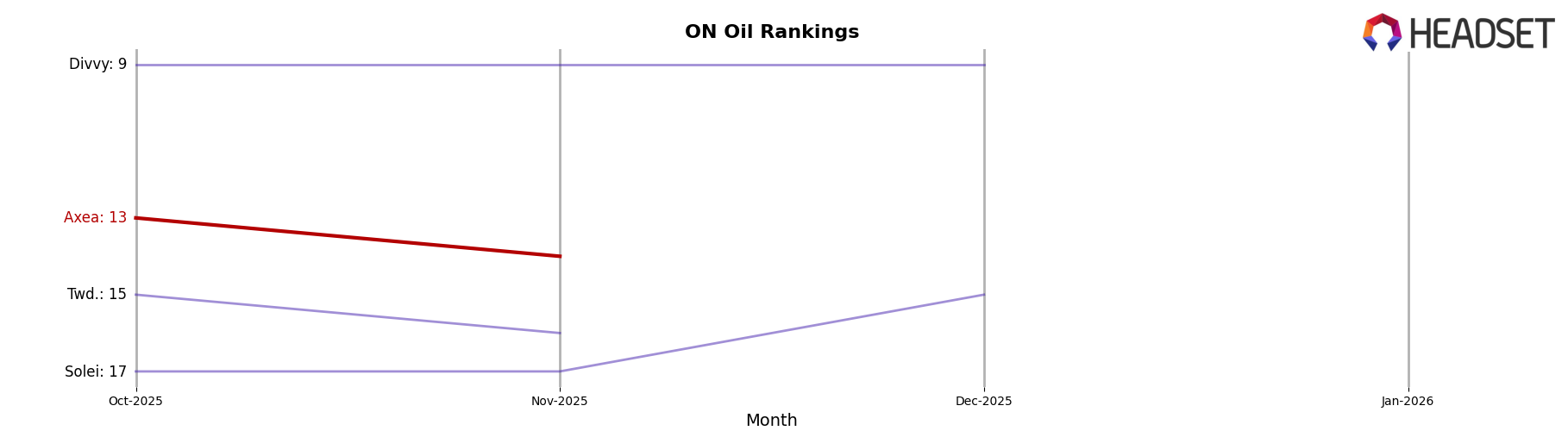

Axea has shown a consistent presence in the Ontario market, specifically within the Oil category. From October 2025 to November 2025, Axea maintained a strong ranking, moving from 13th to 14th position. This slight drop in ranking could be attributed to competitive pressures or changes in consumer preferences, yet it still signifies a robust performance in a highly competitive market. Notably, the brand's sales in Ontario for October 2025 were recorded at 20,560, indicating a healthy demand for their oil products. However, by November 2025, sales slightly decreased, which might suggest a seasonal trend or increased competition.

It is important to highlight that in December 2025 and January 2026, Axea did not appear in the top 30 rankings for the Oil category in Ontario. This absence could be seen as a setback, potentially indicating a need for strategic adjustments or market reevaluation. The lack of presence in these months might also reflect shifts in consumer behavior or the introduction of new competitors in the market. Understanding these dynamics could provide valuable insights for stakeholders looking to capitalize on future opportunities within this region.

Competitive Landscape

In the competitive landscape of the oil category in Ontario, Axea has shown a notable presence, although it faces stiff competition from other brands. In October 2025, Axea ranked 13th, but by November, it slipped to 14th, indicating a slight decrease in competitive standing. Despite this, Axea's sales figures remained robust, outperforming brands like Solei and Twd., which consistently ranked lower. Interestingly, Divvy maintained a higher rank and sales volume, suggesting a strong market position that Axea could aspire to. The absence of Axea in the top 20 by January 2026 highlights the volatility in this market segment and suggests a need for strategic adjustments to regain and improve its competitive rank. Monitoring these trends can provide valuable insights for Axea to enhance its market strategy and potentially reclaim a higher position in the coming months.

Notable Products

In January 2026, the top-performing product for Axea was THC-Free Daytime CBD Isolate Oil (30ml), which reclaimed the number one position after dropping to third place in December 2025, with sales reaching 109 units. CBN/CBD Nighttime THC-Free Isolate Oil (30ml) maintained its second-place ranking for the second consecutive month, despite a slight decline in sales. CBD Arnica Cream (400mg CBD, 50g) made a notable entry into the rankings, securing the third position after being absent in the previous months. The CBD Frankincense Dead Sea Pink Himalayan Bath Salt (250mg CBD, 250g) experienced a drop from first place in December to third in January. THC Pure Isolate Oil (30ml) held steady in fourth place, showing consistent performance over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.