Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

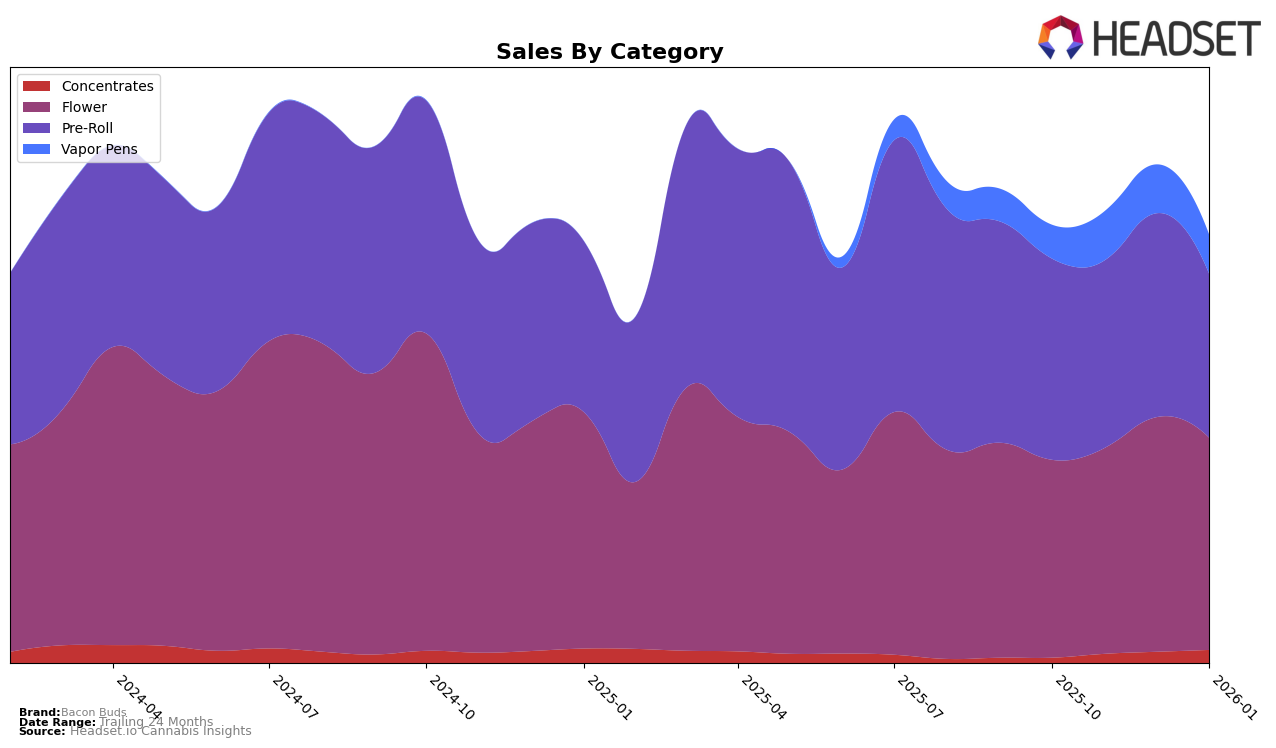

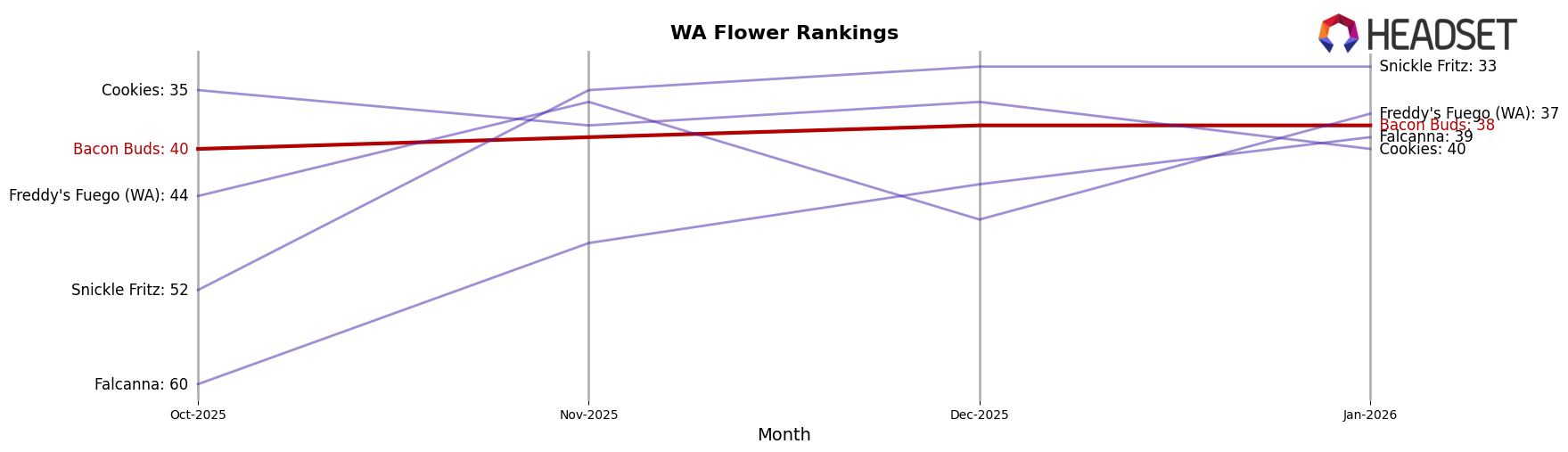

Bacon Buds has shown a consistent but modest presence in the Washington market across various product categories. In the Flower category, the brand has steadily improved its ranking from 40th in October 2025 to 38th by January 2026, indicating a gradual increase in market penetration despite not breaking into the top 30. This improvement is reflected in their sales figures, which peaked in December 2025. Meanwhile, in the Pre-Roll category, Bacon Buds experienced slight fluctuations, maintaining a presence within the top 30, but their rank decreased to 29th by January 2026. This decline in rank, coupled with a drop in sales, suggests increased competition or shifting consumer preferences.

In the Vapor Pens category, Bacon Buds has not managed to enter the top 30 rankings, holding a consistent position in the 90s range. This indicates a challenge in gaining traction within this segment, as evidenced by a decline in sales from November 2025 to January 2026. The absence from the top 30 suggests that Bacon Buds may need to reassess its strategy or product offerings in this category to better compete in the Washington market. Overall, while Bacon Buds shows potential in the Flower category, the brand's performance in other segments highlights areas for improvement and strategic reevaluation.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, Bacon Buds has shown a consistent improvement in its ranking from October 2025 to January 2026, moving from 40th to 38th position. This upward trend is indicative of a steady increase in sales, with a notable peak in December 2025. Despite this progress, Bacon Buds faces stiff competition from brands like Snickle Fritz, which has maintained a stronger position, consistently ranking in the top 35 and experiencing a significant sales surge in January 2026. Meanwhile, Cookies has shown fluctuating performance, dropping to 40th in January 2026, which could present an opportunity for Bacon Buds to overtake if it continues its growth trajectory. Additionally, Freddy's Fuego (WA) and Falcanna have shown variable rankings, with Freddy's Fuego briefly surpassing Bacon Buds in November 2025 before dropping again. These dynamics suggest that while Bacon Buds is on an upward trend, maintaining this momentum will require strategic efforts to capitalize on the fluctuations and weaknesses of its competitors.

Notable Products

In January 2026, the top product for Bacon Buds was Legend of Nigeria Pre-Roll 2-Pack (1g) in the Pre-Roll category, maintaining its number one rank from December 2025, despite a decrease in sales to 1993 units. Bootylicious Pre-Roll 2-Pack (1g) rose to the second position, showing a significant sales increase from 965 units in December to 1873 in January. Big Smooth Pre-Roll 2-Pack (1g) dropped from second to third place, with a noticeable decline in sales. Clementine Pre-Roll 2-Pack (1g) remained steady in fourth position, showing a slight increase in sales figures. Legend of Nigeria (3.5g) made its debut in the rankings in January, securing the fifth position in the Flower category with 915 units sold.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.