Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

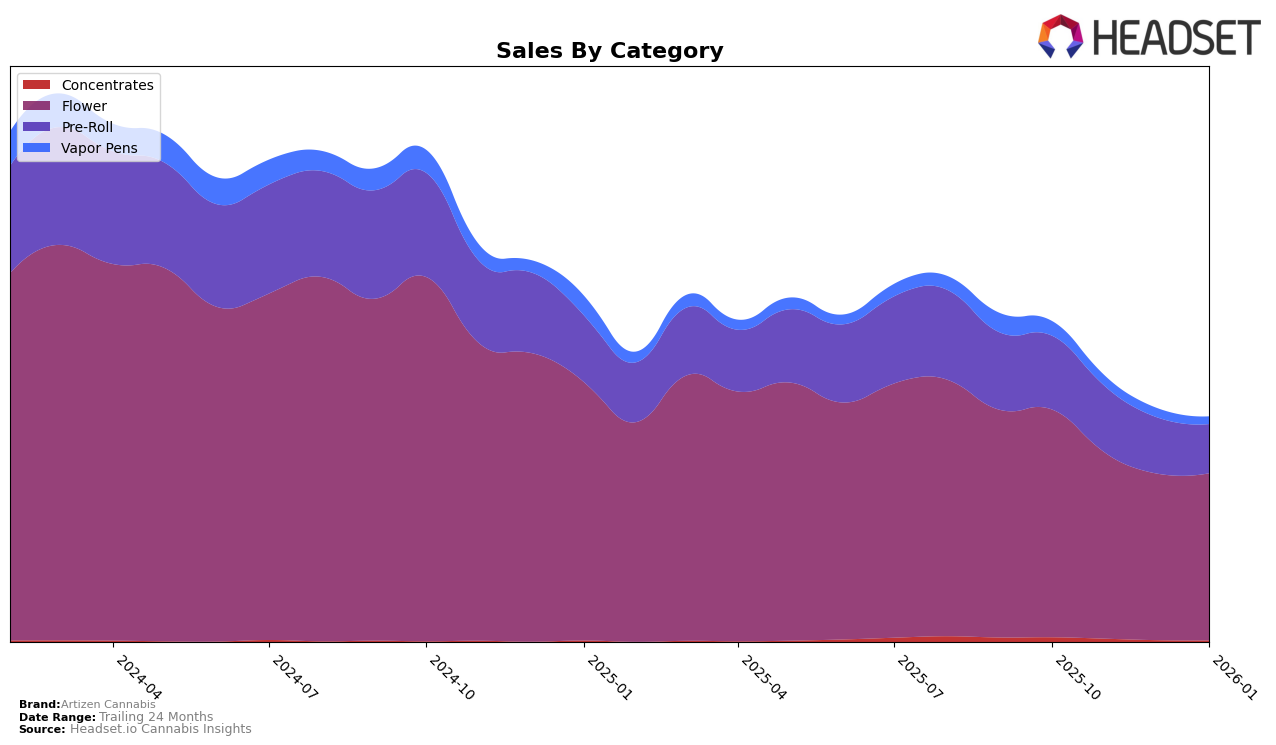

Artizen Cannabis has shown varying performance across different categories and states, with notable trends in Washington. In the Flower category, Artizen Cannabis experienced a decline in their ranking from 7th in October 2025 to 15th by January 2026. This movement suggests a competitive market environment or potential shifts in consumer preferences. Despite the drop in ranking, the sales figures in January 2026 showed a slight increase compared to December 2025, indicating some resilience or recovery in their market strategy. Such a trend could be of interest to those monitoring the brand’s ability to adapt and maintain its presence in the Flower category.

In the Pre-Roll category, Artizen Cannabis faced challenges in maintaining a top position, as evidenced by their rankings slipping from 24th in October 2025 to being outside the top 30 by December 2025 and January 2026. This decline highlights the competitive nature of the Pre-Roll market in Washington and possibly points to the need for strategic adjustments by the brand. The decreasing sales figures over these months further emphasize the brand's struggle to capture consumer interest in this category. Observers may find it insightful to explore how Artizen Cannabis plans to address these challenges and whether they can regain a foothold in the Pre-Roll market.

Competitive Landscape

In the competitive landscape of the Washington Flower category, Artizen Cannabis has experienced a notable decline in rank from October 2025 to January 2026, dropping from 7th to 15th place. This shift is accompanied by a decrease in sales over the same period, indicating potential challenges in maintaining market share. Meanwhile, Thunder Chief Farms has shown a positive trajectory, climbing from 24th to 14th place, suggesting an increase in consumer preference or effective marketing strategies. Similarly, Momma Chan Farms has maintained a relatively stable position, fluctuating slightly but remaining within the top 15, which may indicate a consistent customer base. On the other hand, Hemp Kings and Method have shown upward movement in rankings, with Method making a significant jump from 26th to 17th place, potentially posing a growing threat to Artizen Cannabis's market position. These dynamics highlight the competitive pressures Artizen Cannabis faces and the importance of strategic adjustments to regain its footing in the Washington Flower market.

Notable Products

In January 2026, the top-performing product for Artizen Cannabis was the Dutchberry Pre-Roll 2-Pack (1g) in the Pre-Roll category, maintaining its consistent number one rank since October 2025, with sales of 3369 units. The Dutchberry (3.5g) in the Flower category also held steady at the second rank, showing a slight decrease in sales compared to previous months. Jack Herer Pre-Roll 2-Pack (1g) remained at the third position, reflecting a downward trend in sales over the months. The Jack Herer (3.5g) Flower product moved up to the fourth position since November 2025, indicating a slight recovery in sales. Meanwhile, Blue Dream Pre-Roll 2-Pack (1g) maintained its fifth position, showing a modest increase in sales from December 2025 to January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.