Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

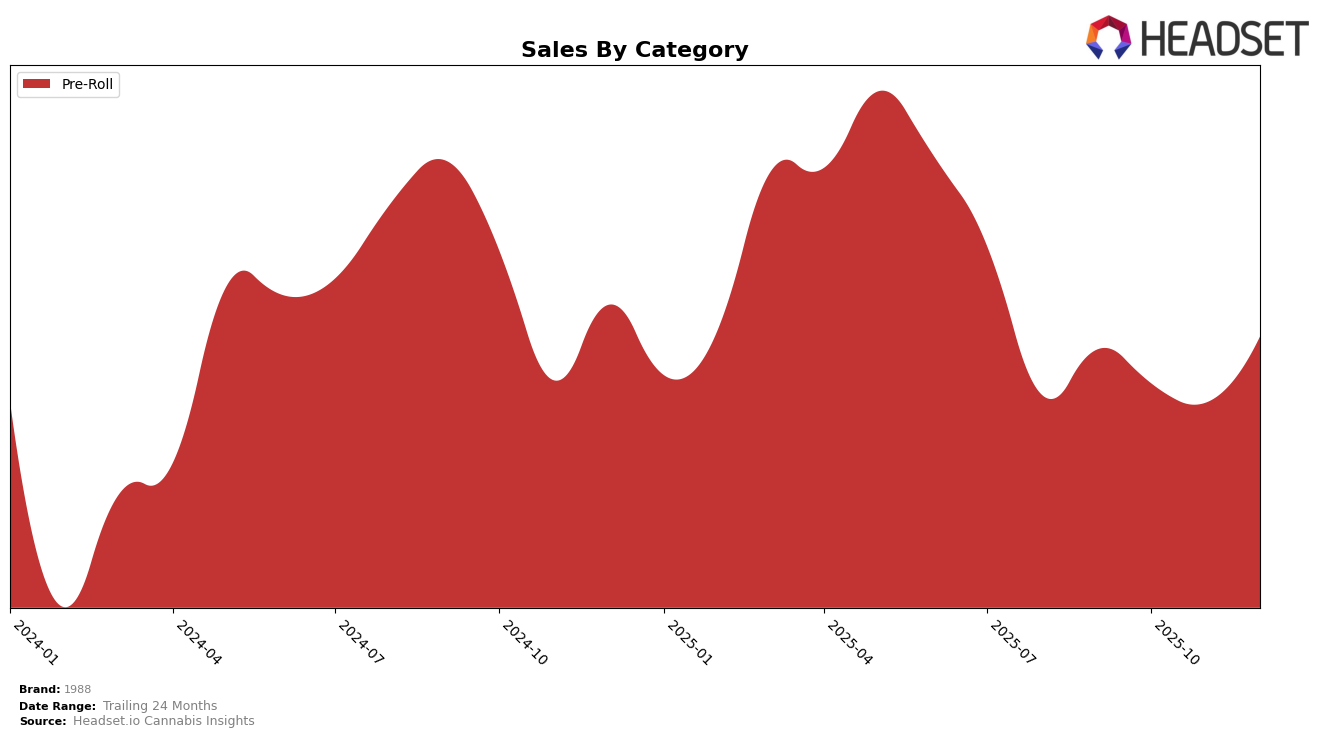

The cannabis brand 1988 has shown varied performance across different states and categories. In Illinois, 1988 has struggled to break into the top 30 in the Pre-Roll category, with rankings consistently above 40 over the last few months of 2025. This indicates a challenging market presence for the brand in Illinois, as they have not managed to capture a significant share of the competitive Pre-Roll market. Despite this, 1988's sales figures in Illinois show a slight decline, which might suggest either a saturated market or increasing competition. Such a trend highlights the need for strategic adjustments to improve their standing.

Conversely, in Washington, 1988 has maintained a stable position in the Pre-Roll category, consistently ranking at 17th place from September to December 2025. This stability suggests a strong foothold in the Washington market, with sales figures reflecting an upward trend, particularly in December. This consistent performance in Washington contrasts sharply with their challenges in Illinois, indicating that 1988 might be better aligned with consumer preferences or market conditions in Washington. Their ability to sustain and potentially grow their market share in Washington could serve as a model for their strategy in other states.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Washington, 1988 has maintained a consistent rank of 17th from September to December 2025. This stability in rank, despite fluctuations in sales, highlights a steady market presence amidst a dynamic competitive environment. Notably, Torus has shown a positive trend, improving its sales from September to December, which might pose a challenge to 1988 if this upward trajectory continues. Meanwhile, Forbidden Farms has experienced a decline in rank from 14th to 19th, indicating potential vulnerabilities that 1988 could capitalize on. Agro Couture and Shatter J's by Seattle Marijuana Company have shown varied performance, with Shatter J's improving its rank slightly by December. For 1988, maintaining its rank amidst these shifts suggests a solid customer base, but to enhance its market position, it may need to innovate or adjust strategies in response to competitors like Torus, which are gaining momentum.

Notable Products

In December 2025, the top-performing product from 1988 was the African Mango Infused Blunt (1g) in the Pre-Roll category, maintaining its number one rank since September, with sales reaching 5484 units. Watermelon Zkittlez Infused Blunt (1g) climbed to the second position from third in November, showing a consistent upward trend from its fifth position in September and October. Blueberry Infused Blunt (1g) saw a slight drop to third place, having held the second spot in October and November. Tiger's Blood Infused Blunt (1g) entered the rankings at fourth place in December, marking a new entry for this month. Honey Infused Blunt (1g) remained stable at fifth place, after fluctuating between second and fifth in previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.