Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

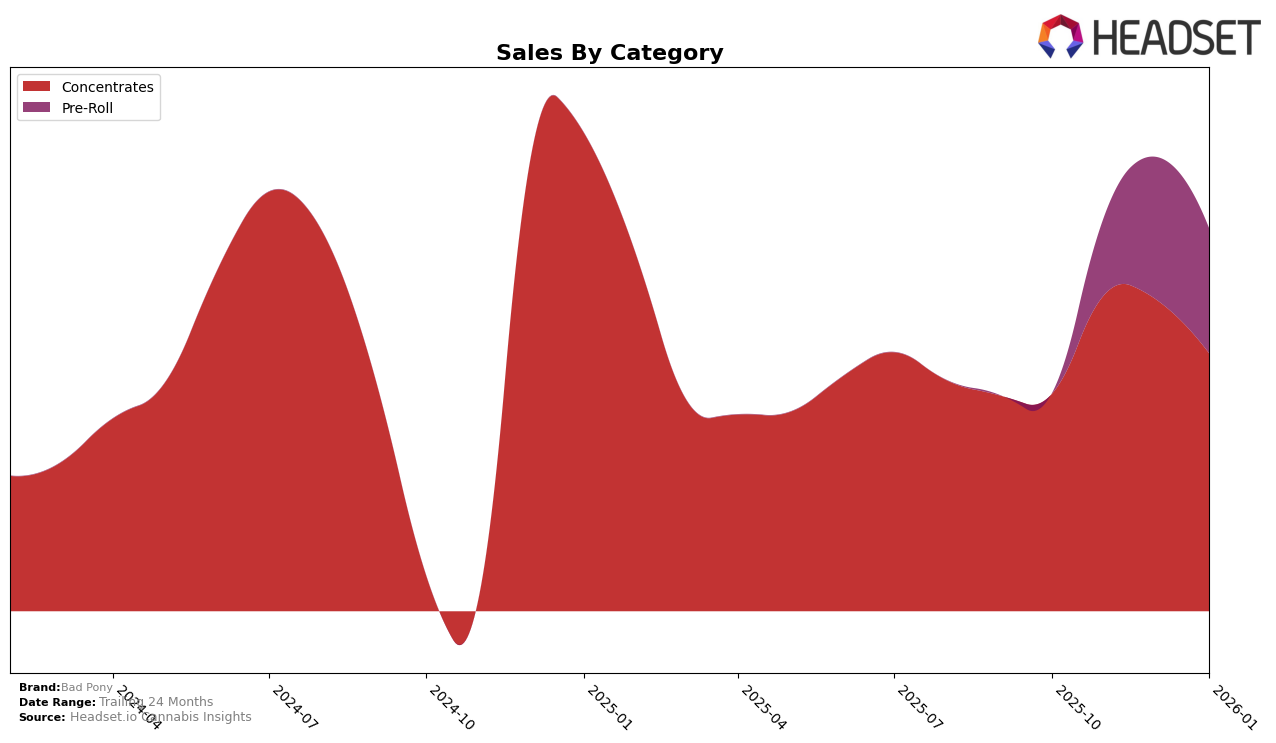

Bad Pony has shown varied performance across different categories in the state of Missouri. In the Concentrates category, the brand has maintained a presence within the top 30 rankings over the past several months. Starting at rank 27 in October 2025, Bad Pony improved to rank 23 by November, although it saw a slight dip to rank 25 in December, before climbing back to rank 24 in January 2026. This indicates a generally positive trend, suggesting consumer interest and competitive positioning within this category. However, it's notable that sales peaked in November before tapering off slightly, which may indicate seasonal demand or other market dynamics at play.

In contrast, Bad Pony's performance in the Pre-Roll category in Missouri has been less remarkable, as the brand didn't make it into the top 30 rankings until November 2025. Starting at rank 73 in November, Bad Pony saw a steady climb to rank 63 in December, and further to rank 60 in January 2026. Although these rankings are outside the top 30, the upward trajectory suggests growing consumer acceptance and potential for future growth. The sales figures mirror this trend, showing a significant increase from November to December, although there was a slight dip in January. This performance in the Pre-Roll category highlights potential opportunities for Bad Pony to enhance its market presence and capture a larger share of the market.

Competitive Landscape

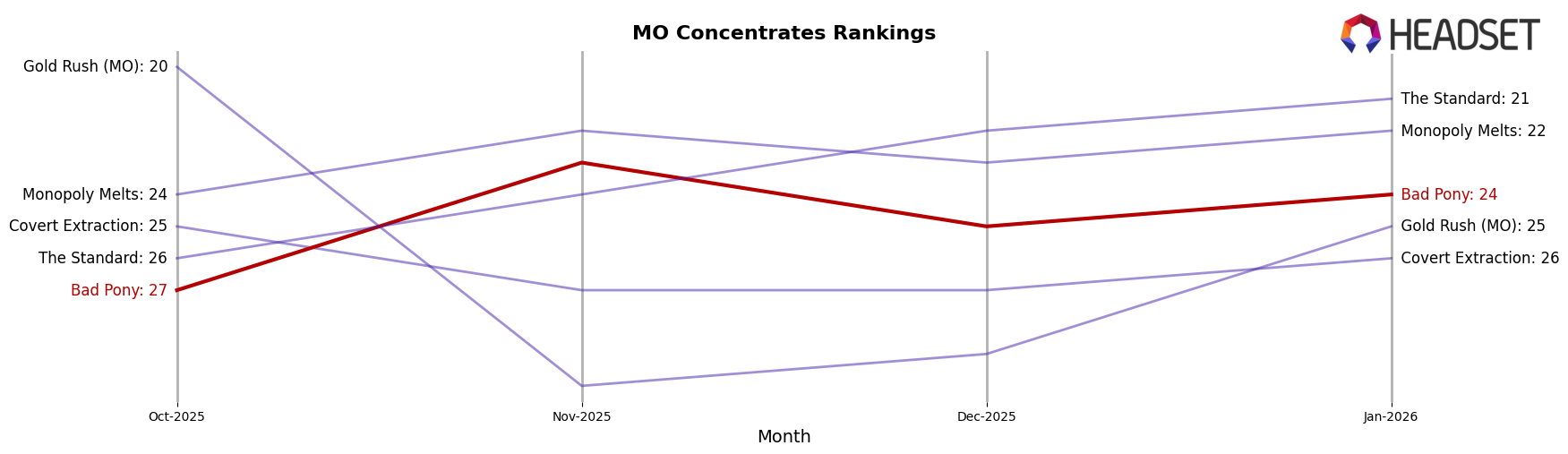

In the Missouri concentrates market, Bad Pony has shown a dynamic performance, climbing from a rank of 27 in October 2025 to 23 in November 2025, before settling at 24 by January 2026. This upward movement in rank is indicative of a positive reception and increased sales momentum, particularly in November 2025, where sales peaked. However, Bad Pony faces stiff competition from brands like The Standard, which consistently improved its rank from 26 to 21 over the same period, reflecting a robust growth trajectory. Additionally, Monopoly Melts maintained a stable position around rank 22, showcasing strong market presence. Meanwhile, Gold Rush (MO) experienced fluctuations, dropping to rank 30 in November before recovering to 25 in January, indicating volatility that Bad Pony can potentially capitalize on. Despite these challenges, Bad Pony's ability to improve its rank amidst such competitive pressures highlights its potential for further growth in the Missouri concentrates market.

Notable Products

In January 2026, the top-performing product from Bad Pony was Bunny Runtz x Puppy Breath Infused Pre-Roll (0.5g), maintaining its number one rank for three consecutive months with sales reaching 1930 units. Golden Apple x Rainbow Rozay Infused Pre-Roll (0.5g) improved its position from third in December 2025 to second in January 2026. Bunny Runtz x Romulan Cake Infused Pre-Roll (0.5g) remained steady at the third rank, showing a slight increase in sales from the previous month. Strawberry Cheesecake Live Resin Badder (1g) moved up to fourth place, despite a minor decrease in sales. Super Buff Cherries x Lemon Oreoz Live Rosin (1g) entered the top five for the first time, highlighting its growing popularity in the Concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.