Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

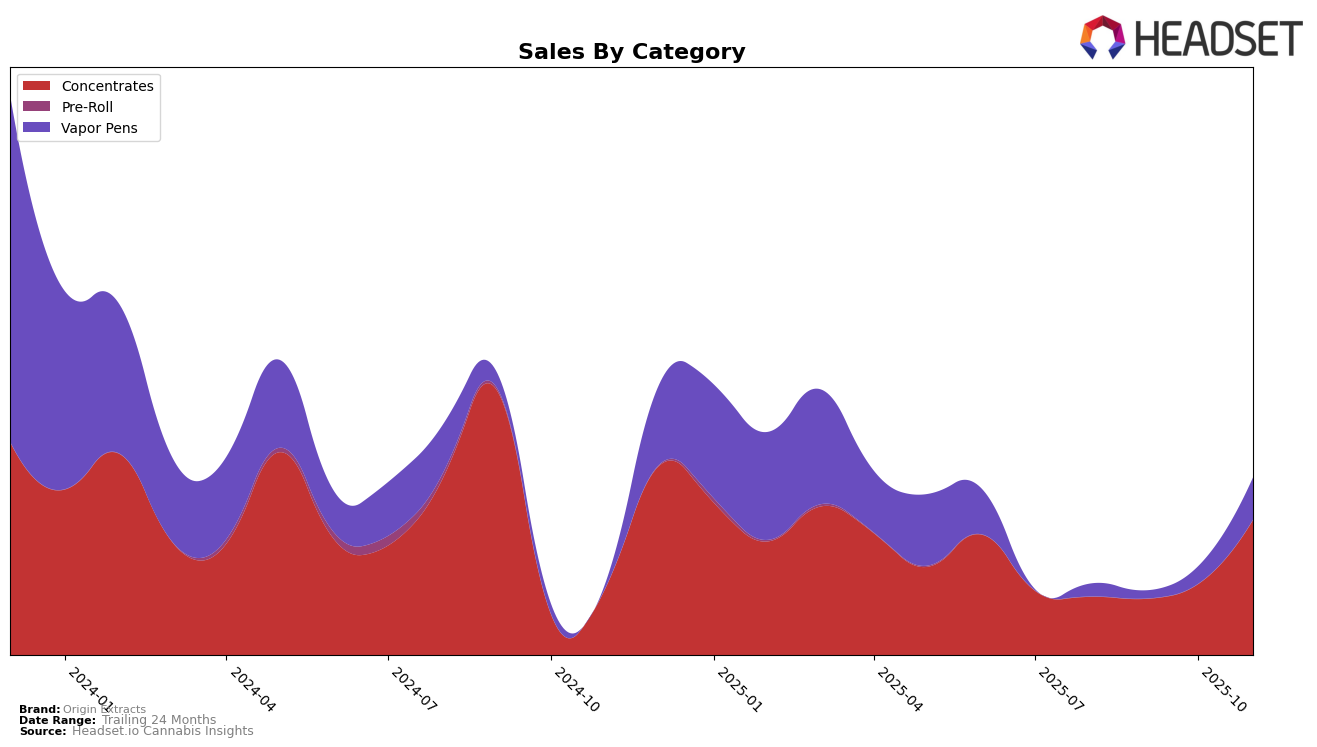

Origin Extracts has shown a notable upward trend in the Concentrates category within Missouri. Over the past few months, the brand's rank has improved from 34th in August 2025 to 28th in November 2025. This positive movement is accompanied by a significant increase in sales, particularly noticeable in November. The brand's ability to break into the top 30 indicates a strengthening presence in the Missouri market, highlighting successful strategies or product offerings that resonate well with consumers in this category. However, it's important to note that Origin Extracts has not been ranked in the top 30 for the Vapor Pens category during the same period, which could be an area for potential growth or reevaluation.

The absence of Origin Extracts in the top 30 rankings for Vapor Pens in Missouri suggests challenges in gaining traction in this competitive category. This could be due to various factors such as market saturation, consumer preferences, or brand positioning. On the other hand, the impressive climb in the Concentrates category showcases a targeted success that might be leveraged for broader category expansion. With the brand's sales in Concentrates more than doubling from October to November, Origin Extracts appears to be capitalizing on a growing demand or effective marketing strategies in Missouri. These dynamics present a mixed picture of the brand's performance, with strengths in certain areas and opportunities for improvement in others.

Competitive Landscape

In the Missouri concentrates market, Origin Extracts has shown a notable upward trajectory in recent months, climbing from a rank of 34 in August 2025 to 28 by November 2025. This improvement in rank is significant, especially when compared to competitors like Safe Bet, which has consistently held the 30th position, and CAMP Cannabis, which has fluctuated but remains close in rank. Meanwhile, Teal Cannabis and Bad Pony have maintained higher ranks, although Teal Cannabis experienced a slight drop from 21st to 25th. Origin Extracts' sales have seen a substantial increase, particularly in November, indicating a positive trend that could further enhance its competitive position if sustained. This upward movement in both rank and sales suggests that Origin Extracts is gaining traction and could potentially challenge higher-ranked brands if the trend continues.

Notable Products

In November 2025, Origin Extracts' top-performing product was GMO Cured Sugar (1g) in the Concentrates category, maintaining its first-place ranking from October with impressive sales of 312 units. Bubblegum Cured Crumble (1g) rose to second place, showing a notable increase from its previous third-place ranking in September, with sales reaching 296 units. Larry OG Diamonds in Sauce (1g) made its debut on the rankings at third place, while Sugar Black Rose Live Crumble (1g) followed closely in fourth. Tallymon Cured Shatter (1g) held steady at fifth place, consistent with its October ranking. The data indicates a strong performance in the Concentrates category, with several products showing significant sales growth over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.