Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

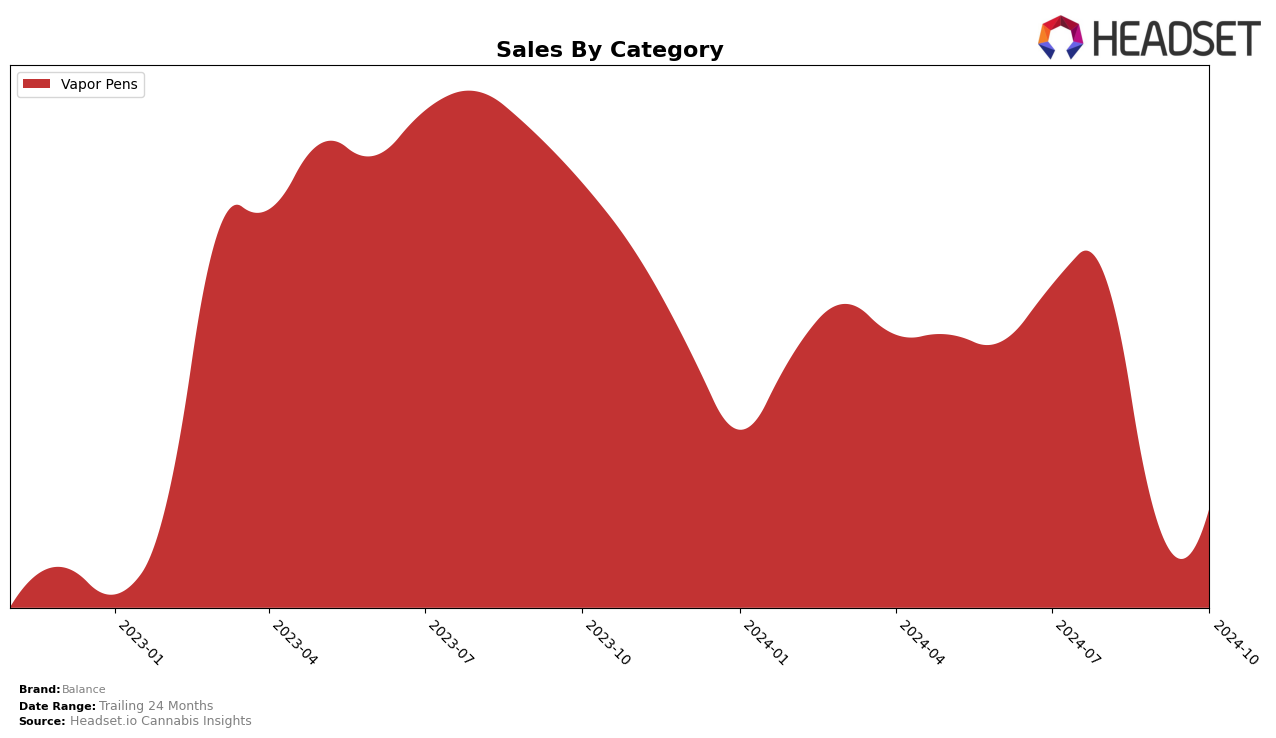

In examining the performance of the cannabis brand Balance across various states and categories, notable trends emerge. In the state of Arizona, Balance's presence in the Vapor Pens category has seen a decline over recent months, moving from a rank of 47 in July 2024 to 66 by October 2024. This downward trend is coupled with a significant drop in sales, indicating challenges in maintaining market share within this category. On the other hand, Balance maintains a more stable position in Washington within the same category, holding steady around the 23rd position from August to October 2024. This consistency suggests a more robust foothold in Washington's Vapor Pens market compared to Arizona.

Balance's absence from the top 30 brands in Arizona's Vapor Pens category for the recent months highlights a struggle to compete effectively in that region, which could be concerning for the brand's market strategy. Conversely, the steadiness in Washington, despite a slight drop from 20th in July to 23rd in subsequent months, reflects a relatively strong performance, indicating potential areas of strength that Balance might capitalize on. The contrasting trajectories in these states underscore the importance of regional strategies and market adaptation for Balance as it navigates the competitive landscape of the cannabis industry.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Balance has experienced a slight decline in its ranking, moving from 20th in July 2024 to 23rd by October 2024. This shift is notable as competitors like Thrills have also seen a downward trend, dropping from 17th to 22nd, yet maintaining higher sales figures throughout this period. Meanwhile, Lifted Cannabis Co has shown a positive trajectory, improving its rank from 24th to 21st with a significant sales boost in October. Herb's Oil also made a notable leap from being outside the top 20 to securing the 25th spot, indicating a potential threat to Balance's position. Despite these shifts, Balance's sales have seen a recovery from a dip in September, suggesting resilience in its market presence. These dynamics highlight the competitive pressures Balance faces and the importance of strategic positioning to regain its rank amidst fluctuating market conditions.

Notable Products

In October 2024, the top-performing product for Balance was the CBN/THC 1:1 Sleepen El Jefe Distillate Disposable (1g) in the Vapor Pens category, maintaining its number one rank from August and reclaiming the top spot from July. The CBD/THC 1:1 Stephen Hawking Kush Distillate Disposable (1g) ranked second, having dropped one position from its previous top rank in September. The CBD/THC/CBG 1:1:1 Tranquility Jefe Full Spectrum Disposable (1g) consistently held the third position for two months in a row. A noteworthy mention is the THCV/THC 1:1 Jefe Energy Distillate Disposable (1g), which maintained its fourth position with a sales figure of 1303.0. The CBG/THC/CBD 1:1:1 Tranquility Jefe Live Resin Disposable (1g) entered the rankings at fifth place in October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.