Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

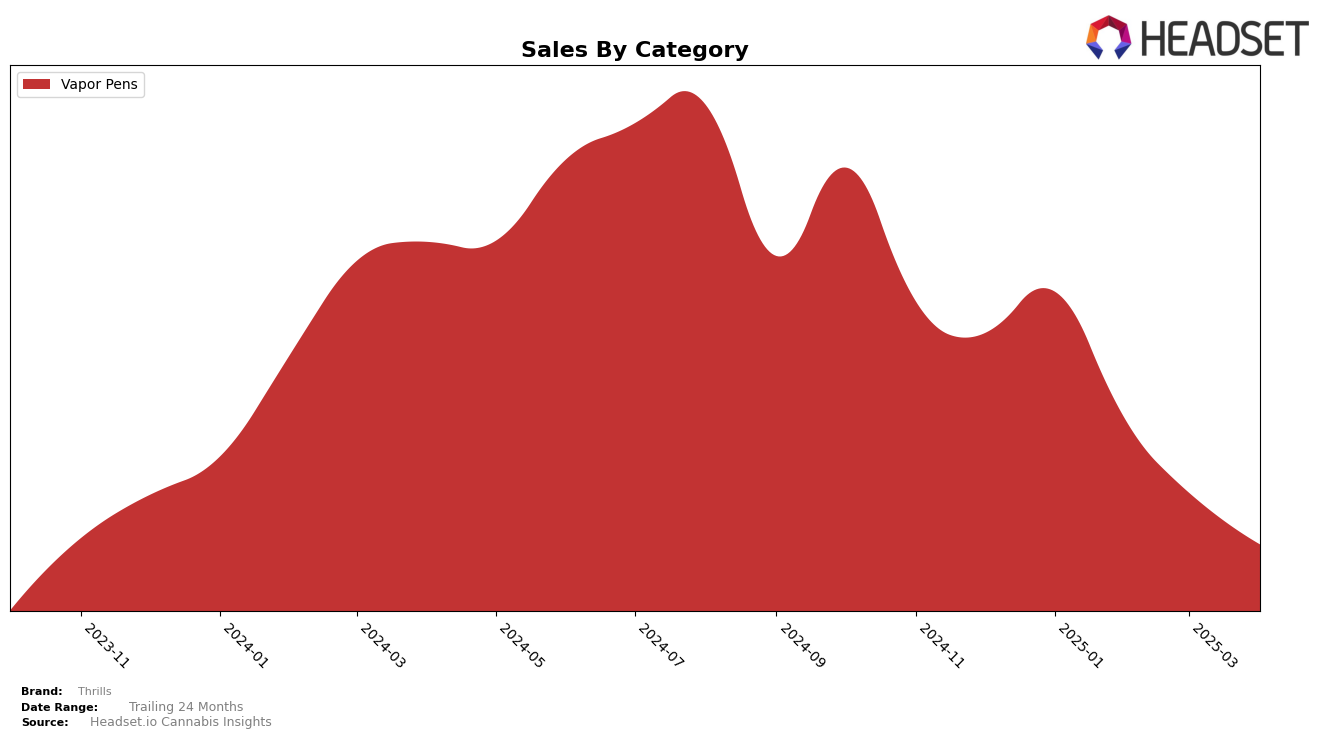

Thrills has experienced a notable decline in its performance within the Vapor Pens category in Washington. Starting the year in January 2025 with a rank of 18, the brand saw a gradual decrease, falling to 29 by April 2025. This downward trend is reflected in their sales, which decreased from $330,299 in January to $173,409 by April. The consistent drop in rankings and sales suggests a need for strategic adjustments to regain a competitive position in this category within the state.

Interestingly, Thrills did not appear in the top 30 brands for any other categories or states during this period, indicating a limited market presence outside the Vapor Pens segment in Washington. This lack of presence could be seen as a disadvantage, as it suggests that Thrills is not capitalizing on opportunities in other profitable markets or categories. Focusing on diversification and exploring new markets might be crucial steps for Thrills to consider in order to expand its footprint and improve overall brand performance.

Competitive Landscape

In the highly competitive Washington state vapor pens category, Thrills has experienced a notable decline in its market position over the first four months of 2025. Starting the year strong with an 18th place ranking in January, Thrills saw a consistent drop, landing at 29th by April. This downward trend in rank correlates with a decrease in sales, which fell from a robust start in January to significantly lower figures by April. In contrast, Bodhi High maintained a relatively stable presence, albeit outside the top 20, while Hellavated and Kelso Kandy (aka Kelso Kreeper) showed some volatility but ended April with better ranks than Thrills. Meanwhile, Herb's Oil managed to improve its position slightly by April, surpassing Thrills. These shifts suggest that Thrills may need to reassess its strategies to regain its competitive edge in this dynamic market.

Notable Products

In April 2025, the top-performing product from Thrills was the Black Cherry Soda Distillate Cartridge (1g) in the Vapor Pens category, maintaining its leading position from March and achieving sales of 1123 units. Following closely, the Blueberry Yum Yum Distillate Cartridge (1g) ranked second, slipping from its top position in January and March. The Zkittles Distillate Cartridge (1g) climbed to third place from a consistent fifth position over the previous months, indicating a positive shift in consumer preference. The Mango Sherbet Distillate Cartridge (1g) held steady at fourth place, while the Durban Poison Distillate Cartridge (1g) saw a decline, dropping to fifth from its second-place ranking in January. These shifts suggest a dynamic market where consumer tastes and product performance are constantly evolving.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.