Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

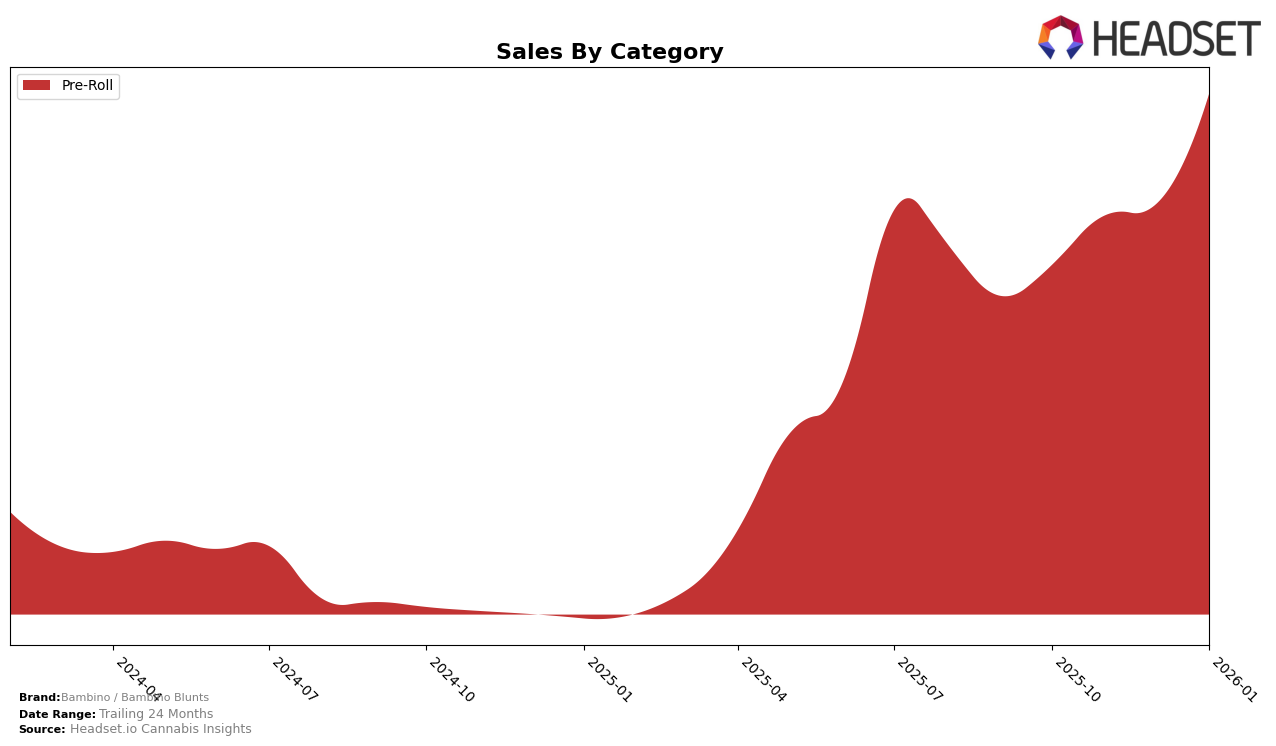

Bambino / Bambino Blunts has shown a consistent upward trajectory in the Missouri pre-roll category rankings. Starting from a rank of 24 in October 2025, they have climbed steadily to reach 19 by January 2026. This progression indicates a growing consumer preference and increased market penetration in Missouri. The brand's sales figures in the state also reflect this positive trend, with a noticeable increase from October to January. Such a rise in rankings and sales suggests that Bambino / Bambino Blunts is effectively capitalizing on the Missouri market dynamics.

However, it's important to note that Bambino / Bambino Blunts' presence outside of Missouri is not captured in the top 30 rankings for other states or categories, which could be seen as a lack of broader market reach. This absence highlights potential areas for expansion and growth for the brand. Focusing on strengthening their market position in Missouri while exploring opportunities in other states could be a strategic move for Bambino / Bambino Blunts to enhance their overall market performance. The brand's ability to maintain and build upon its current trajectory in Missouri will be crucial as they look to expand their footprint in the cannabis industry.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Missouri, Bambino / Bambino Blunts has shown a promising upward trajectory in rank and sales from October 2025 to January 2026. Initially ranked 24th in October 2025, Bambino / Bambino Blunts climbed to 19th by January 2026, indicating a positive shift in market presence. This upward movement contrasts with competitors like Kushy Punch, which experienced a decline from 14th to 17th place over the same period, and Plume Cannabis (MO), which fell out of the top 20 by January 2026. Meanwhile, Curio Wellness and Franklin's maintained relatively stable positions, with slight fluctuations in their rankings. Bambino / Bambino Blunts' sales growth, particularly the significant increase in January 2026, suggests a strengthening brand presence and consumer preference in the Missouri market, positioning it as a rising contender against established brands.

Notable Products

In January 2026, the top-performing product from Bambino / Bambino Blunts was the Lemon Cherry Gelato Moonrock Infused Blunt (1g) in the Pre-Roll category, maintaining its number one position from December 2025, with notable sales of 1,731 units. The Wedding Cake Moonrock Infused Blunt (1g) climbed from fourth place in December 2025 to second place in January 2026, showing a significant increase in sales. The Sugar Cookie Infused Blunt (2g) entered the rankings in January 2026 at third place, after not being ranked in December 2025. Additionally, the Peach Infused Blunt (2g) and Grape Infused Blunt (2g) made their debut in the rankings at fourth and fifth place, respectively. This shift highlights a growing popularity and diversification in the Pre-Roll category for Bambino / Bambino Blunts.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.