Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

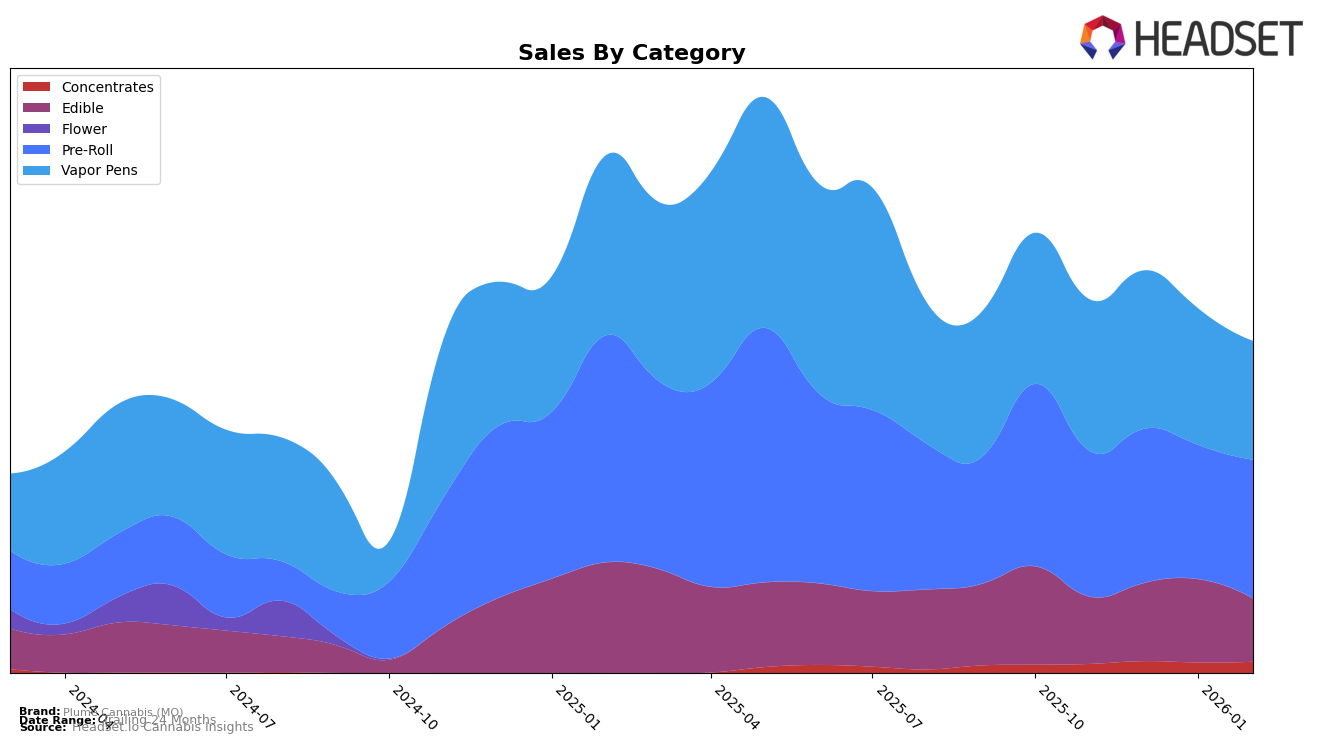

Plume Cannabis (MO) has demonstrated varied performance across its product categories in the state of Missouri. In the Concentrates category, the brand has seen a slight improvement in its ranking from 38th in January 2026 to 33rd in February 2026, indicating a positive trend. However, the brand did not make it into the top 30, which could be viewed as a challenge in gaining a stronger foothold in this competitive market segment. The Edibles category shows a more fluctuating pattern, where Plume Cannabis (MO) improved its rank to 25th in January 2026 but dropped to 28th in February 2026. This volatility suggests ongoing competition and potential areas for strategic focus to stabilize and improve their standing.

The Pre-Roll category has been a relatively stable performer for Plume Cannabis (MO), maintaining a consistent presence in the top 20, with a slight dip in January 2026 to 21st before rebounding back to 19th in February 2026. This consistency suggests a strong consumer base and brand loyalty in this category. For Vapor Pens, the brand remained outside the top 30, ranking 32nd in both December 2025 and February 2026, which could indicate room for growth and potential market expansion. While the sales figures for Vapor Pens showed a decline from December 2025 to February 2026, this trend highlights the necessity for strategic adjustments to regain momentum in this category.

Competitive Landscape

In the Missouri pre-roll category, Plume Cannabis (MO) has experienced fluctuating rankings over the past few months, indicating a competitive market landscape. In November 2025, Plume Cannabis (MO) was ranked 20th, improving slightly to 19th in December, dropping to 21st in January 2026, and then climbing back to 19th in February. This volatility suggests a dynamic market with shifting consumer preferences. Notably, Galactic consistently outperformed Plume Cannabis (MO), maintaining a higher rank, though it experienced a decline from 13th to 17th by February. Meanwhile, Curio Wellness and Franklin's maintained stable positions within the top 20, indicating steady performance despite slight rank changes. Interestingly, Bambino / Bambino Blunts showed a notable jump from 25th in December to 19th in January, briefly surpassing Plume Cannabis (MO) before falling back to 21st in February. These insights highlight the competitive pressure on Plume Cannabis (MO) and the importance of strategic positioning to enhance its market share in Missouri's pre-roll segment.

Notable Products

For February 2026, the top-performing product from Plume Cannabis (MO) is the Watermelon Sugar Infused Pre-Roll 2-Pack (1g), taking the number one spot with sales figures of 1162 units. Following closely is the Blueberry Cream Infused Pre-Roll 2-Pack (1g), which maintained its upward trend, moving from third place in January to second place in February. The Watermelon Marg Crunch Gummy (100mg) entered the rankings at third place, showcasing strong consumer interest in edibles. The Blackberry Kush Infused Pre-Roll (1g) debuted at fourth place, adding to the popularity of the pre-roll category. Consistency is observed with the Strawnana Boom Gummy (100mg), which held steady in fifth place for three consecutive months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.