Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

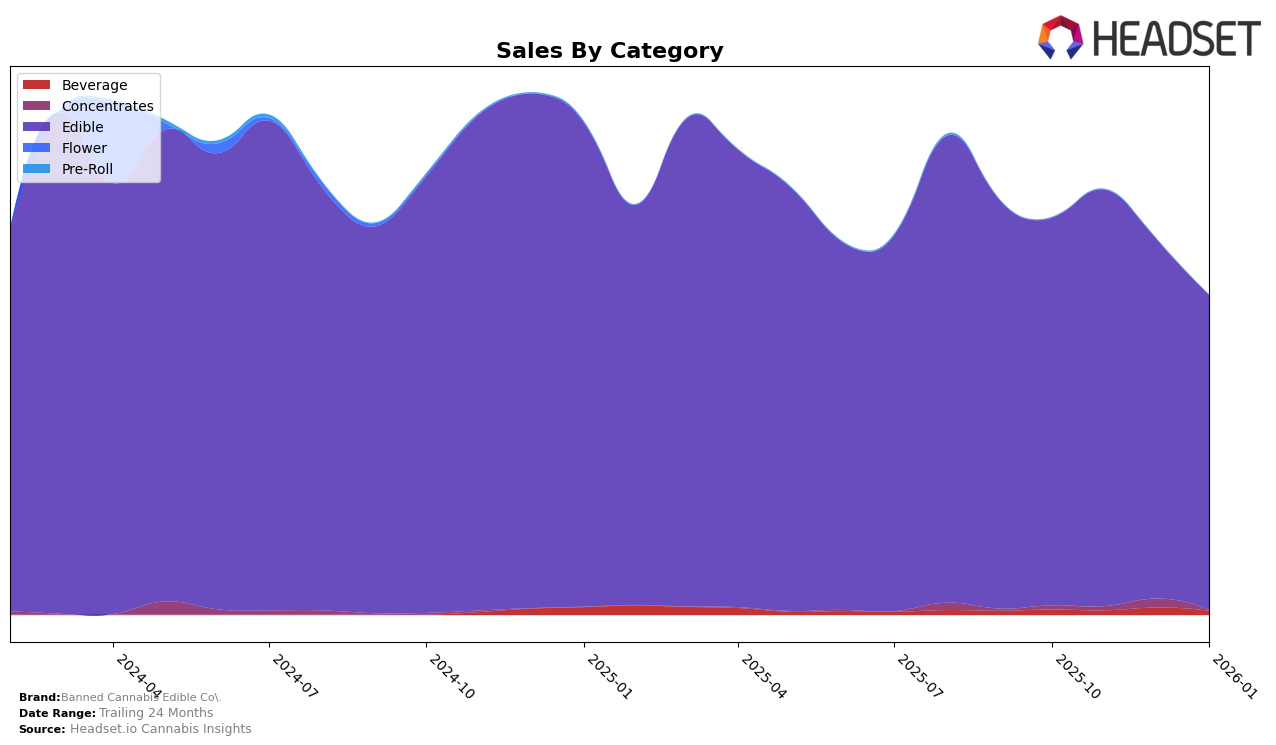

Banned Cannabis Edible Co. has shown notable performance trends in the Michigan market, particularly within the Edible category. Over the last few months, the brand has seen fluctuations in its ranking, moving from 14th in October 2025 to 12th in November, before dropping to 16th in December, and then recovering slightly to 14th in January 2026. This movement indicates a competitive landscape in Michigan's edible market, where Banned Cannabis Edible Co. is consistently vying for a higher position. Despite the drop in December, the brand's ability to regain its previous ranking by January suggests a resilience and potential for strategic adjustments that could stabilize or improve its standing in the coming months.

In terms of sales performance, Banned Cannabis Edible Co. experienced a peak in November 2025, with a noticeable decline in the subsequent months. The sales figures reflect a high point in November, followed by a decrease in December and January, which could be attributed to seasonal variations or competitive pressures within the state. Notably, the absence of Banned Cannabis Edible Co. from the top 30 rankings in other states or provinces indicates that their market presence is currently concentrated in Michigan. This focus could present both challenges and opportunities, as the brand might benefit from diversifying its reach to other regions to mitigate the risks associated with market saturation or local competition in Michigan.

Competitive Landscape

In the competitive landscape of Michigan's cannabis edible market, Banned Cannabis Edible Co. has experienced fluctuating rankings over the past few months, reflecting a dynamic market environment. Starting from October 2025, Banned Cannabis Edible Co. was ranked 14th, improved to 12th in November, dropped to 16th in December, and then climbed back to 14th by January 2026. This volatility is indicative of the competitive pressures from brands like Cannalicious Labs and Mojo (Edibles), which have also seen shifts in their rankings, though they generally maintained a slightly higher position than Banned Cannabis Edible Co. Notably, Rocket (MI) consistently outperformed Banned Cannabis Edible Co., securing a better rank each month, culminating in a 12th place in January 2026. Meanwhile, Dope Rope showed a positive trend, surpassing Banned Cannabis Edible Co. in January. Despite these challenges, Banned Cannabis Edible Co.'s ability to regain its rank in January suggests resilience and potential for growth amidst a competitive field.

Notable Products

In January 2026, the top-performing product from Banned Cannabis Edible Co. was Blueberry Cluster Gummies 4-Pack (200mg), maintaining its number one rank from December 2025, despite a slight decrease in sales to 7467 units. Berry Melon Nerdless Gummies 4-Pack (200mg) followed closely in second place, consistent with its position in November 2025, with a notable sales figure of 7313 units. Green Apple Nerd Gummies 4-Pack (200mg) climbed to third place, marking its first appearance in the rankings since October 2025. Berry Melon Live Hash Rosin Gummies 5-Pack (200mg) entered the rankings for the first time in fourth place. Paradise Punch Nerdless Gummies 4-Pack (200mg) held steady at fifth place, as it did in December 2025, showing stable performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.