Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

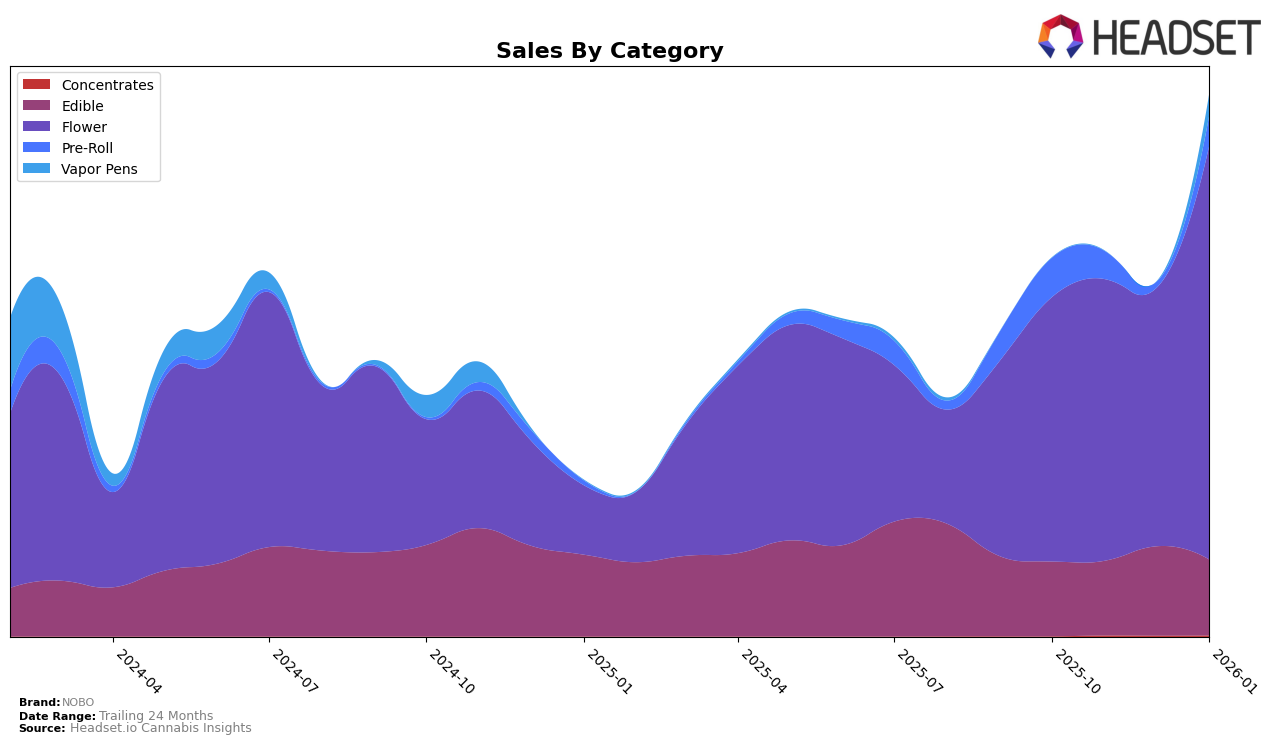

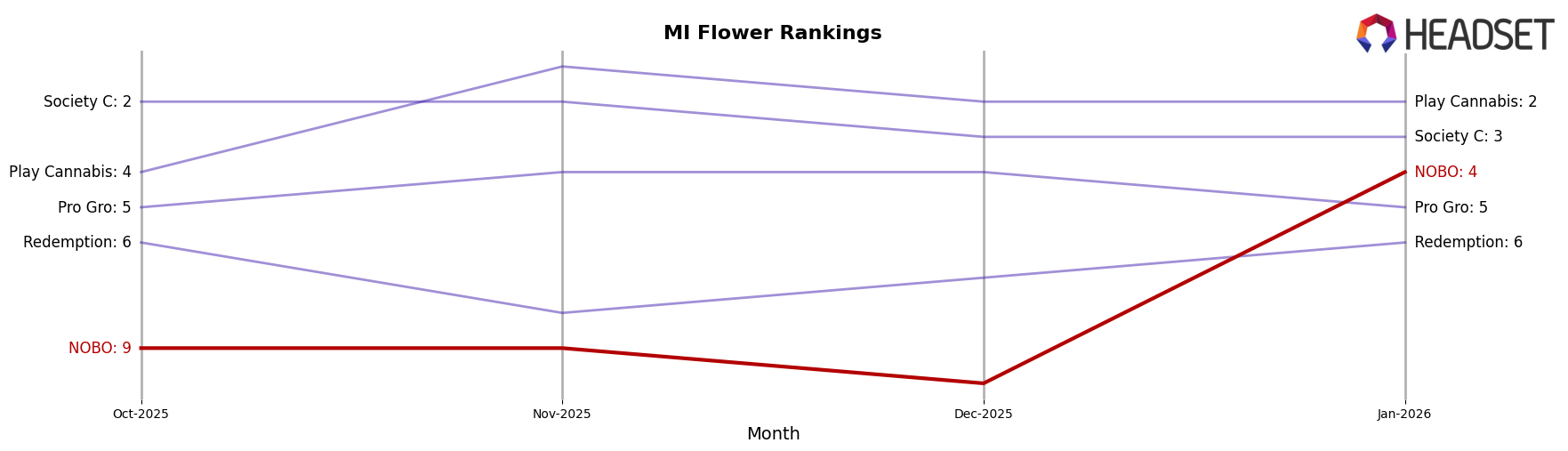

NOBO's performance across different categories and states has shown notable variations, particularly in the Flower category. In Colorado, NOBO experienced a significant fluctuation in rankings, dropping from 18th in October 2025 to 39th in December 2025, before bouncing back to 18th in January 2026. This rebound is indicative of a strategic recovery or market adjustment. Meanwhile, in Michigan, NOBO's Flower category maintained a strong presence, improving its rank from 9th in October 2025 to an impressive 4th by January 2026, suggesting a strong foothold in this particular market. Such movements highlight NOBO's varying market strategies and their effectiveness across different regions.

In Michigan, NOBO's performance in the Edible category remained relatively stable, holding the 10th and 11th positions over several months, which suggests consistent consumer demand or effective brand loyalty. However, the brand's presence in the Pre-Roll category was less stable, as it failed to maintain a top 30 position in December 2025, which could point to a competitive challenge or shifting consumer preferences. Interestingly, NOBO entered the Vapor Pens category in Michigan in January 2026, achieving a rank of 48th, indicating a potential new area for growth. These insights into NOBO's category performance suggest a brand that is both resilient and adaptable, with opportunities for expansion and improvement in certain segments.

Competitive Landscape

In the competitive landscape of the Michigan flower market, NOBO has demonstrated a significant upward trajectory in recent months. Starting from a rank of 9th in October 2025, NOBO maintained its position in November, slightly dipped to 10th in December, but made a remarkable leap to 4th place by January 2026. This improvement in rank is indicative of a strategic shift or successful campaign that has bolstered their market presence. In contrast, Pro Gro experienced a slight decline from 4th to 5th place, while Redemption remained relatively stable, fluctuating between 6th and 8th place. Meanwhile, Society C and Play Cannabis have consistently occupied the top ranks, with Play Cannabis even reaching the 1st position in November. NOBO's sales surge in January, which brought them closer to the sales figures of these top competitors, suggests a promising trend that could further enhance their competitive standing in the Michigan flower market.

Notable Products

In January 2026, the top-performing product for NOBO was Martian Melon Gummy (200mg) in the Edible category, securing the number one rank with sales of 15,198 units. Following closely was Double Burger (3.5g) from the Flower category, ranked second. Berrien Cherry (3.5g), also in the Flower category, rounded out the top three. Notably, Green Apple Gummies 10-Pack (200mg) maintained its fourth position from December 2025, showing consistent performance. Watermelon Gummies 10-Pack (200mg) dropped from second place in December to fifth, indicating a slight decline in its ranking despite a robust sales figure.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.