Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

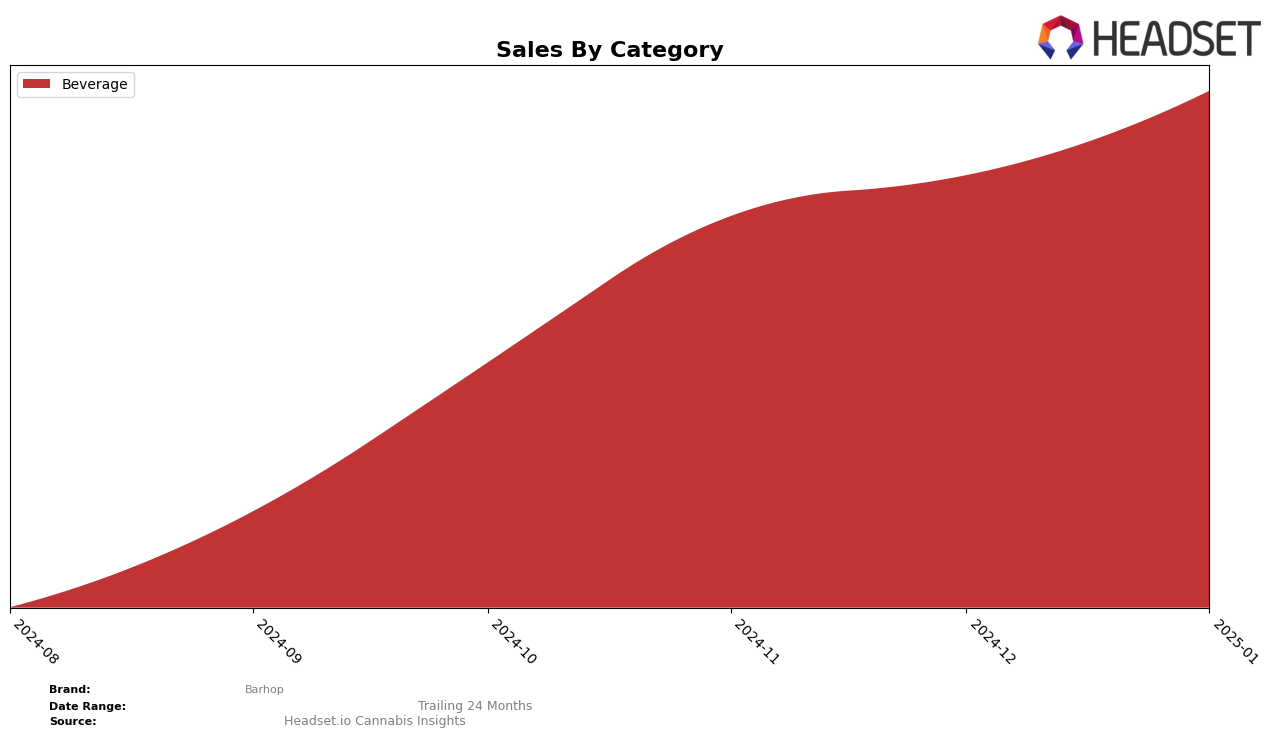

Barhop's performance in the beverage category within Ontario has shown promising signs of growth over the recent months. Notably, the brand did not appear in the top 30 rankings for October and November 2024, indicating a period of relative obscurity or underperformance. However, by December 2024, Barhop managed to break into the rankings at position 33, and further improved to 32nd place in January 2025. This upward movement suggests a positive trajectory and growing consumer interest, although the brand still has a way to go to secure a more competitive position within the top 30. The sales figures reflect this trend, with a slight decrease from December to January, hinting at potential challenges in sustaining growth momentum.

Across different states and categories, Barhop's visibility remains limited, as evidenced by the absence of its ranking in the top 30 for most of the period analyzed. This lack of presence could be interpreted as either a strategic focus on specific markets like Ontario or a need for more aggressive market penetration strategies in other regions. The brand's performance in Ontario's beverage category serves as a potential benchmark for its expansion efforts, highlighting the importance of targeted market strategies. Observers might find it beneficial to keep an eye on Barhop's future movements, especially if they manage to translate their recent gains in Ontario into success in other states or categories.

Competitive Landscape

In the competitive landscape of the beverage category in Ontario, Barhop has shown a promising upward trajectory, particularly noticeable in the last two months of the data period. While Barhop did not rank in the top 20 from October to November 2024, it made a significant entrance in December 2024 at rank 33 and improved to rank 32 by January 2025. This upward movement is noteworthy, especially when compared to competitors like Ace Valley, which experienced a decline from rank 27 in October 2024 to falling out of the top 20 by January 2025. Similarly, 7 Acres and Sense & Purpose Beverages also faced challenges in maintaining their ranks, with the latter dropping from 28 to 31 over the same period. Meanwhile, Voila! showed a slight improvement, moving from rank 32 in October 2024 to 30 by January 2025, yet Barhop's entry and subsequent rise suggest a growing consumer interest and potential for increased market share. This trend highlights Barhop's competitive edge and potential for further growth in the Ontario beverage market.

Notable Products

In January 2025, Barhop's top-performing product was OG Citrus Hopwater (10mg THC, 355ml) in the Beverage category, maintaining its number one rank for four consecutive months with sales reaching 1,204 units. Strawberry Hopwater (10mg THC, 355ml) also held steady in the Beverage category at the second spot, despite a slight dip in sales to 666 units from the previous month. The consistent rankings of these products highlight their strong consumer demand and loyalty. Compared to the previous months, both products have shown remarkable sales stability, indicating effective market positioning. Overall, Barhop's Beverage category continues to dominate, with OG Citrus Hopwater leading the charge in sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.