Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

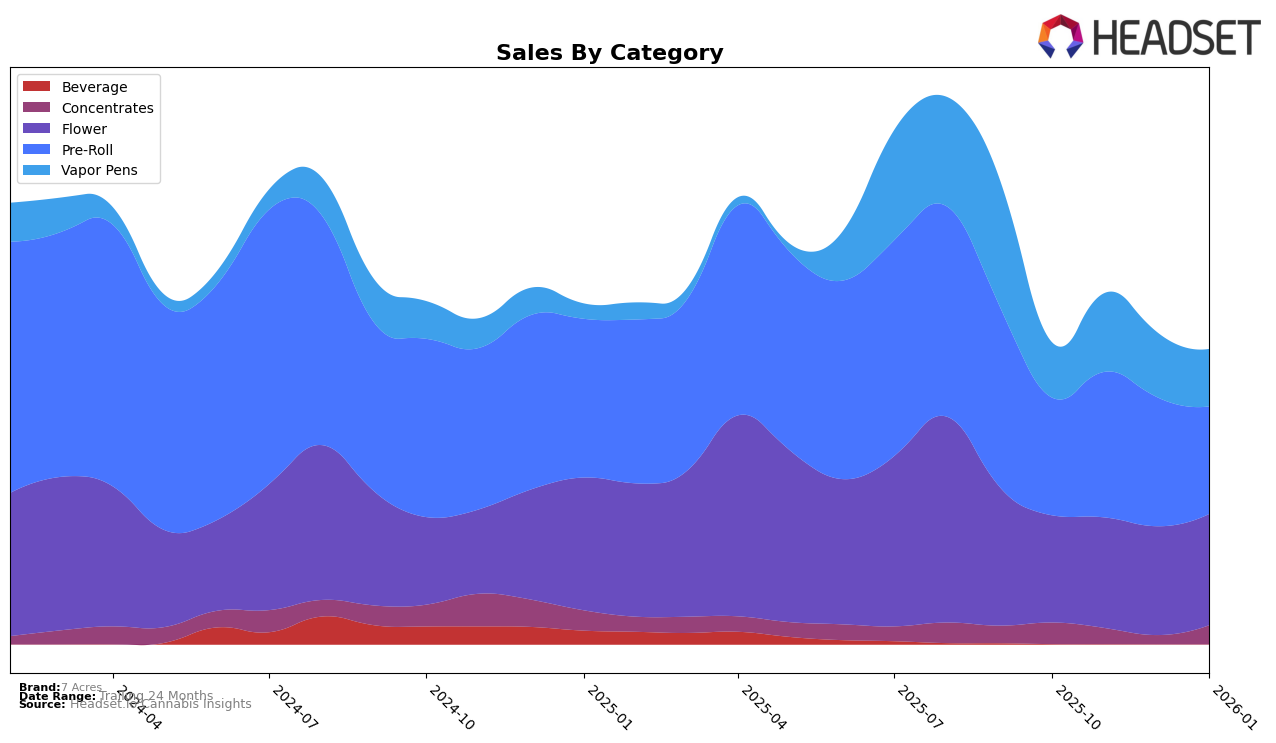

In the Canadian cannabis market, 7 Acres has shown varied performance across different provinces and product categories. In Alberta, the brand has maintained a consistent presence in the Flower category, with a slight fluctuation in rankings, moving from 58th in October 2025 to 57th in January 2026. However, in the Pre-Roll category, 7 Acres experienced a decline from 49th to 56th over the same period, indicating potential challenges in maintaining market share. Notably, the Vapor Pens category witnessed a positive trajectory, improving from 62nd to 40th, suggesting a growing consumer interest in this product line. In British Columbia, the Flower category saw a significant jump from 68th in November 2025 to 44th in January 2026, highlighting an upward trend in consumer demand.

Conversely, in Ontario, 7 Acres faced challenges in the Flower category, with rankings slipping from 79th to 85th by January 2026, reflecting a competitive market environment. The Vapor Pens category also saw a decline from 63rd to 75th, suggesting potential areas for improvement in product offerings or marketing strategies. Meanwhile, in Saskatchewan, 7 Acres demonstrated strong performance in the Concentrates category, achieving a notable 7th place ranking in January 2026 after a brief absence from the top 30 in December 2025. This resurgence indicates a robust demand for their concentrates in this province, presenting an opportunity for further growth and market penetration.

Competitive Landscape

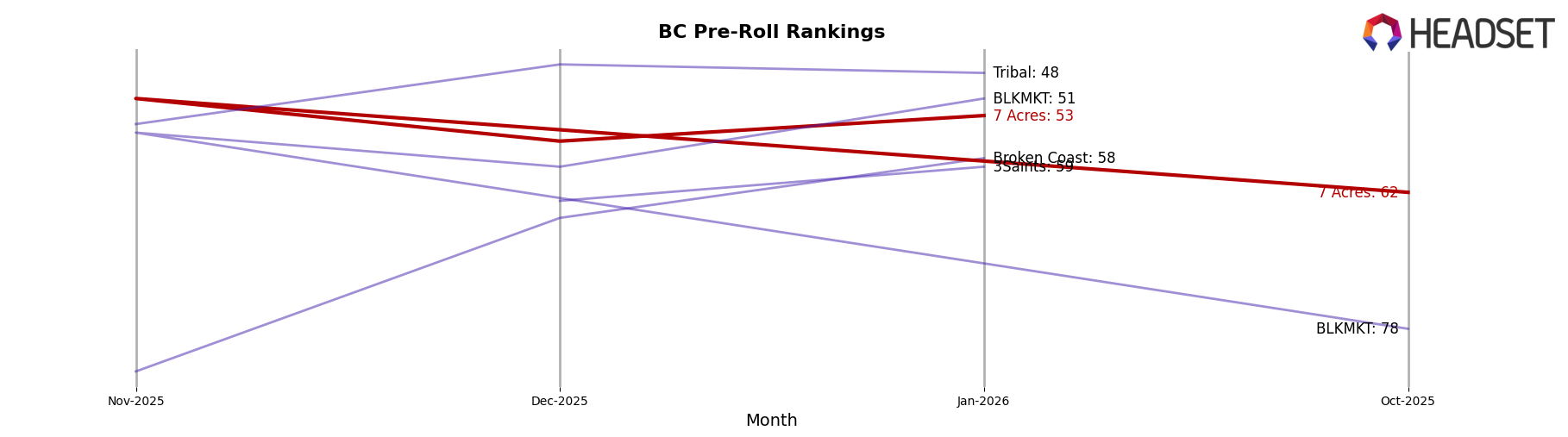

In the competitive landscape of the Pre-Roll category in British Columbia, 7 Acres has shown a moderate yet consistent performance. From October 2025 to January 2026, 7 Acres improved its rank from 62nd to 53rd, indicating a positive trend in market presence. Notably, Broken Coast and BLKMKT have also been active competitors, with BLKMKT surpassing 7 Acres in January 2026 by achieving the 51st rank. Despite this, 7 Acres maintained a competitive edge over 3Saints, which entered the top 20 only in December 2025. Interestingly, Tribal consistently ranked higher than 7 Acres, highlighting a potential area for strategic improvement. The sales trajectory for 7 Acres shows a peak in November 2025, followed by a slight decline, suggesting a need for strategic initiatives to sustain growth amidst the dynamic market competition.

Notable Products

In January 2026, Jack Haze Pre-Roll 2-Pack (1g) maintained its position as the top-performing product from 7 Acres, consistently holding the number one rank for four consecutive months with sales figures reaching 13,627 units. White Widow Pre-Roll 7-Pack (3.5g) showed a strong performance by climbing from fourth place in December 2025 to second place in January 2026. Jack Haze Live Resin Liquid Diamonds Disposable (0.95g) improved its rank to third place from fifth in December 2025, indicating a growing preference for vapor pens. White Widow Pre-Roll 2-Pack (1g) dropped slightly to fourth place, while Blue Dream Live Resin Liquid Diamonds Disposable (0.95g) fell to fifth place from its consistent second-place ranking in the previous months. These shifts highlight a competitive landscape where consumer preferences are evolving, particularly favoring pre-rolls and vapor pens.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.