Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

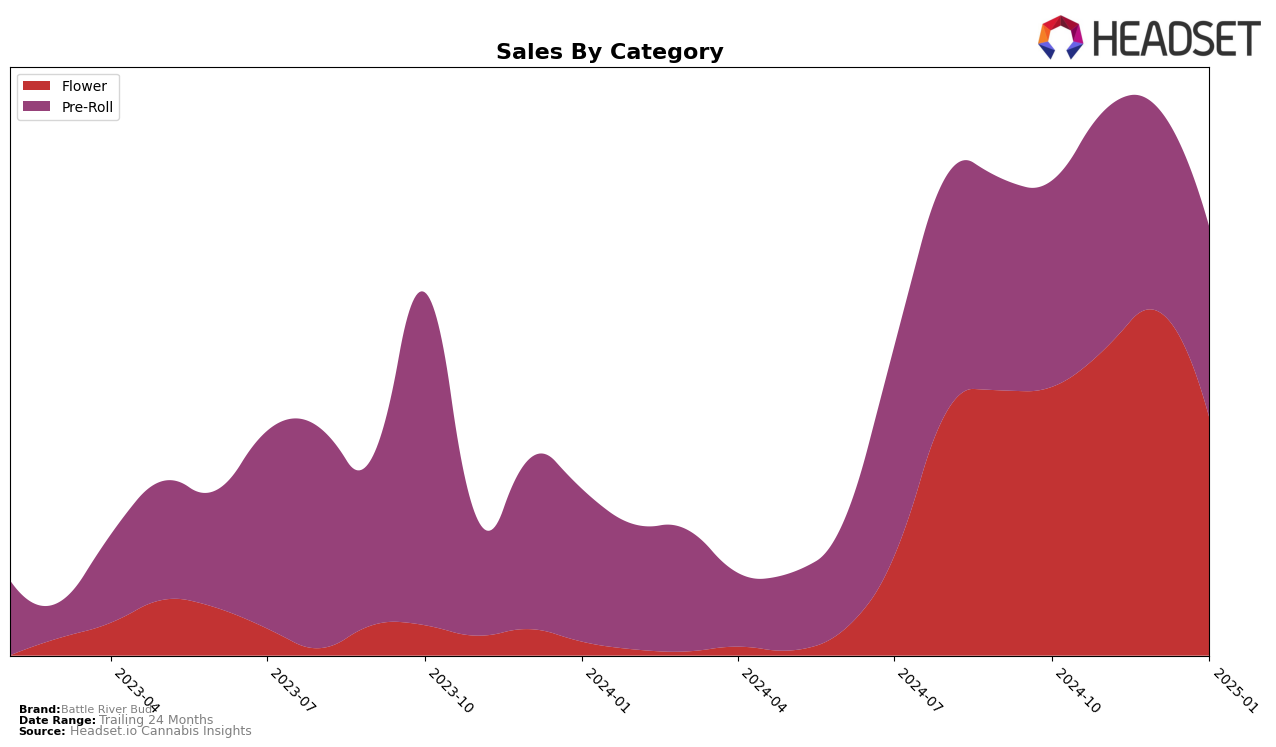

Battle River Bud has shown varied performance across the categories of Flower and Pre-Roll in the Canadian provinces of Alberta and Saskatchewan. In Alberta, the brand's Flower category did not manage to break into the top 30 rankings over the last four months, signaling a challenging market presence. Despite this, there was a slight increase in sales from October to November, but the subsequent months saw a decline, indicating potential issues with market penetration or consumer preference. Conversely, the Pre-Roll category in Alberta saw a positive shift in January 2025, moving up to a ranking of 76 from 86 in December, suggesting some recovery or strategic adjustments that resonated with consumers.

In Saskatchewan, Battle River Bud's performance in the Flower category appears more promising, with rankings consistently within the top 30. Notably, the brand achieved its highest ranking of 21 in December 2024, before experiencing a slight drop in January 2025. This indicates a strong foothold in this province, possibly due to favorable consumer reception or effective distribution strategies. However, the Pre-Roll category in Saskatchewan tells a different story, with rankings fluctuating and eventually falling to 45 by January 2025. This decline might suggest increased competition or a shift in consumer preferences away from their Pre-Roll offerings. Overall, Battle River Bud's performance varies significantly between categories and provinces, highlighting areas of strength and opportunities for improvement.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Alberta, Battle River Bud has shown a notable upward trend in rank from October 2024 to January 2025. Starting at rank 85 in October, Battle River Bud improved to rank 76 by January, indicating a positive shift in market presence. This improvement contrasts with competitors like Tantalus Labs and Color Cannabis, which experienced a decline in their rankings over the same period. Notably, Tantalus Labs dropped from rank 60 to 73, and Color Cannabis fell from 61 to 75. Despite these competitors having higher sales figures, their declining ranks suggest potential challenges in maintaining market share. Meanwhile, Battle River Bud's sales saw a significant increase in January, aligning with its improved ranking. This upward trajectory positions Battle River Bud as a growing contender in the Alberta Pre-Roll market, potentially attracting more consumers and increasing sales momentum.

Notable Products

In January 2025, the top-performing product from Battle River Bud was the Ugly GRRlfriend Pre-Roll 5-Pack (2.5g), which reclaimed its number one ranking after dropping to second place in the previous months, with sales reaching 1,303 units. The Fossil Fuel Pre-Roll 5-Pack (2.5g) climbed to second position, marking a significant rise from its previous absence in rankings for November and December 2024. The Ugly GRRlfriend Pre-Roll (0.5g) maintained a steady presence, securing the third spot, slightly improving from its fourth position in the last two months of 2024. The Fossil Fuel Pre-Roll (0.5g) dropped to fourth place, a decline from its third position in December 2024. Finally, the Fossil Fuel Pre-Roll 3-Pack (1.5g) held steady at fifth place, consistent with its December 2024 ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.