Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

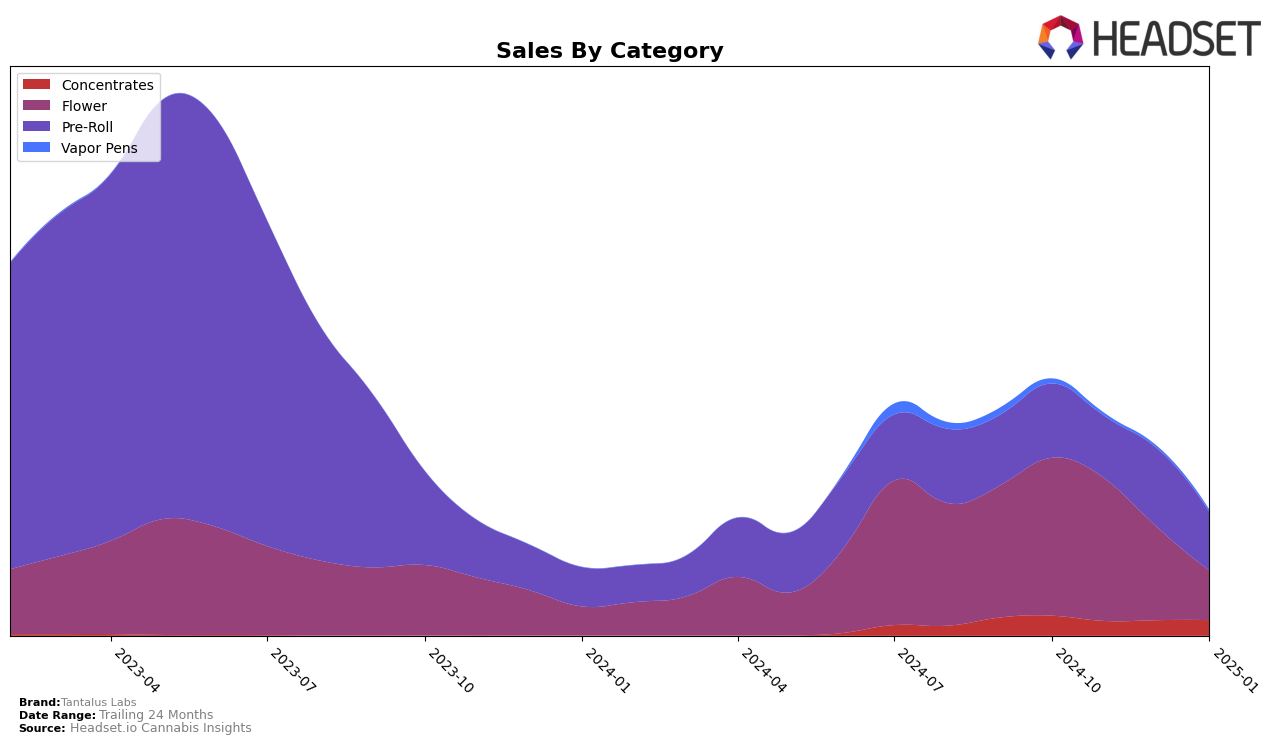

In the province of Alberta, Tantalus Labs has shown varied performance across different cannabis categories. Notably, their ranking in the Concentrates category remained relatively stable, fluctuating slightly from 12th to 16th position over the months from October 2024 to January 2025. This steadiness is contrasted by a significant decline in the Flower category, where they dropped from 12th in October 2024 to 74th by January 2025, indicating a substantial decrease in market presence. The Pre-Roll category also saw some challenges, with rankings not breaking into the top 30, peaking at 58th in December 2024 before falling again. A brief appearance in the Vapor Pens category at 67th in October 2024 suggests limited engagement in this segment.

In British Columbia, Tantalus Labs experienced a more consistent performance, particularly in the Flower category, where they maintained a presence within the top 50, although their rank did dip to 45th in January 2025. The Pre-Roll category also showed stability, holding around the 50th position throughout the reported months. Meanwhile, in Ontario, Tantalus Labs' Pre-Roll products did not make it into the top 30, with rankings just shy of the top 100, which suggests room for growth in this large market. Overall, while Tantalus Labs maintains a foothold in certain categories, there are clear opportunities and challenges across different regions and product lines.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, Tantalus Labs has experienced fluctuations in its rank, indicating a dynamic market presence. As of January 2025, Tantalus Labs ranked 45th, a decline from its 32nd position in December 2024, suggesting a potential challenge in maintaining consistent market traction. Notably, 3Saints has shown a relatively stable performance, ranking 41st in January 2025, slightly down from 30th in October 2024, yet still ahead of Tantalus Labs. Meanwhile, Good Buds and Freedom Cannabis have not been consistent top performers, with ranks often outside the top 40, which may present an opportunity for Tantalus Labs to capitalize on their inconsistency. However, Tribal has shown a promising upward trend, improving from 53rd in November 2024 to 42nd in January 2025, suggesting a potential rising competitor. These insights highlight the importance for Tantalus Labs to strategize effectively to regain and maintain a competitive edge in the British Columbia Flower market.

Notable Products

In January 2025, the top-performing product from Tantalus Labs was the More Cowbell Pre-Roll 3-Pack (1.5g), which ascended to the number one rank with sales figures of 3206 units. The Mai Tai x Zero Gravity Pre-Roll (1g) followed closely, maintaining a strong position by climbing to the second rank. The Pacific OG Pre-Roll 3-Pack (1.5g) experienced a slight drop, moving to the third position from its previous top rank in December 2024. The Horchata Ultra Max Diamond Infused Pre-Roll (1g) saw a decline in its ranking, moving from first in November 2024 to fourth in January 2025. Notably, the Animal Sundae Pre-Roll (1g) emerged in the rankings for the first time, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.