Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

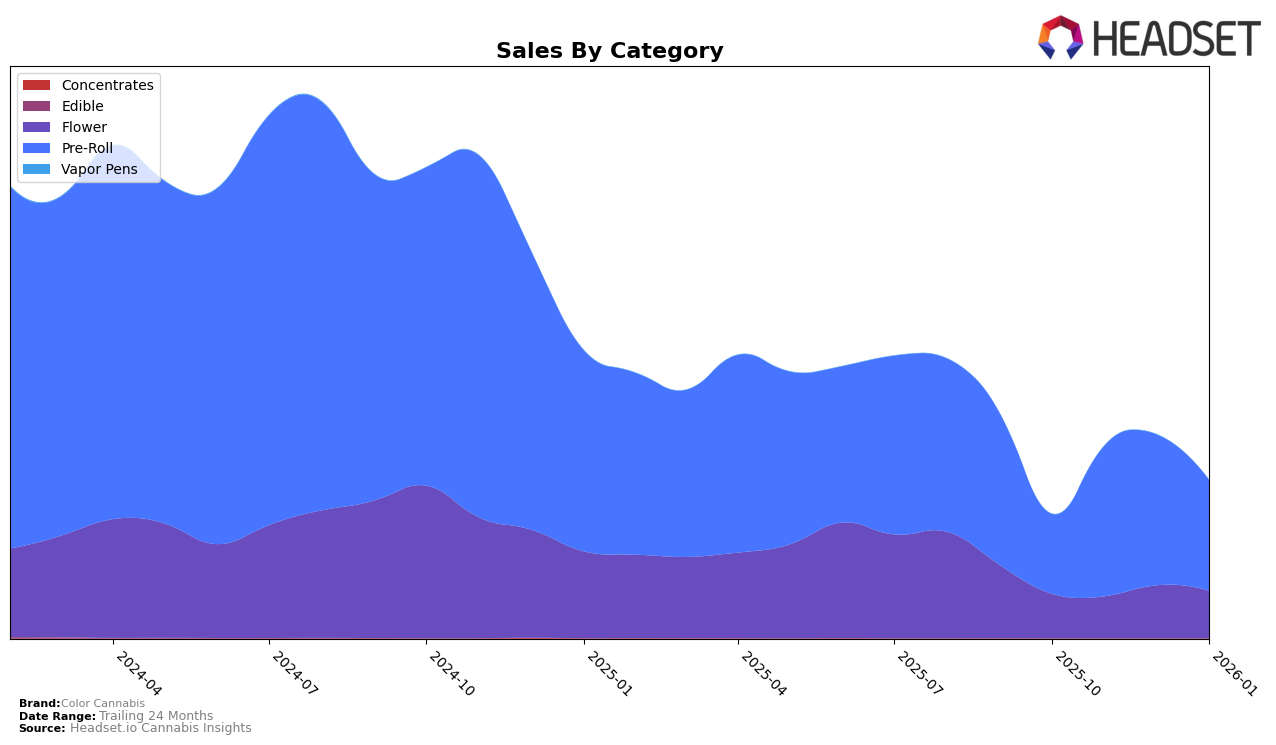

Color Cannabis has demonstrated varied performance across different categories and regions, with notable movements in rankings and sales. In Alberta, the brand's Flower category experienced a decline, dropping from the 74th position in October 2025 to the 81st position by January 2026, accompanied by a decrease in sales from approximately 44,148 CAD to 29,754 CAD. This suggests a weakening presence in this market segment. Conversely, in British Columbia, Color Cannabis showed a promising upward trend in the Flower category, climbing from 65th to 43rd place over the same period. This improvement was mirrored by a significant increase in sales, indicating a strengthening foothold in the province's Flower market.

The Pre-Roll category tells a different story. In British Columbia, Color Cannabis maintained a strong position, consistently ranking within the top 30 brands and improving from 28th to 17th place between October 2025 and January 2026. This upward trajectory highlights their competitive edge in the Pre-Roll market within the province. However, in Ontario, the Pre-Roll rankings showed some fluctuations, with the brand moving from 53rd in October to 44th in November, before settling back at 53rd in January. Despite these shifts, the sales figures indicate a robust market presence, although a notable dip in sales occurred in January 2026. This data suggests that while Color Cannabis is gaining ground in some areas, there are opportunities for growth and stabilization in others.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in British Columbia, Color Cannabis has shown a notable upward trend in its brand ranking from October 2025 to January 2026. Starting outside the top 20 in October, Color Cannabis climbed to the 19th position by November and maintained this rank in December before advancing to 17th in January. This positive trajectory indicates a strengthening market presence, although it still trails behind competitors like DEALR, which consistently held a higher rank, peaking at 13th in November. Meanwhile, Dab Bods and The Loud Plug also demonstrated competitive performances, with Dab Bods briefly surpassing Color Cannabis in November and December. Despite these challenges, Color Cannabis's consistent rank improvement suggests a growing consumer base and potential for increased sales momentum in the coming months.

Notable Products

In January 2026, Mango Haze Pre-Roll 10-Pack (3.5g) maintained its position as the top-performing product for Color Cannabis, with sales amounting to 10,447 units. Mango Haze Pre-Roll 2-Pack (0.7g) climbed back to second place, recovering from a dip to fourth place in December 2025. Space Cake Pre-Roll 10-Pack (3.5g) showed significant improvement, moving up to third place from fifth in the previous two months. Ghost Train Haze Pre-Roll 10-Pack (3.5g) experienced a slight drop, falling to fourth place from its second position in December 2025. Pedro's Sweet Sativa Pre Roll 10-Pack (3.5g) rounded out the top five, sliding from its third-place spot in December 2025 to fifth in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.