Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

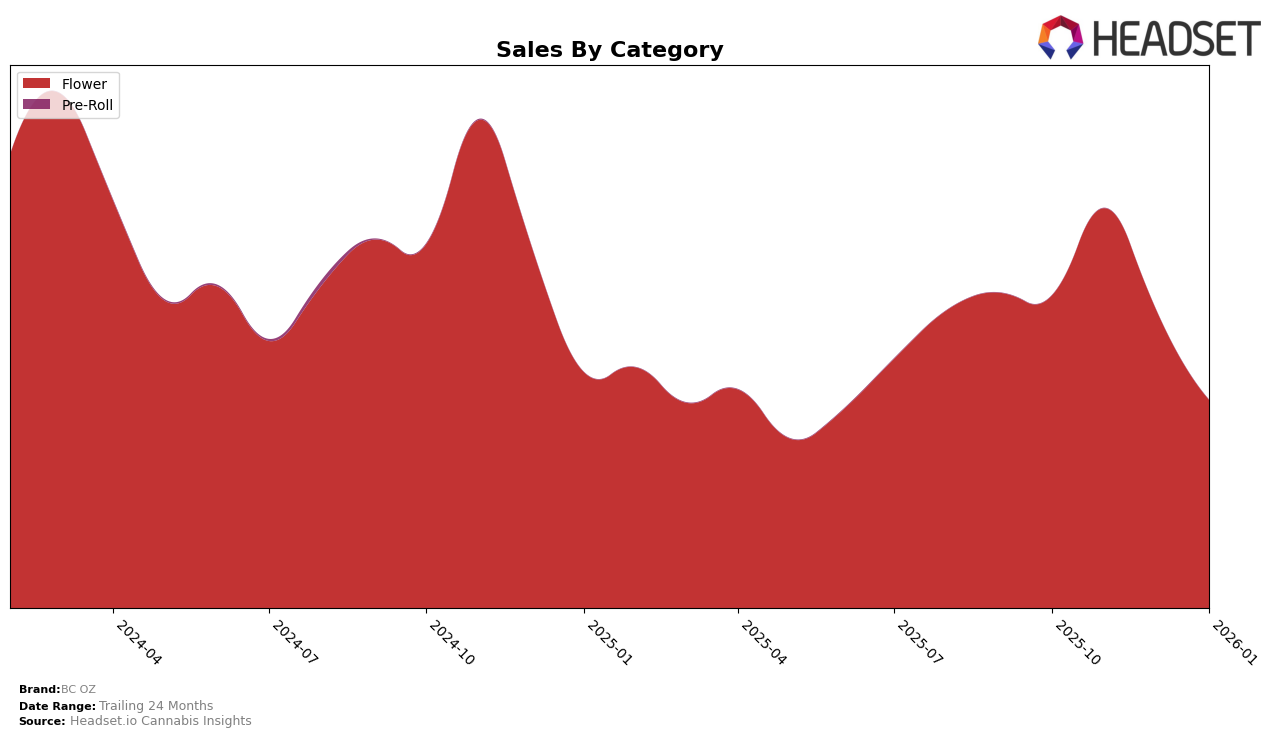

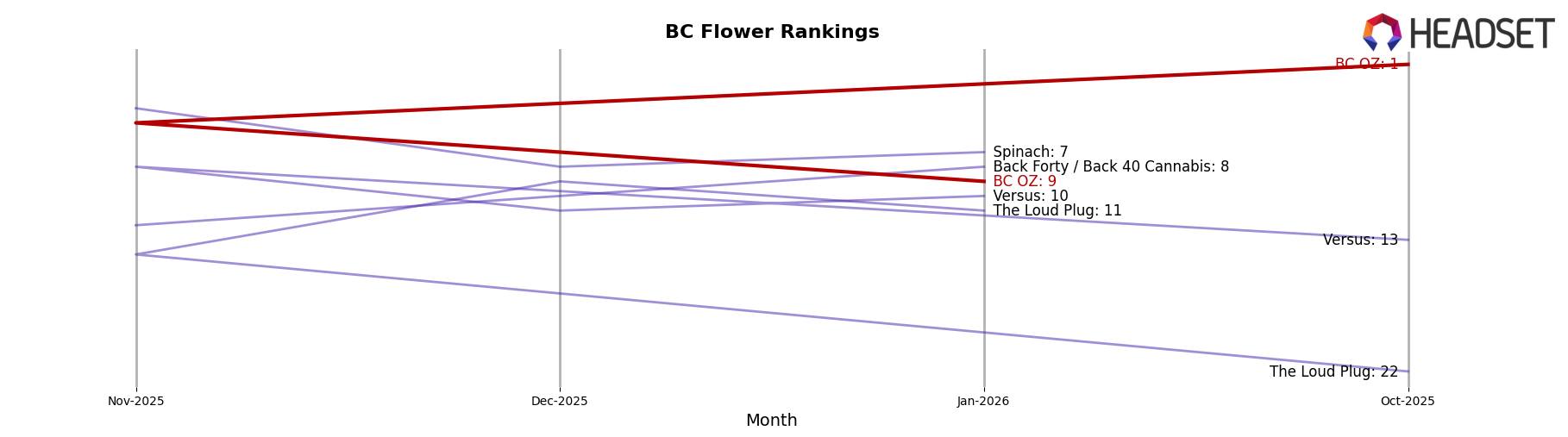

BC OZ has shown notable fluctuations in its performance across different Canadian provinces, particularly in the Flower category. In British Columbia, BC OZ started strong in October 2025, securing the top rank, but experienced a downward trend, falling to the 9th position by January 2026. This decline in ranking is accompanied by a decrease in sales from October to January. The brand's initial high rank suggests a strong market presence, but the subsequent drop indicates challenges in maintaining its position amid competitive pressures.

In contrast, the performance of BC OZ in Ontario paints a different picture. The brand did not manage to break into the top 30 rankings for the Flower category during the observed months, with positions ranging from 47th to 68th. This consistent absence from the upper echelons of the rankings highlights potential hurdles in gaining traction within Ontario's market. Despite these challenges, the data suggests there might be underlying factors affecting their sales trajectory in Ontario that could be explored further.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, BC OZ has experienced notable fluctuations in its market position from October 2025 to January 2026. Initially holding the top rank in October 2025, BC OZ saw a decline to 5th place in November, further dropping to 7th in December, and settling at 9th in January 2026. This downward trend in rank is mirrored by a decrease in sales, particularly evident from November to January. In contrast, Spinach has shown resilience, maintaining a strong presence in the top 10, despite a slight decline from 4th to 7th place. Meanwhile, Back Forty / Back 40 Cannabis has improved its rank from 12th to 8th, indicating a positive sales trajectory. The Loud Plug and Versus have also demonstrated competitive growth, with The Loud Plug entering the top 10 by December and Versus maintaining a consistent presence. These shifts highlight a dynamic market where BC OZ faces increasing competition, necessitating strategic adjustments to regain its leading position.

Notable Products

In January 2026, Comfortably Numb (28g) emerged as the top-performing product for BC OZ, leading the sales with 829 units sold. Heady Eddy (28g) secured the second position, while Snow Globe (28g) slipped from its previous top spot in December 2025 to third place. Golden Hour Gelato (28g) maintained its fourth position from December, showing consistent performance. Holy Gmoly (28g) rounded out the top five, indicating a drop from its third-place finish in December. This shift in rankings suggests a dynamic market where consumer preferences are evolving rapidly.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.