Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

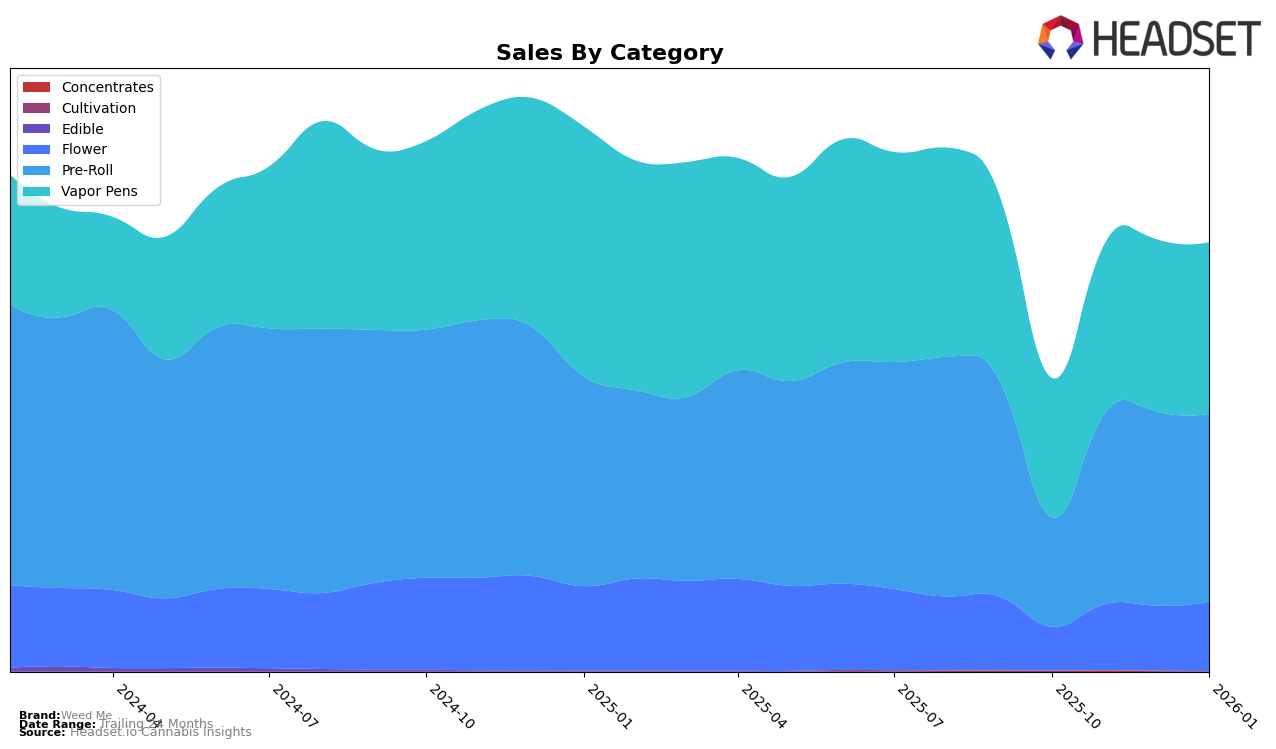

Weed Me has demonstrated a varied performance across different categories and provinces. In Alberta, the brand maintained a steady presence in the Pre-Roll category, consistently ranking 9th in both December 2025 and January 2026. This stability indicates a strong foothold in this segment. However, their performance in Vapor Pens showed more fluctuation, dropping from 12th in October to 16th in December before slightly recovering to 15th in January. Meanwhile, in British Columbia, Weed Me's Pre-Roll category saw a remarkable climb, securing the 2nd spot by December 2025 and maintaining it into January 2026. This upward trend highlights their growing popularity and competitive edge in this market.

The situation in Ontario presents a mixed picture. While Weed Me did not make it into the top 30 in the Flower category in November 2025, they showed resilience by ranking 63rd by January 2026. In contrast, their Vapor Pens maintained a strong position, consistently staying within the top 11. In Saskatchewan, the brand improved its ranking in both Flower and Vapor Pens categories. Notably, the Vapor Pens category saw a significant leap from 15th in October to 6th by January, indicating a successful strategy or product appeal in that region. This diverse performance across provinces underscores the dynamic nature of Weed Me's market presence and their ability to adapt to different consumer preferences.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in British Columbia, Weed Me has demonstrated a significant upward trajectory in its market position. Initially ranked 13th in October 2025, Weed Me surged to the 2nd position by December 2025 and maintained this rank into January 2026. This impressive climb is indicative of robust sales growth, outpacing several competitors. Notably, Thumbs Up Brand also showed a strong performance, climbing from 23rd to 3rd place by December 2025, but still trailing behind Weed Me. Meanwhile, General Admission consistently held the top rank, suggesting a strong market presence. Pistol and Paris experienced a slight decline, dropping from 2nd to 4th place by December 2025, which may have contributed to Weed Me's rise. This data highlights Weed Me's growing influence and competitive edge in the Pre-Roll market in British Columbia.

Notable Products

For January 2026, the top-performing product from Weed Me is Black Mountain Side Pre-Roll 3-Pack (1.5g) in the Pre-Roll category, consistently holding the number one rank since November 2025. The King Size Sativa 420 Pre-Roll 20-Pack (8g) climbed to the second position, showing a notable increase in sales to $11,184 compared to previous months. Max - Seedless Grape Liquid Diamond Cartridge (1g) maintained a strong presence in the Vapor Pens category, ranking third, slightly dropping from its second place in December 2025. Meanwhile, Max- Mango Blueberry Slush Liquid Diamond Cartridge (1g) slipped to fourth place, indicating a decrease in sales momentum. Indica 420 Pre-Roll 20-Pack (8g) re-entered the rankings at fifth place, showing a resurgence after being absent in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.