Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

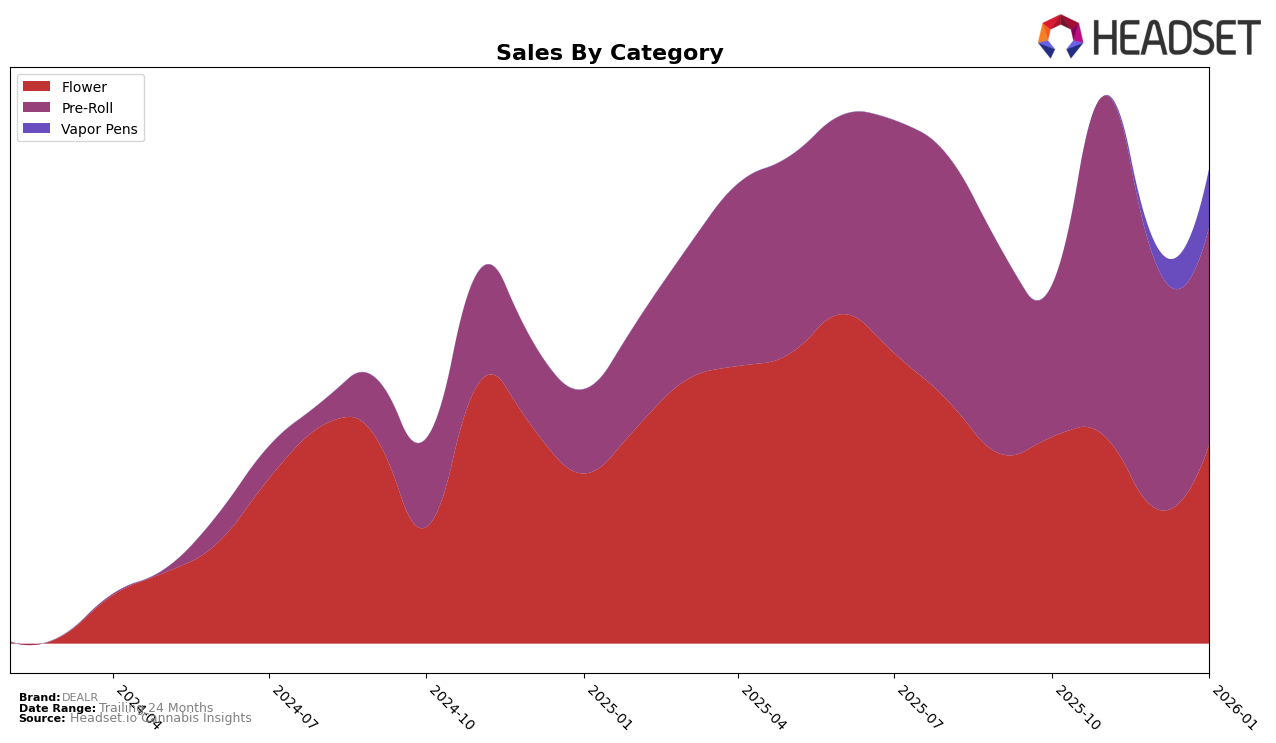

In British Columbia, DEALR has shown fluctuating performance across different cannabis categories. In the Flower category, the brand experienced a notable dip in rankings from October to December 2025, dropping from 5th to 24th place, but made a recovery to 16th in January 2026. This suggests a potential resurgence in popularity or strategic adjustments in the new year. Meanwhile, the Pre-Roll category remained relatively stable, with DEALR maintaining a consistent position around 15th place from November 2025 to January 2026. However, in the Vapor Pens category, DEALR was absent from the top 30 rankings in the last quarter of 2025 but made a significant jump to 23rd place by January 2026, indicating a positive trend and growing consumer interest in their vapor products.

In Ontario, DEALR's performance in the Flower category has been less impressive, consistently ranking in the 90s throughout the observed months, with a slight decline in January 2026. This indicates challenges in gaining a foothold in this competitive market. The Pre-Roll category also saw DEALR on the fringes of the top 100, with a disappearance from the rankings in January 2026, which could be a cause for concern regarding their market strategy or consumer preferences. These trends suggest that while DEALR has made strides in certain areas, there remains room for improvement and adaptation to better capture market share in Ontario's cannabis landscape.

Competitive Landscape

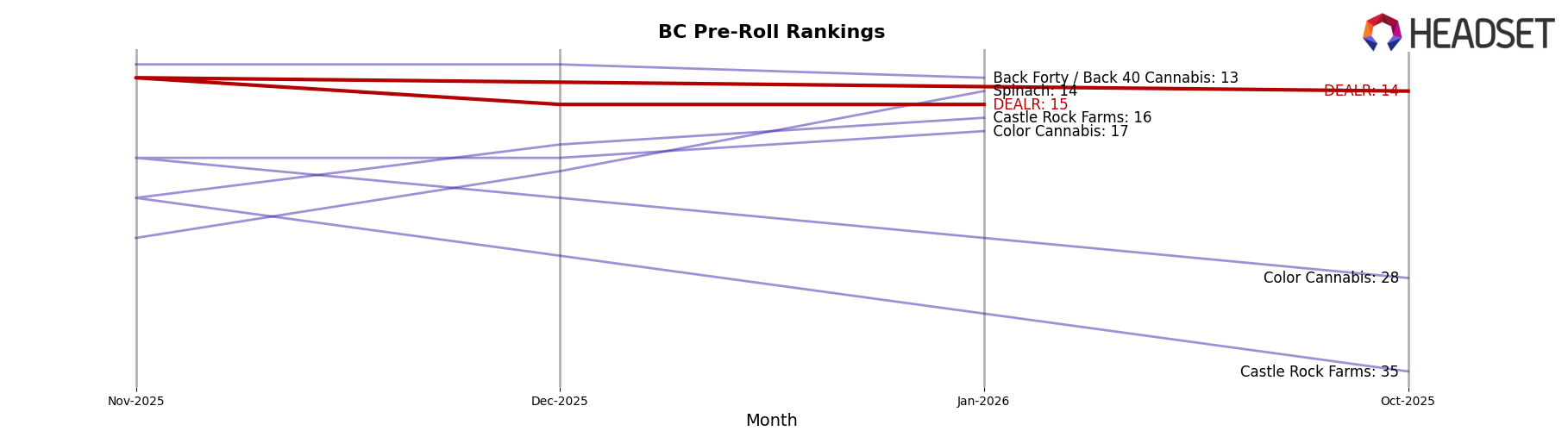

In the competitive landscape of the Pre-Roll category in British Columbia, DEALR has shown a relatively stable performance from October 2025 to January 2026, maintaining a rank between 13th and 15th. This stability is notable given the fluctuations observed among its competitors. For instance, Spinach improved its position significantly from being unranked in October to 14th by December, surpassing DEALR briefly. Meanwhile, Color Cannabis consistently improved its rank, moving from 28th in October to 17th by January, indicating a strong upward trend. Back Forty / Back 40 Cannabis maintained a higher rank than DEALR throughout this period, though its sales showed a downward trend. Castle Rock Farms also demonstrated a notable rise, climbing from 35th to 16th, closely trailing DEALR by January. These dynamics suggest that while DEALR has maintained its position, the competitive pressure is increasing, particularly from brands like Color Cannabis and Castle Rock Farms, which are rapidly gaining ground in the market.

Notable Products

In January 2026, the top-performing product for DEALR was Sweet Jesus Pre-Roll 5-Pack (2.5g), maintaining its number one ranking consistently since October 2025, with January sales reaching 5662 units. Breakfast of Champions Pre-Roll 5-Pack (2.5g) held steady in the second position, despite a decline in sales from previous months. Pink Bubblegum Infused Pre-Roll 3-Pack (1.5g) ranked third, showing a resurgence after not being ranked in December 2025. Honey Nectar Pre-Roll 5-Pack (2.5g) entered the rankings at fourth place, marking its first appearance. El Changuito Pre-Roll 5-Pack (2.5g) consistently remained in the fifth position since November 2025, with a slight decrease in sales in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.