Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

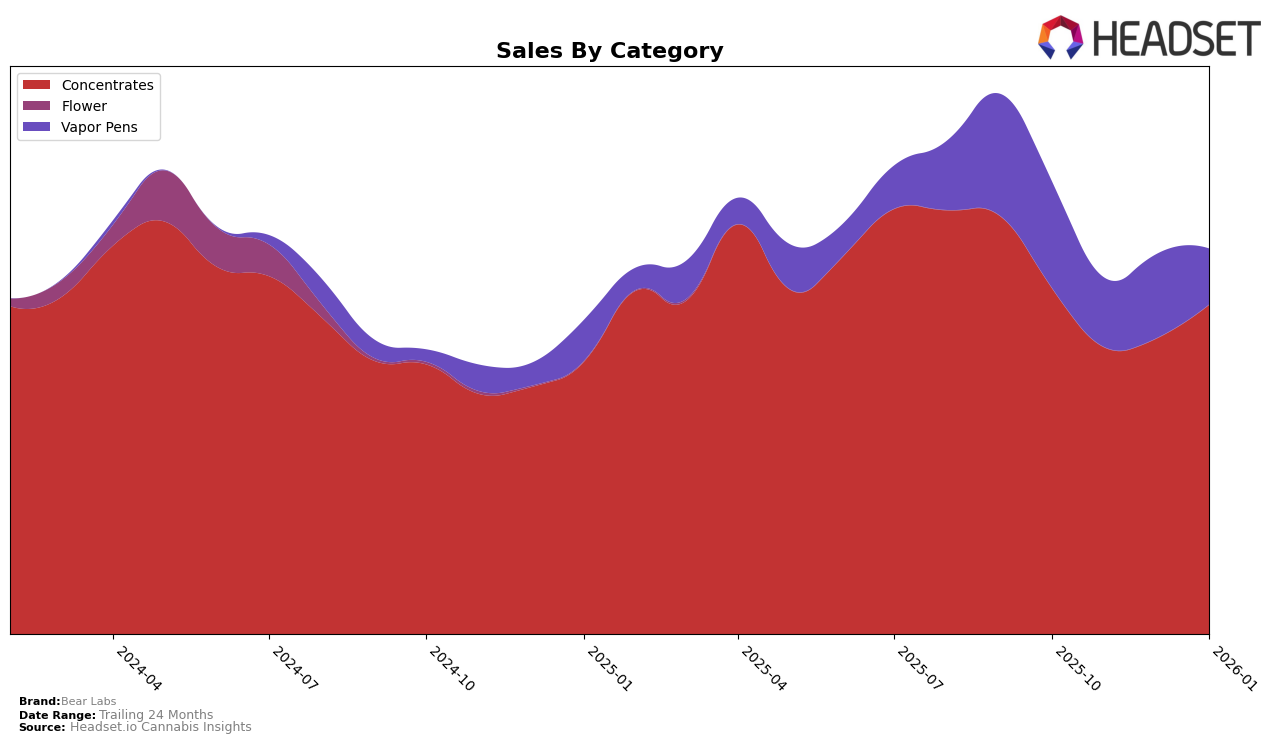

Bear Labs has demonstrated notable performance in the California market, particularly within the Concentrates category. Over the four-month period from October 2025 to January 2026, Bear Labs consistently maintained a position within the top 15 brands, peaking at rank 9 in October 2025. Despite a slight dip to rank 11 in November and December, the brand rebounded to rank 10 in January 2026. This stable positioning suggests a strong foothold in the Concentrates market, with sales showing resilience despite fluctuations. The brand's sales in this category increased from $320,223 in November to $368,280 in January, indicating a positive growth trend as they entered the new year.

In contrast, Bear Labs faced challenges in the Vapor Pens category within California. The brand's rank in this category was 77 in October 2025, but it slipped to 96 in November, before a slight recovery to 91 in December. However, by January 2026, Bear Labs was no longer in the top 30, indicating a struggle to maintain competitive positioning in this segment. This decline in ranking could suggest increased competition or a shift in consumer preferences. Despite these challenges, there was a noticeable increase in sales from November to December, indicating potential areas for strategic improvement and market re-engagement.

Competitive Landscape

In the competitive landscape of the California concentrates market, Bear Labs has experienced notable fluctuations in its ranking and sales performance over the recent months. From October 2025 to January 2026, Bear Labs' rank shifted from 9th to 11th, before recovering slightly to 10th. This movement reflects a competitive pressure from brands like ABX / AbsoluteXtracts, which consistently maintained a higher rank, fluctuating between 9th and 10th, and Hashish House, which held a stable position within the top 8. Despite these challenges, Bear Labs showed resilience with a sales rebound in January 2026, indicating a potential upward trend. Meanwhile, Himalaya and Nasha Extracts have been closing in, with Himalaya improving its rank from 12th to 11th and Nasha Extracts from 14th to 12th, suggesting an increasingly competitive environment that Bear Labs must navigate to sustain and improve its market position.

Notable Products

In January 2026, Bear Labs' top-performing product was Grape Stomper Budder (1g) in the Concentrates category, securing the number one rank with sales reaching 890 units. Following closely, Cherry Pie Hoe Budder (1g) and Grape Gas Budder (1g) took the second and third spots, respectively, showcasing a strong preference for Budder products. Mango Pure Kush Live Rosin (1g) and White Runtz Badder (1g) rounded out the top five, indicating a consistent demand for high-quality concentrates. Notably, this is the first month these products have been ranked, suggesting they are new or recently gained popularity. The shift in rankings highlights a potential trend towards Budder products within Bear Labs' lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.