Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

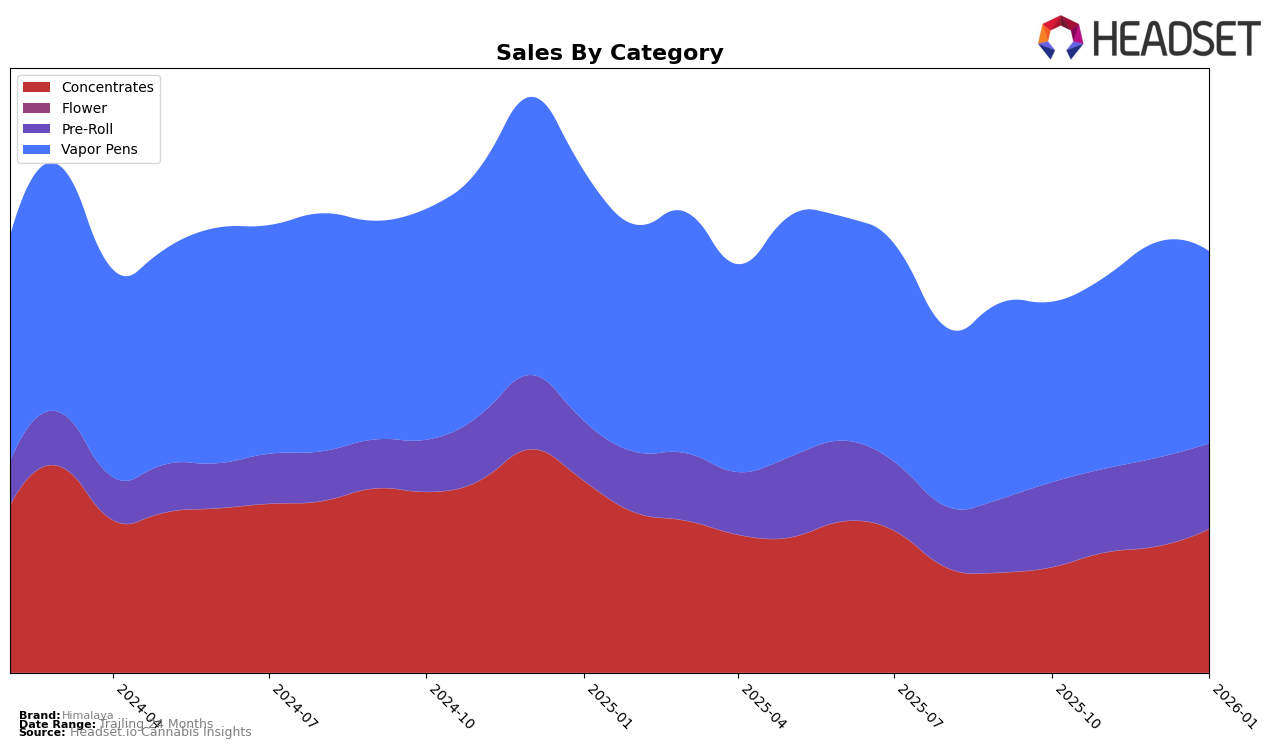

Himalaya has shown a consistent performance in the California market, particularly in the Concentrates category. Over the months from October 2025 to January 2026, the brand maintained a steady position at rank 12, before improving slightly to rank 11 by January. This upward movement is indicative of a positive trend, as their sales figures also reflect a significant increase from $260,290 in October to $354,989 in January. In the Vapor Pens category, Himalaya has shown resilience, holding ranks 36 and 37 interchangeably over the same period, suggesting a stable presence in this competitive segment.

However, the performance in the Pre-Roll category reveals a different story for Himalaya in California. The brand did not break into the top 30, consistently ranking at 50 or above. Despite this, sales figures have been relatively stable, with a slight increase in December 2025. This indicates a potential area for growth if the brand can leverage its strengths from the Concentrates and Vapor Pens categories to enhance its Pre-Roll offerings. The absence of a top 30 rank could be seen as a challenge, but it also highlights an opportunity for Himalaya to innovate and capture more market share in this segment.

Competitive Landscape

In the competitive landscape of the California vapor pen market, Himalaya has shown a steady presence, maintaining its rank at 36th in both November 2025 and January 2026, despite a slight dip to 37th in October and December 2025. This stability in rank is noteworthy given the fluctuations experienced by competitors. For instance, Punch Extracts / Punch Edibles saw a drop from 31st in October to 35th in November and January, indicating potential volatility. Meanwhile, Dime Bag (CA) experienced a more dramatic shift, climbing from 32nd to 26th by December before falling to 34th in January. Despite these shifts, Himalaya's sales trajectory is positive, with a notable increase from $446,413 in October to $533,207 in December, before slightly decreasing to $474,997 in January. This suggests a resilient market position amidst competitive pressures, particularly when compared to Eighth Brother, Inc., which fell from 25th to 38th by January, and Allswell, which remained mostly below Himalaya in rank. Himalaya's consistent performance amidst these dynamics highlights its potential for growth and stability in the California vapor pen market.

Notable Products

In January 2026, the top-performing product from Himalaya was the Peanut Butter Souffle Live Resin Infused Pre-Roll, which secured the number one rank with sales of 5,937 units. Following closely, the Blue Dream Infused Pre-Roll ranked second, showing an improvement from its fourth position in the previous two months. The Illemonati Live Resin Infused Pre-Roll debuted at the third position, while Its Pluto Infused Pre-Roll came in fourth. The Shake Shack Live Resin Terp Sugar, categorized under Concentrates, rounded out the top five. Notably, the shift in rankings highlights a strong preference for infused pre-rolls, with several new entries appearing in the top ranks for January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.