Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

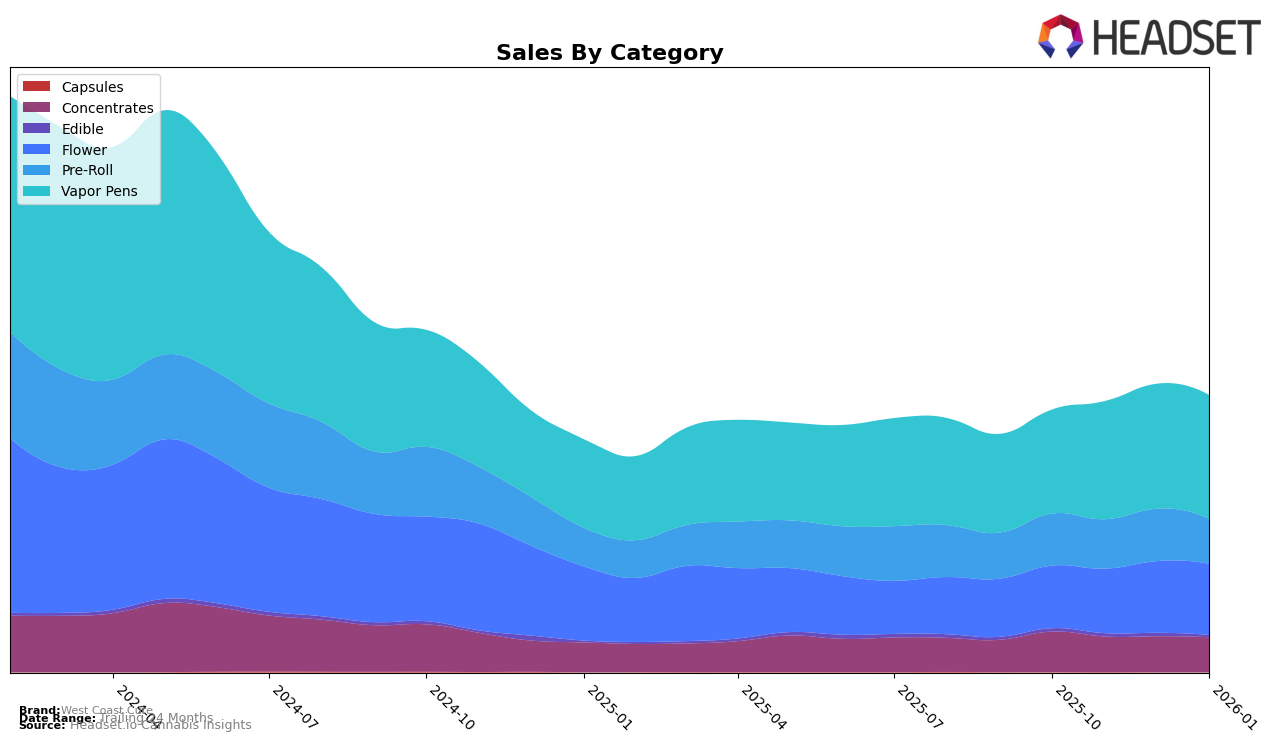

West Coast Cure has demonstrated varied performance across different product categories in California. In the Concentrates category, the brand experienced a slight decline in rankings, moving from 5th in October 2025 to 7th by January 2026. This movement is accompanied by a decrease in sales figures over the same period, indicating potential challenges in maintaining market share. In contrast, the Flower category shows a positive trend, with West Coast Cure improving its rank from 24th to 18th, suggesting a growing consumer preference or successful marketing strategies in this segment. The consistent improvement in rank, despite the competitive nature of the Flower category, is a notable achievement for the brand.

When examining the Pre-Roll category, West Coast Cure maintained a steady presence, holding the 16th rank for three consecutive months before a slight drop to 18th in January 2026. This stability, even with a drop in sales, indicates a resilient market position but also highlights the need for strategic initiatives to regain momentum. In the Vapor Pens category, the brand has shown a commendable performance, moving up the ranks from 14th to 12th by December 2025 and maintaining this position into January 2026. This upward movement, coupled with increasing sales, reflects strong consumer demand and effective brand positioning in the vapor pen market. Notably, West Coast Cure did not fall out of the top 30 rankings in any category, underscoring its overall competitive presence in the California market.

Competitive Landscape

In the competitive landscape of California's Vapor Pens category, West Coast Cure has demonstrated a steady climb in rankings, maintaining its position at 12th place from December 2025 to January 2026. This stability suggests a robust market presence, particularly as competitors like Bloom and Clsics have shown more fluctuation, with Bloom improving from 16th to 13th and Clsics dropping from 13th to 14th over the same period. Notably, Dime Industries and Turn have maintained higher rankings, consistently holding 10th and 11th positions respectively, indicating stronger sales volumes. Despite this, West Coast Cure's sales have shown a positive trajectory, with a notable increase from November to December 2025, suggesting effective market strategies and consumer loyalty. This upward trend in sales positions West Coast Cure favorably against competitors, highlighting its potential for further growth in the California market.

Notable Products

For January 2026, West Coast Cure's top-performing product remains Garlic Juice (3.5g) in the Flower category, maintaining its consistent first-place ranking since October 2025, with sales figures at 5337. The Curepen - Granddaddy Purple Distillate Cartridge (1g) in the Vapor Pens category rose to the second position from fifth in December, showing a significant upward trend. CUREpen - Gas OG Distillate Oil Cartridge (1g) held steady at third place, indicating stable sales performance. Meanwhile, CUREpen - Skywalker OG Distillate Cartridge (1g) experienced a slight drop from second to fourth place compared to the previous month. Lastly, Curepen - Pink Yum Yum Distillate Disposable (1g) re-entered the top five, securing the fifth position, after not being ranked in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.