Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

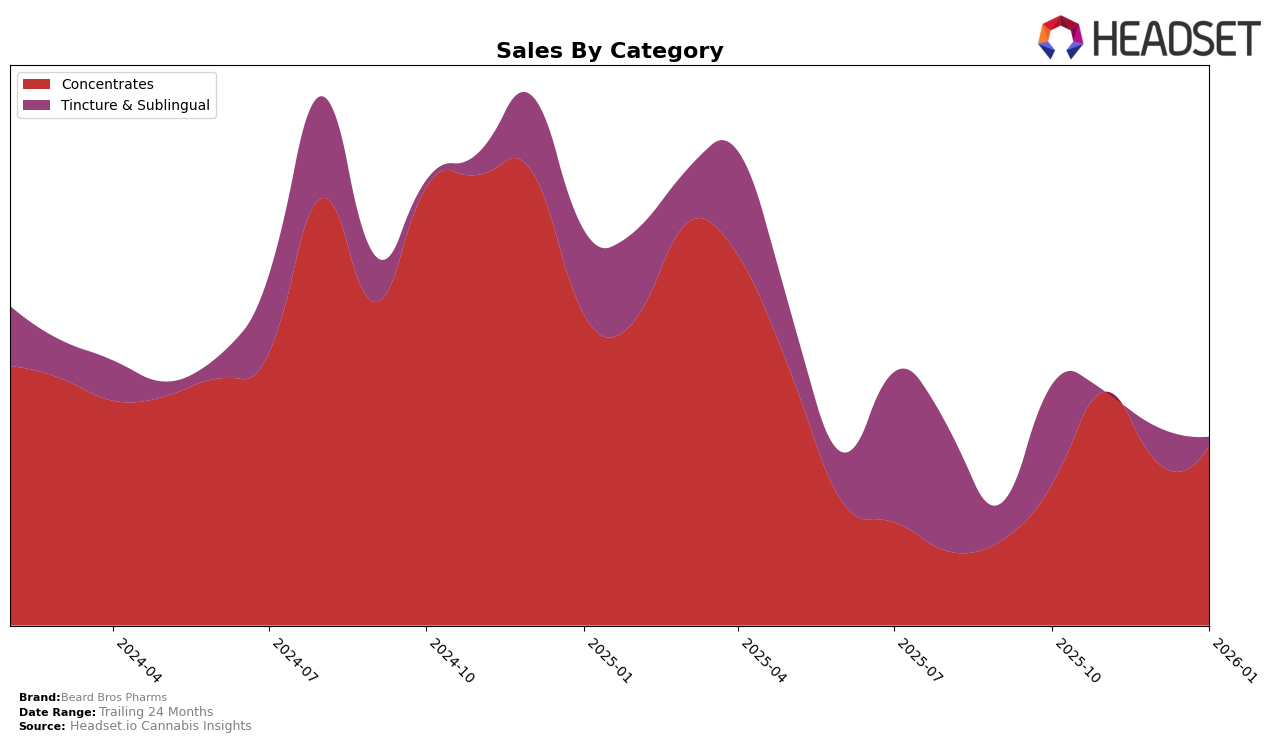

Beard Bros Pharms has shown fluctuating performance across different categories and states, with notable movements in the concentrates category in California. The brand did not make it into the top 30 rankings in this category from October 2025 to January 2026, which could indicate challenges in maintaining a competitive edge in a saturated market. This absence from the top rankings suggests that the brand might need to reassess its strategies to improve its market presence in California's concentrates category, particularly given the competitive nature of this segment.

Despite these challenges in California, the brand's overall sales figures reveal some positive trends that might not be immediately apparent from the rankings alone. For instance, even without a top 30 ranking, Beard Bros Pharms managed to generate sales in October 2025, indicating that there is still a consumer base for their products. This suggests potential for growth if the brand can leverage its existing customer loyalty and refine its approach to capture a larger market share. While specific sales figures for subsequent months are not disclosed, the initial data point provides a foundation for analyzing future performance and strategic adjustments.

Competitive Landscape

In the competitive landscape of California's concentrates market, Beard Bros Pharms experienced notable fluctuations in its ranking and sales trajectory. By January 2026, Beard Bros Pharms did not appear in the top 20 brands, indicating a challenging period in maintaining market visibility. In contrast, Friendly Farms showed a more stable presence, ranking 74th in November 2025 and 88th in December 2025, with sales figures consistently surpassing those of Beard Bros Pharms. Similarly, Proof maintained a presence in the top 100, albeit with a downward trend from 71st in October 2025 to 98th by January 2026. Meanwhile, Locals Only Concentrates re-emerged in the rankings at 94th in January 2026, suggesting a recovery in sales momentum. The market leader, Alien Labs, maintained a strong position, consistently outperforming others with significantly higher sales, underscoring the competitive challenges faced by Beard Bros Pharms in regaining its market share.

Notable Products

In January 2026, the High THC Full Spectrum Oil Syringe (1g) maintained its position as the top-selling product from Beard Bros Pharms, continuing its streak from previous months. The Hybrid Full Spectrum RSO Dablicator (1g) rose to the second spot, showing a significant increase in sales to 60 units, up from its fourth place in December 2025. The CBD/THC 20:1 CBD Full Spectrum RSO Syringe (1g) held steady in third place, consistent with its December ranking. The THC:CBD 20:1 HighTHC Spectrum Tincture (600mg THC, 30mg CBD, 30ml, 1oz) dropped to fourth place, despite being second in December. Lastly, the THC/CBN 2:1 Nighttime Tincture (600mg THC, 300mg CBN, 1oz) remained in the fifth position, mirroring its December ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.