Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

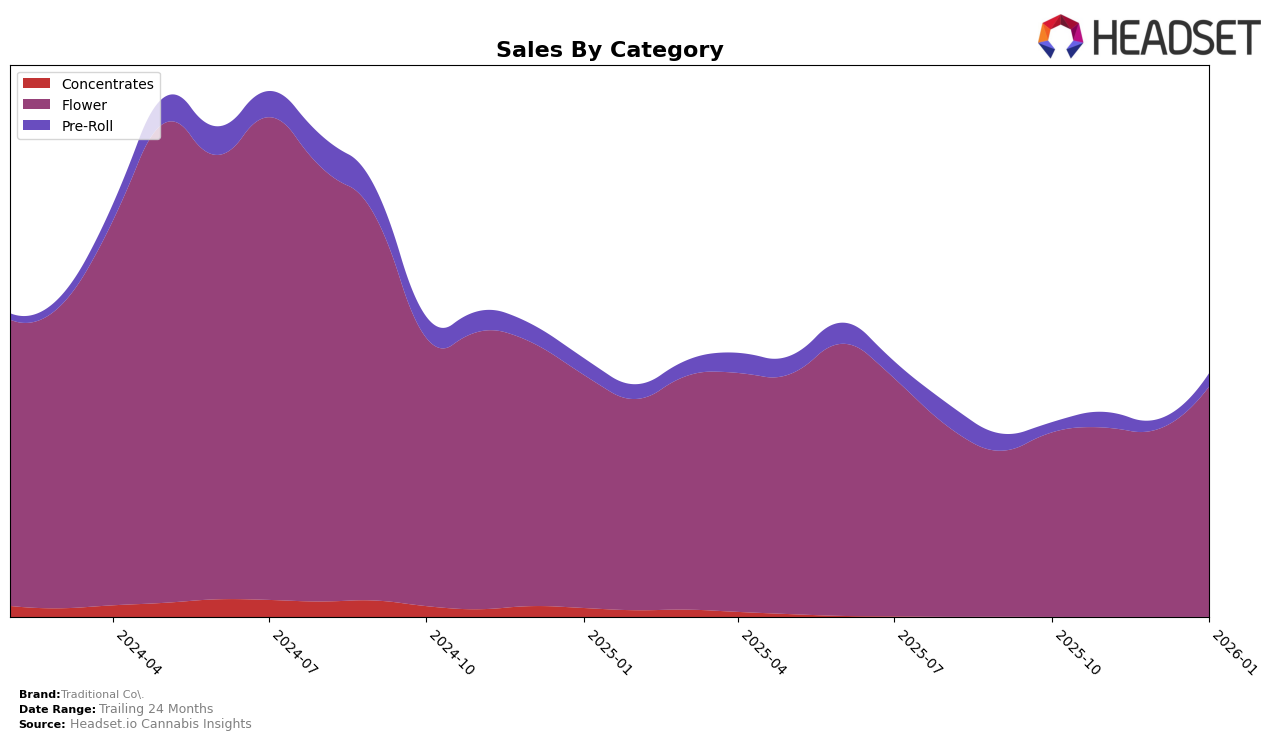

Traditional Co. has demonstrated notable performance in the Flower category within the state of California. Over the span from October 2025 to January 2026, the brand showed an upward trend in its ranking, moving from 29th place in October to 26th place by January. This positive movement indicates a strengthening presence in the market, likely driven by strategic initiatives or product offerings that resonated well with consumers. The increase in sales from approximately $727,889 in October to $910,867 in January further underscores this upward trajectory, reflecting a growing consumer base or increased market penetration.

While Traditional Co. has made strides in California, their presence in other states or categories remains less visible, as indicated by their absence from the top 30 rankings in those areas. This absence suggests potential opportunities for growth and expansion that the brand may explore in the future. The focus on the Flower category in California appears to be a stronghold for the company, but diversifying into other categories or states could provide additional avenues for growth. Monitoring their strategic moves in the coming months could offer insights into their plans to capture a larger market share across different regions.

Competitive Landscape

In the competitive landscape of the California flower category, Traditional Co. has shown a notable upward trend in rankings, moving from 29th in October 2025 to 26th by January 2026. This improvement in rank is accompanied by a significant increase in sales, reflecting a positive reception in the market. Meanwhile, competitors such as Soma Rosa Farms and Eighth Brother, Inc. have maintained relatively stable positions, with slight fluctuations but generally staying ahead in terms of sales volume. Originals experienced a decline in rank from 19th to 25th, indicating potential challenges despite their higher sales figures. Interestingly, Heirbloom by CBX has made a significant leap from 52nd to 28th, suggesting a rapid growth trajectory that could pose a future threat to Traditional Co. if the trend continues. These dynamics highlight the competitive pressures and opportunities within the California flower market, emphasizing the importance for Traditional Co. to continue its momentum to capture more market share.

Notable Products

In January 2026, Blue Donut (3.5g) maintained its position as the top-performing product for Traditional Co., with sales reaching 3741 units, showcasing a consistent rise from previous months. A new entrant, Blue Donut Minis (5g), quickly secured the second position, indicating strong consumer interest in this variant. Cotton Censored Minis (5g) climbed to the third spot, marking a significant improvement from its previous ranking in October 2025. Strawberry Milkshake (3.5g) held steady in fourth place, demonstrating consistent performance over the months. Pink Gelato (3.5g), debuting in the rankings, captured the fifth position, reflecting a positive reception in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.