Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

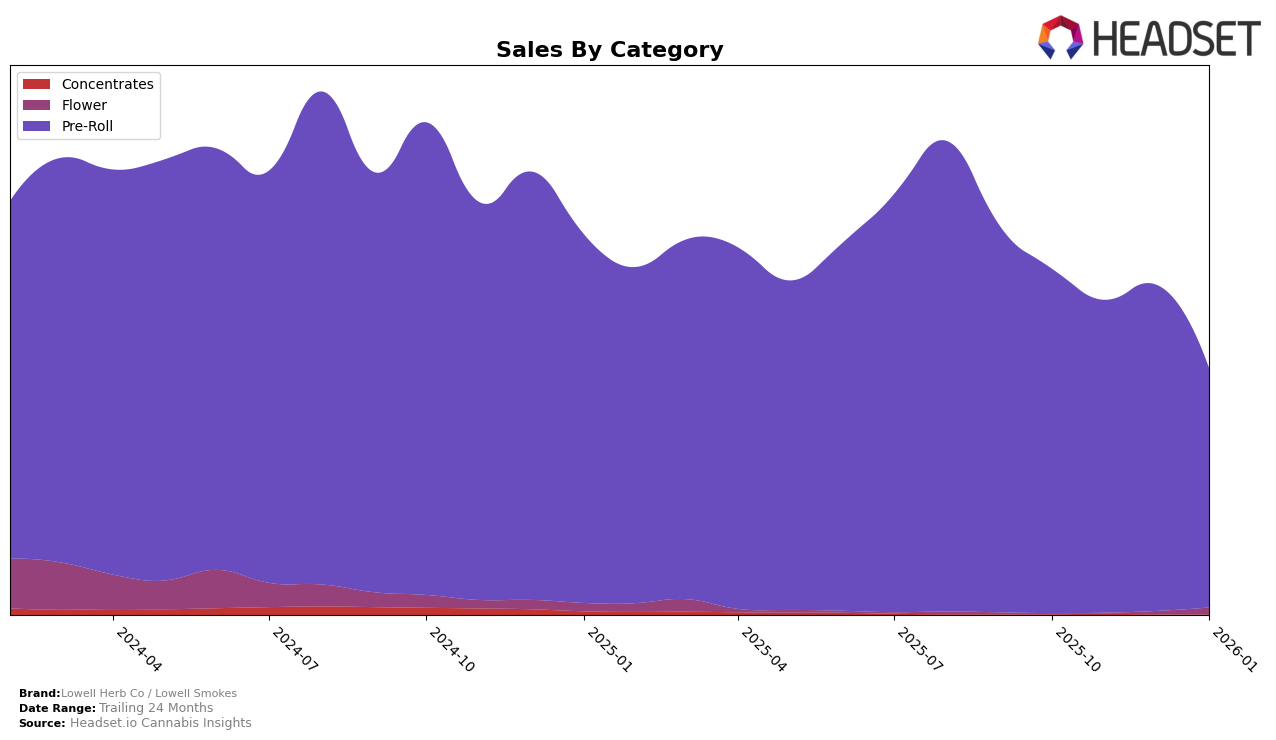

Lowell Herb Co / Lowell Smokes has shown varied performance across different states and categories over the recent months. In California, the brand's presence in the Pre-Roll category has been fluctuating, with rankings oscillating from 51st in October 2025 to 53rd by January 2026, indicating some challenges in maintaining a consistent top-tier position. Meanwhile, in Colorado, the brand has demonstrated more stability, consistently ranking within the top 20 for Pre-Rolls, even improving its position slightly from 17th in October to 15th in January. This suggests a stronger foothold in the Colorado market, possibly due to targeted marketing strategies or consumer preferences aligning more closely with the brand's offerings.

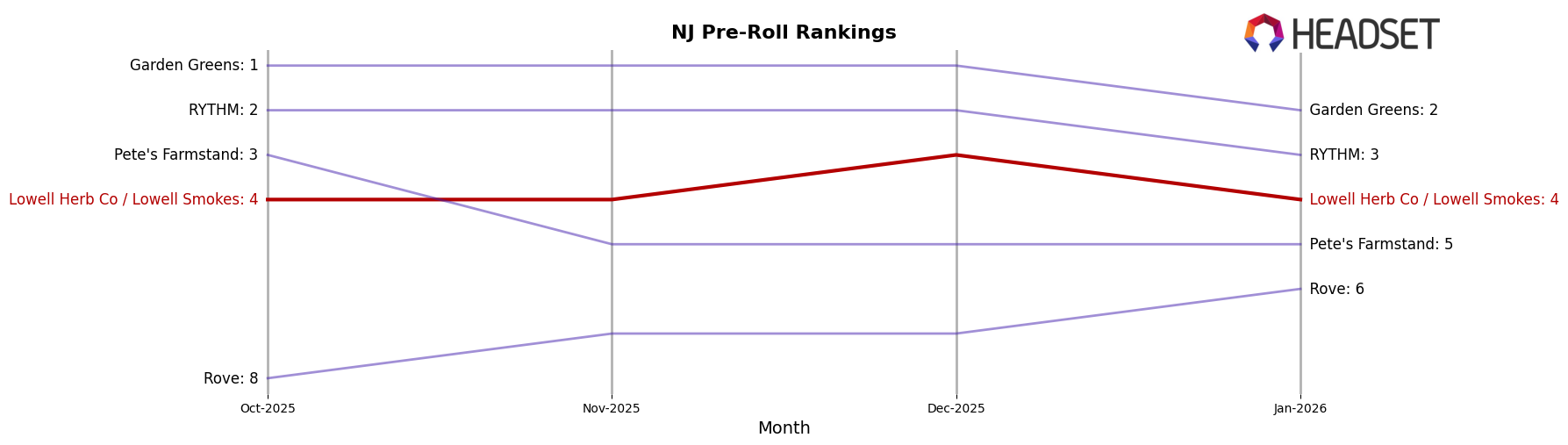

In Illinois, Lowell Herb Co / Lowell Smokes has experienced a decline in rankings, slipping from 7th in October to 12th by January in the Pre-Roll category, which might be indicative of increasing competition or shifting consumer trends. However, the brand has maintained a strong position in New Jersey, consistently ranking in the top 5 for Pre-Rolls, although the sales figures suggest a drop in January 2026. Interestingly, the brand has also made an entry into the Flower category in New Jersey, debuting at 78th place, which could signal potential for growth in this category. Conversely, in New York, the brand's ranking in Pre-Rolls has seen a significant drop from 30th in October to 84th in January, highlighting potential challenges in maintaining market presence in this state.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in New Jersey, Lowell Herb Co / Lowell Smokes has maintained a strong presence, consistently ranking within the top four brands from October 2025 to January 2026. Despite a slight dip in January 2026, where it moved from the third to the fourth position, Lowell Herb Co / Lowell Smokes has shown resilience, especially when compared to competitors like RYTHM and Pete's Farmstand. RYTHM, which held a steady second place until January 2026, experienced a similar drop, indicating a competitive and fluctuating market. Meanwhile, Garden Greens has consistently led the market, maintaining the top rank, although its sales saw a notable decrease in January 2026. This competitive environment highlights the importance for Lowell Herb Co / Lowell Smokes to continue innovating and adapting to maintain its market position amidst such dynamic shifts.

Notable Products

In January 2026, the top-performing product for Lowell Herb Co / Lowell Smokes was A Shore Thing Sativa Blend Pre-Roll 6-Pack (3.5g), maintaining its lead from December with sales of 3935 units. The Happy - Hybrid Blend Pre-Roll 6-Pack (3.5g) climbed to the second position, improving from its third-place finish in December. A Shore Thing Sativa Blend Pre-Roll 10-Pack (3.5g) consistently held the third spot for the second consecutive month. The Chill - Indica Blend Pre-Roll 6-Pack (3.5g) remained in fourth place, showing stable performance across the months. Full Service Gas Station Pre-Roll 10-Pack (3.5g) saw a decline, dropping to fifth place from fourth in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.