Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

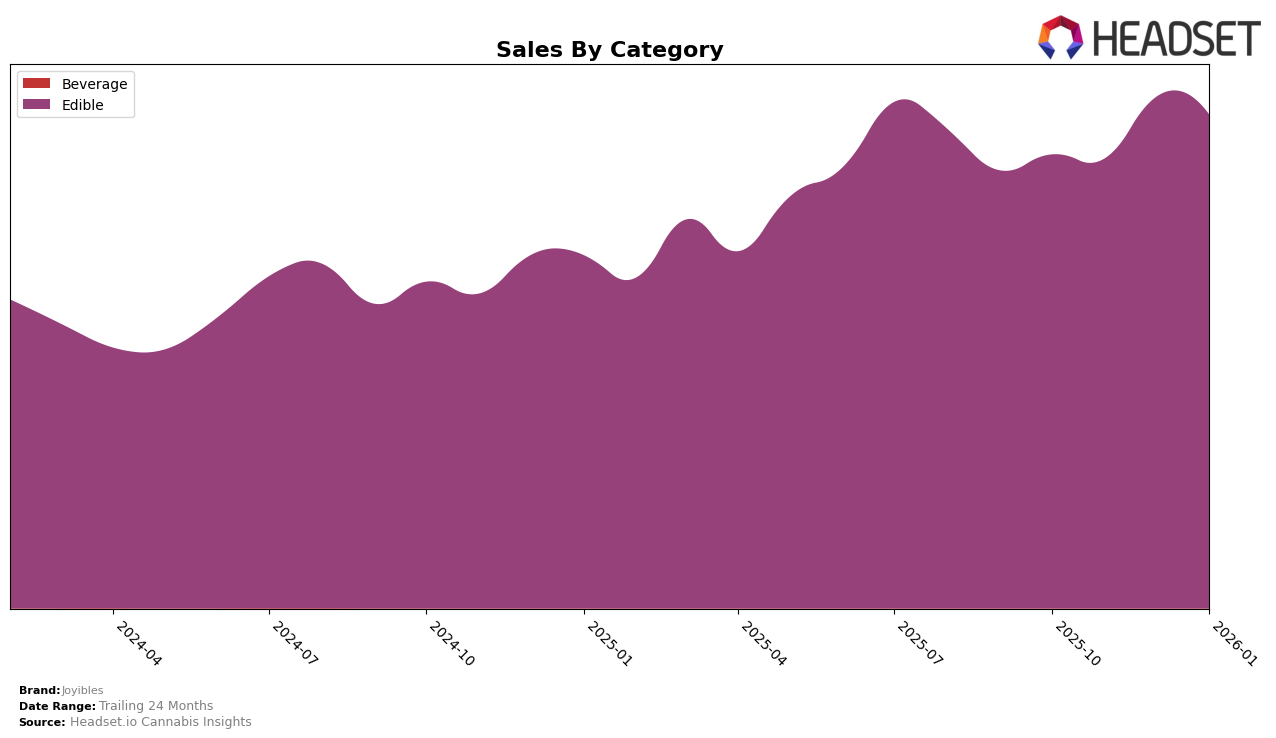

Joyibles has shown a consistent performance in the Edible category across several states, with noteworthy stability in Colorado. The brand maintained a steady 7th place ranking from October 2025 through January 2026, indicating a strong foothold in this market. This consistency is complemented by a gradual increase in sales, peaking in January 2026. In contrast, in Massachusetts, Joyibles improved its ranking slightly from 13th to 12th place by December 2025, although sales figures showed more fluctuation, with a notable increase in December followed by a decline in January. Such movements suggest a competitive landscape where Joyibles is managing to hold its ground, but with room for growth.

In New Jersey, Joyibles has not yet broken into the top 30, as indicated by its rankings in the 30s, with a gradual improvement from 42nd to 37th place over the four-month period. This upward trend, although slow, hints at potential future growth in this market. Meanwhile, in Oregon, Joyibles has shown a steady improvement in sales, with a consistent ranking at 18th place by January 2026. Despite not climbing higher in the rankings, the increase in sales suggests a growing consumer base or increased purchase frequency. These diverse performances across states highlight the varying challenges and opportunities Joyibles faces in different markets.

Competitive Landscape

In the competitive landscape of the Colorado edible cannabis market, Joyibles consistently held the 7th rank from October 2025 to January 2026, indicating a stable position amidst strong competition. Notably, TasteBudz (CO) maintained a higher rank at 6th, with sales figures significantly surpassing Joyibles, peaking in November 2025. Meanwhile, Good Tide consistently outperformed both Joyibles and TasteBudz, holding the 5th rank with a notable sales surge in November 2025. Despite these challenges, Joyibles showed a positive sales trend, particularly in January 2026, suggesting potential for upward movement in rank if this growth continues. Competitors like Revel (CO) and Incredibles remained stable at 8th and 9th ranks respectively, with sales figures trailing behind Joyibles, highlighting Joyibles' competitive edge in maintaining its position in the market.

Notable Products

In January 2026, the top-performing product from Joyibles was Joy Bombs - Original Fruit Chews 40-Pack (100mg), maintaining its position as the number one seller for four consecutive months with a notable sales figure of 14,774 units. Joybombs - Sour Fruit Chews 40-Pack (100mg) also held steady at the second rank, continuing its consistent performance since October 2025. Joybombs - Tropical Haze Fruit Chews 40-Pack (100mg) remained in third place, showing a slight decrease in sales compared to December 2025. The Joy Bombs - CBN/THC 1:1 Dream Blends Fruit Chews 40-Pack (100mg CBD, 100mg THC) maintained its fourth position, having climbed from fifth place in October 2025. Finally, the Joybomb - CBD/THC 1:1 Sour Cherry Berry Blend Chew 40-Pack (100mg CBD, 100mg THC) consistently stayed in the fifth spot, showing a minor decline in sales from the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.