Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

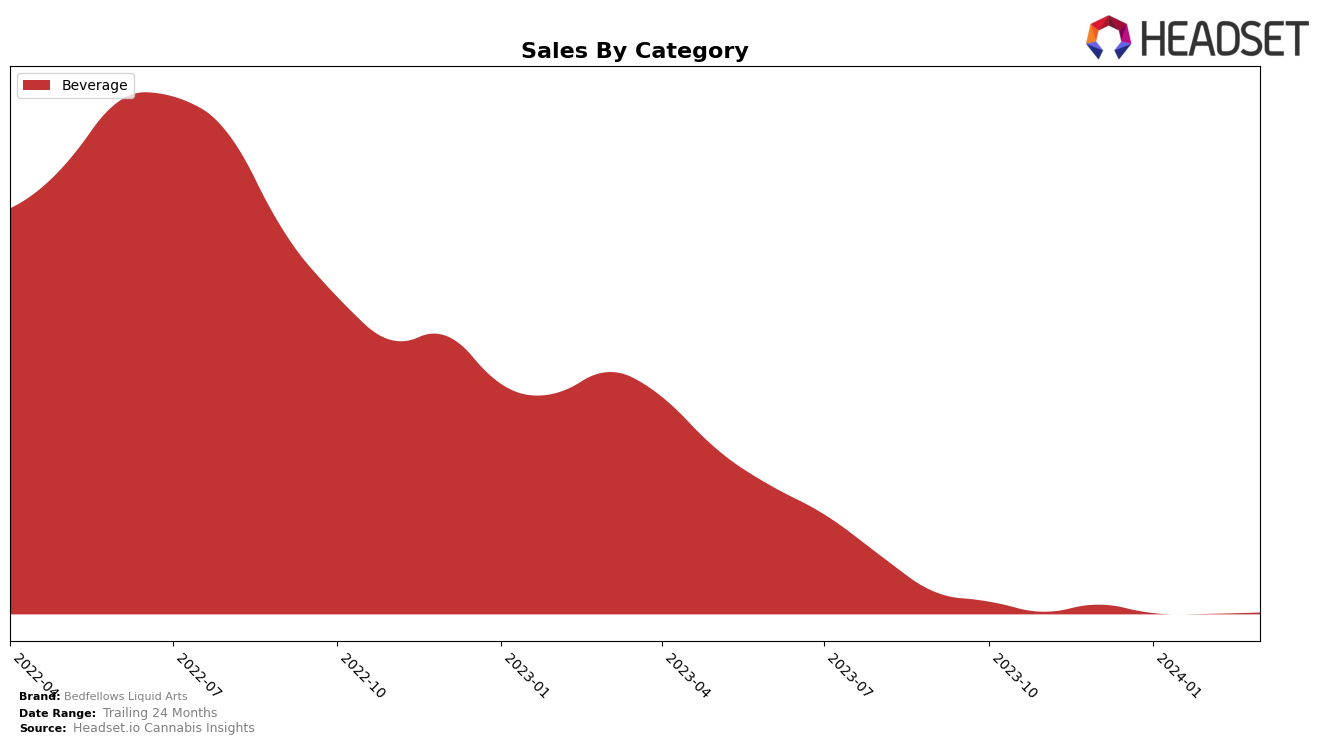

In the competitive landscape of the cannabis beverage market, Bedfellows Liquid Arts has shown varying performance across different regions. In Alberta, the brand experienced a gradual decline in rankings from December 2023 to March 2024, moving from 30th to 34th place. This downward trend is mirrored in their sales figures, which decreased from 1001 units in December 2023 to 240 units by March 2024, indicating a significant reduction in market share within this category in Alberta. Conversely, in Saskatchewan, Bedfellows Liquid Arts demonstrated a positive trajectory, improving their rank from 18th in December 2023 to 16th by March 2024. This upward movement is supported by a notable increase in sales, especially from February to March 2024, suggesting a growing consumer base and enhanced brand performance in the Saskatchewan market.

However, the brand's performance in Ontario tells a different story, with rankings hovering around the 50th position from December 2023 through March 2024. This stagnation near the bottom of the top 50 indicates a struggle to capture a significant portion of the beverage market in Ontario, despite a large potential consumer base. The sales figures, while starting at a higher point than in other provinces with 1929 units sold in December 2023, also saw a decrease over the subsequent months, settling at 1040 units by March 2024. This consistent position outside the top 30 brands in Ontario throughout the observed period highlights challenges in market penetration and brand growth within the province. The differing trends across these provinces underscore the complex dynamics at play in the Canadian cannabis beverage market, with Bedfellows Liquid Arts facing both opportunities and challenges in expanding its consumer reach and improving its market standing.

Competitive Landscape

In the competitive landscape of the beverage category in Saskatchewan, Bedfellows Liquid Arts has experienced fluctuations in its market position, indicating a dynamic and challenging environment. Initially ranked 18th in December 2023, it saw a decline to 24th in January 2024, before partially recovering to 19th in February and finally reaching 16th in March 2024. This trajectory suggests a recovery in market presence, albeit with significant volatility. Notably, its competitors have shown varied performances; Ace Valley made a significant leap from being outside the top 20 to 15th by March 2024, while CANN Social Tonics experienced a decline from 13th to 17th in the same period. Zele maintained a stronger position, fluctuating within the top 15, and Thunder & Lightning showed modest improvement, moving from 25th to 18th. These movements highlight the competitive dynamics Bedfellows Liquid Arts faces, with varying degrees of challenge and opportunity as it seeks to improve its standing and sales in a fluctuating market.

Notable Products

In Mar-2024, Bedfellows Liquid Arts saw its top product as the THC:CBD 5:1 Sour Razpaartner Sparkling Beverage, maintaining its number one rank from previous months with sales figures reaching 165 units. Following closely was the CBD/THC 1:5 Indie Pals Sparkling Beverage, securing the second position consistently from Dec-2023 to Mar-2024, showcasing a notable increase in sales to 156 units in March. The third spot was held by CBD:THC 1:3 Haus Mates Sparkling Beverage, which saw a positive trajectory moving up from the fourth position in Dec-2023 to third by Mar-2024, indicating a growing consumer preference. CBD/THC 1:2 Doppelrädder Sparking Beverage and CBD:THC 1:2 Passion Fruit Pals Sparkling Beverage rounded out the top five, both showing stability in their rankings over the months. These rankings highlight a steady demand for Bedfellows Liquid Arts' beverages, with the top products showing consistent performance and consumer loyalty.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.